Travala (AVA) value has surged 300% just lately, following Binance CEO CZ’s revelation of Binance’s early funding within the platform. This announcement, coupled with the corporate reporting $100 million in annual income, has fueled vital market curiosity in AVA.

Nevertheless, as momentum indicators present indicators of cooling, the asset has entered a pivotal section, balancing between additional good points and potential corrections.

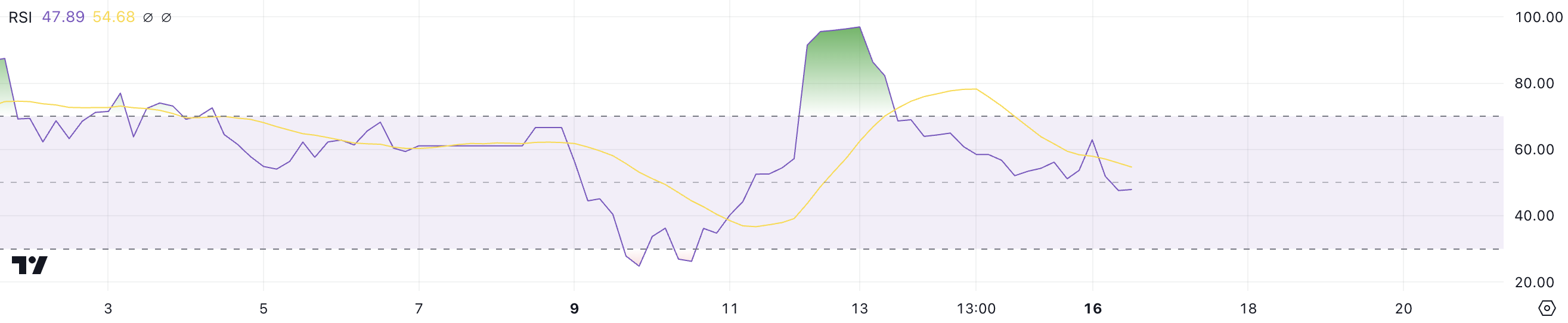

AVA Is Now In The Impartial Zone

AVA’s Relative Energy Index (RSI) just lately surged to 96, staying above 70 from December 12 to December 13, signaling extraordinarily overbought situations pushed by robust bullish momentum. Now, the RSI has dropped to 47.8, reflecting a big cooldown in shopping for stress.

RSI, a momentum indicator measuring value modifications on a scale of 0 to 100, signifies overbought situations above 70 and oversold situations under 30. AVA’s transition from an overbought zone to a impartial stage suggests a shift in market sentiment.

With the RSI at 47.8, AVA value is now in impartial territory, indicating that the prior surge has subsided, and the asset is neither overbought nor oversold. This drop from 96 highlights a lack of momentum, suggesting that the value could stabilize or face additional consolidation.

Whereas the present RSI leaves room for a renewed uptrend, merchants also needs to be cautious of potential draw back dangers as AVA’s bullish momentum continues to wane.

Travala Present Development Is Dropping Its Energy

Travala Common Directional Index (ADX) is at the moment at 39.5, down from 57 simply three days in the past. The ADX measures the energy of a pattern, with values above 25 indicating a powerful pattern and people under 20 suggesting a weak or directionless market.

Whereas an ADX of 39.5 nonetheless displays a powerful pattern, the notable decline from its current excessive indicators a weakening of momentum, elevating the potential of an upcoming shift out there.

Regardless of the ADX decline, AVA strains nonetheless present an uptrend, indicating that the bullish pattern is undamaged for now. Nevertheless, the dropping ADX suggests it could be difficult for a brand new robust uptrend to emerge, because the pattern energy is progressively fading.

Merchants ought to stay cautious, because the weakening ADX may sign an impending consolidation or a possible reversal in value motion if shopping for stress continues to lower.

AVA Value Prediction: Will It Attain $3.5 Earlier than Christmas?

AVA value evaluation chart reveals that its short-term EMA strains stay above long-term ones, sustaining a bullish setup. Nevertheless, the downward slope of the shortest EMA line suggests the uptrend might be shedding energy.

If the bearish momentum continues, AVA value may take a look at the robust help at $1.56. If this stage fails, the value may decline additional, probably dropping by virtually 50% to $0.81 and even $0.62.

However, if the uptrend regains momentum, AVA value may rebound and retest the $3.38 resistance stage, with the potential of reaching $3.50 subsequent, remaining as one of many best-performing cash of the final week.

The EMA strains spotlight a pivotal second for AVA, with the following strikes possible relying on whether or not a bullish restoration outweighs the present fading pattern indicators.

Disclaimer

According to the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.