As Bitcoin continues to mature, some of the telling indicators of its longevity and integration into the broader monetary ecosystem is the fast progress of Bitcoin Alternate-Traded Funds (ETFs). These merchandise—providing mainstream, regulated publicity to Bitcoin—have garnered substantial inflows from each institutional and retail buyers since their inception. In response to knowledge aggregated by Bitcoin Journal Professional’s Cumulative Bitcoin ETF Flows Chart, Bitcoin ETFs have already gathered greater than 936,830 BTC, elevating the query: Will these holdings surpass 1 million BTC earlier than 2025?

The #Bitcoin ETFs have already gathered 936,830 #BTC! 🏦

Will this surpass 1,000,000 BTC earlier than 2025? 🪙

Let me know 👇 pic.twitter.com/UojJpJlC4P

— Bitcoin Journal Professional (@BitcoinMagPro) December 16, 2024

The Significance of the 1 Million BTC Mark

Crossing the 1 million BTC threshold can be greater than a symbolic milestone. It will point out profound market maturity and long-term confidence in Bitcoin as a reputable, institutional-grade asset. Such a lot of Bitcoin locked up in ETFs successfully tightens provide within the open market, setting the stage for what might be a robust catalyst for upward value stress. As fewer cash stay accessible on exchanges, the market’s long-term equilibrium shifts—doubtlessly elevating Bitcoin’s ground value and lowering draw back volatility.

The Development Is Your Buddy: Report-Breaking Inflows

The momentum is simple. November 2024 noticed report inflows into Bitcoin ETFs, surpassing $6.562 billion—over $1 billion greater than the earlier month’s figures. This wave of capital influx dwarfs the speed of latest Bitcoin creation. In November alone, simply 13,500 BTC had been mined, whereas greater than 75,000 BTC flowed into ETFs—5.58 instances the month-to-month provide. Such an imbalance underscores the shortage dynamics now in play. When demand vastly outpaces provide, the pure market response is upward value stress.

A Chart of Insatiable Demand

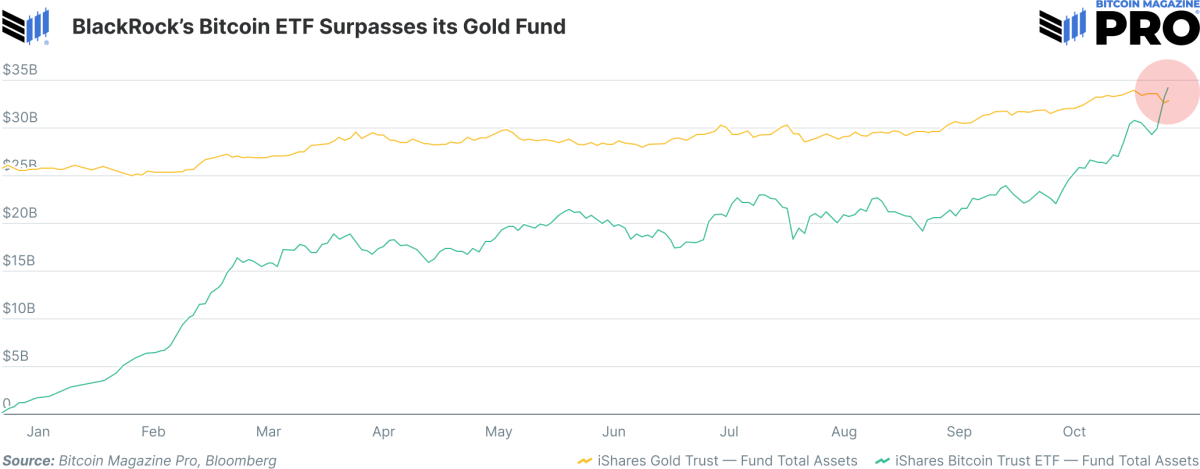

In a landmark second, BlackRock’s Bitcoin ETF not too long ago outpaced the corporate’s personal iShares Gold Belief in complete fund property. This second was captured visually within the November challenge of The Bitcoin Report, revealing a transparent shift in investor desire. For many years, gold sat atop the throne of “secure haven” property. At this time, Bitcoin’s rising function as “digital gold” is validated by ever-growing institutional allocations. The urge for food for Bitcoin-backed ETF merchandise has grow to be relentless, as each seasoned buyers and new entrants acknowledge Bitcoin’s potential to function a cornerstone in diversified portfolios.

