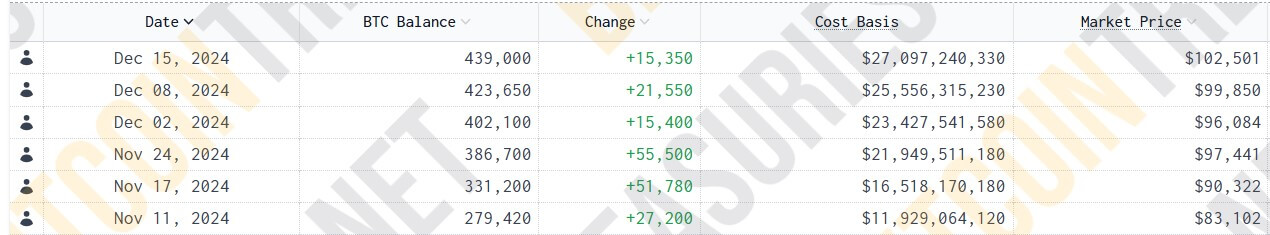

Michael Saylor-led MicroStrategy has bought 15,350 Bitcoin for $1.5 billion at a mean value of $100,386 per coin, in line with a Dec. 16 submitting with the US Securities and Alternate Fee (SEC).

This newest acquisition marks the sixth consecutive week of Bitcoin purchases by the corporate, which lately grew to become a part of the Nasdaq 100 index on Dec. 13. Over the earlier 5 weeks, MicroStrategy considerably elevated its Bitcoin reserve, buying 171,430 BTC at a complete value of $15.61 billion.

With this addition, MicroStrategy now owns 439,000 Bitcoin, representing over 2% of the flagship asset’s whole provide. The corporate’s cumulative funding in Bitcoin stands at $27.1 billion, translating to a mean buy value of $61,725 per Bitcoin. At present market charges of over $104,000, these holdings are price greater than $45.6 billion.

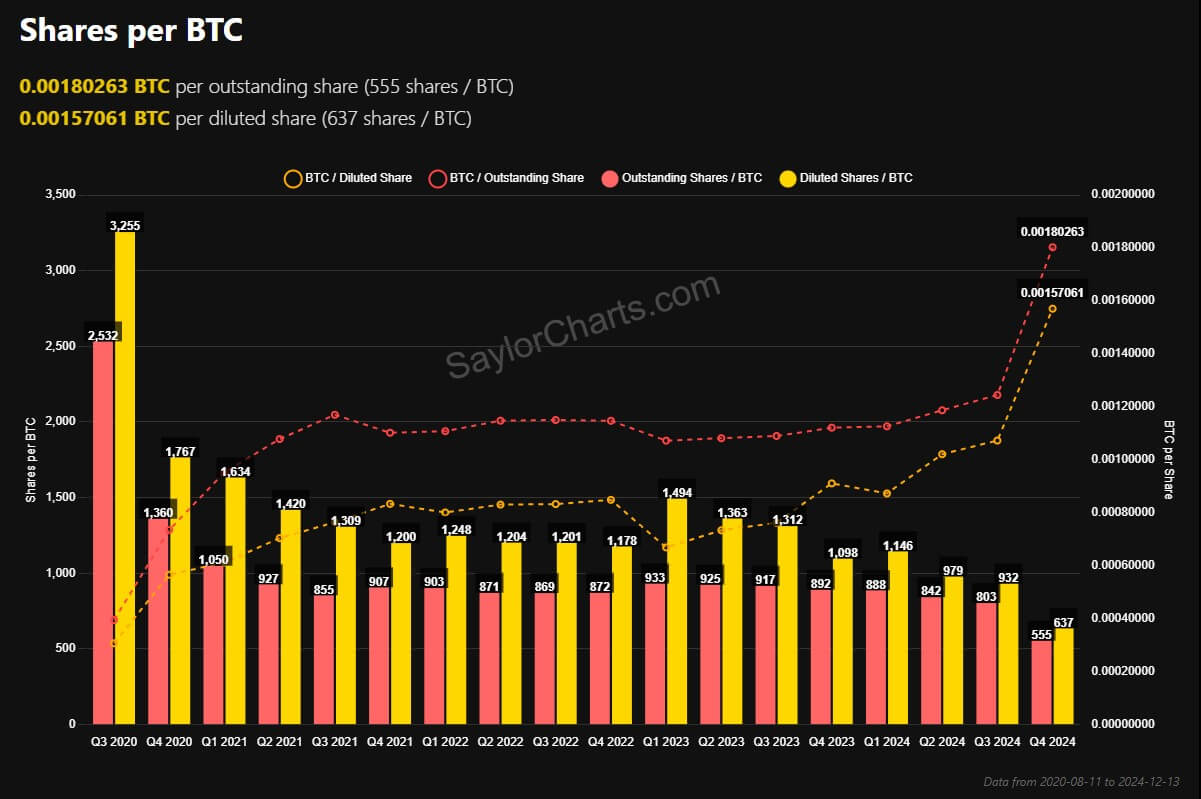

The agency’s government chairman, Michael Saylor, highlighted how Bitcoin’s sturdy efficiency in current months has translated into spectacular returns for the corporate. Its BTC Yields stood at 46.4% for the quarter and 72.4% for the 12 months.

In the meantime, information of the most recent Bitcoin acquisition and the corporate’s inclusion within the Nasdaq 100 index has positively impacted its inventory. MicroStrategy shares rose 4% in pre-market buying and selling, reaching $425.