Macro guru Luke Gromen believes the US has minimal alternative however to significantly think about elevating Bitcoin (BTC) as a impartial reserve asset.

In a brand new interview with Bitcoin firebrand Robert Breedlove, Gromen says the nation is dealing with a nationwide safety disaster after Russia crushed US and NATO forces in Ukraine.

Gromen believes that the defeat has modified the foundations of the sport, forcing the Division of Protection and the nationwide safety equipment to desert the fiat foreign money system. Based on the macro guru, the US greenback system drove the nation to shutter its factories, crippling America’s potential to fabricate armaments for nationwide protection.

However Gromen says the nationwide protection and intelligence institution now sees a chance to revitalize its industries by debasing the greenback and utilizing Bitcoin to again the Treasury market.

“The sport principle has modified round this: for nationwide political stability, for bringing again the center and dealing class for protection base re-establishment. All of this stuff are pointing to a impartial reserve asset…

Bitcoin has gone from an eye-roll snicker on this sentence a 12 months in the past… however I don’t assume there needs to be.

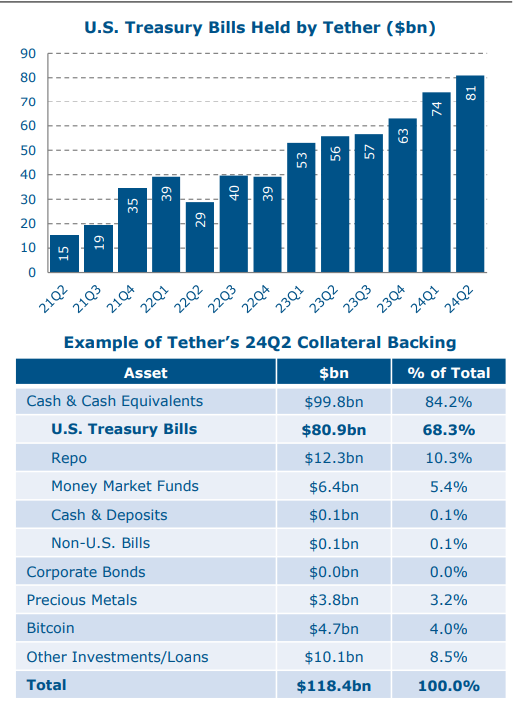

Treasury [Department] is speaking about how one can use stablecoins to create a steadiness sheet mainly for T-bills to finance deficits. Paul Ryan, former speaker of the Home [and] VP candidate, [wrote an] op-ed about how stablecoins could possibly be used to create demand for T-bills. Trump saying Bitcoin is the brand new oil, reportedly, [and] the strategic [Bitcoin] reserve.”

Gromen says the statements of politicians and the Treasury Division inform him that the US is gearing as much as massively increase the market cap of Bitcoin, just like what occurred to grease in 1973 when it surged 400%.

“What that oil worth did by transferring up that method was it successfully made oil large enough to again the greenback, to again the US deficits.”

Based on Gromen, elevating Bitcoin as a impartial reserve asset will enable the US to finance the re-establishment of its industries for nationwide protection with out making Individuals poor.

“The Treasury Borrowing Advisory Committee report has a chart: right here’s the market cap of crypto, right here’s the market cap of stablecoins, right here’s what number of T-bills stablecoins have purchased, and it’s linear. That’s how they’re it…

When you concentrate on it that method within the context of political stability points that it is advisable to deal with, the nationwide protection points it is advisable to deal with, the sport principle is turned on its head…

Bitcoin isn’t a risk that’s rising. It must go up quicker in order that we’ve got extra steadiness sheet capability and in order that our individuals, as we reinflate to re-shore all of these items as a result of it will be inflationary, that’s not a foul factor to compensate your individuals to maintain them complete on an actual foundation whereas that occurs.”

At time of writing, Bitcoin is buying and selling for $105,063.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses chances are you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: DALLE3