Lengthy-Time period Holding and Provide Shock

One key attribute of Bitcoin ETF inflows is the long-term nature of those investments. Institutional patrons and long-term allocators are much less more likely to commerce often. As a substitute, they purchase Bitcoin via ETFs and maintain it for prolonged durations—years, if not a long time. As this sample continues, the Bitcoin held in ETFs turns into primarily faraway from circulation. The result’s a gentle drip of provide leaving exchanges, pushing the market towards a possible provide shock.

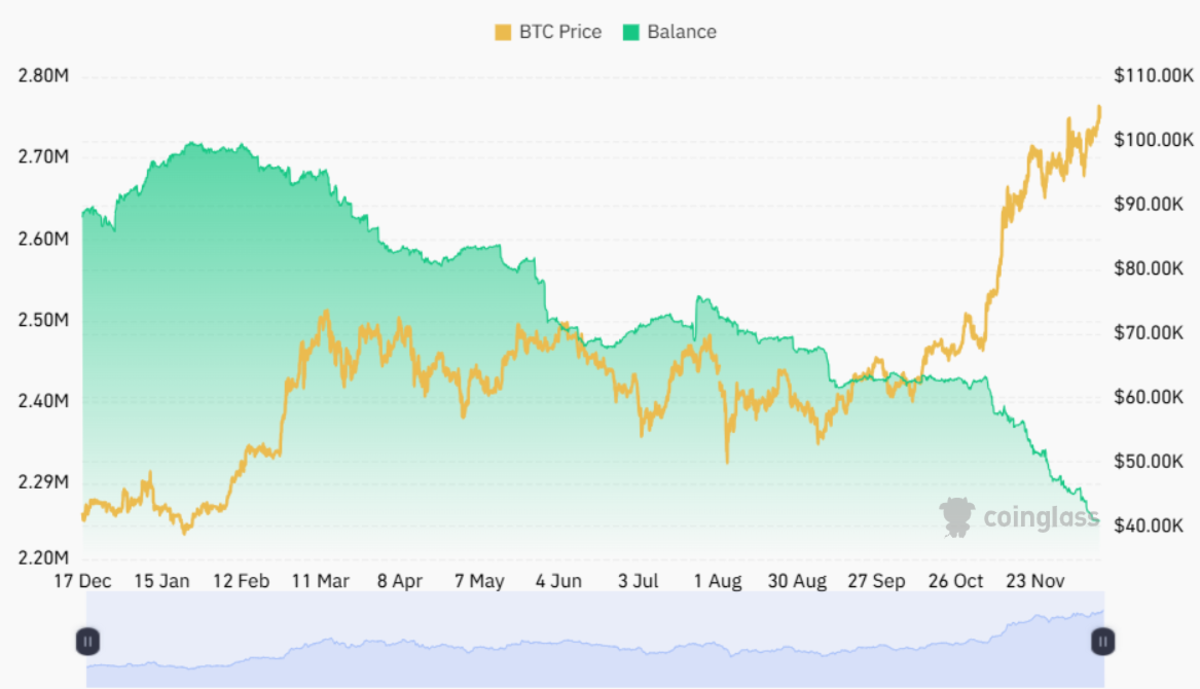

This development is clearly illustrated by the newest knowledge from Coinglass. Solely about 2.25 million BTC presently stay on exchanges, highlighting a persistent decline in available provide. The chart under (offered individually) exhibits a divergence the place Bitcoin’s value appreciation continues upward, whereas the change balances head down—an irrefutable sign of shortage dynamics at work.

A Excellent Bitcoin Bull Storm and the March Towards $1 Million

These evolving dynamics have already propelled Bitcoin past the $100,000 milestone, and such achievements might quickly really feel like distant reminiscences. Because the market rationalizes a possible journey in direction of $1 million per BTC, what as soon as appeared like a lofty dream now seems more and more possible. The “multiplier impact” in market psychology and value modeling suggests that when a big purchaser comes into play, the ripple results could cause explosive value surges. With ETFs regularly accumulating, every main buy might ignite a cascade of follow-on shopping for as buyers worry lacking out on the following leg up.

Incoming Trump Administration, the Bitcoin Act, and a U.S. Strategic Reserve

If present developments weren’t bullish sufficient, a brand new and doubtlessly transformative situation is brewing on the geopolitical stage. Incoming President-elect Donald Trump in 2025 has expressed assist for the “Bitcoin Act,” a proposed invoice directing the Treasury to determine a Strategic Bitcoin Reserve. The plan entails promoting a part of the U.S. authorities’s gold reserves to accumulate 1 million BTC—about 5% of all presently accessible Bitcoin—and maintain it for 20 years. Such a transfer would sign a seismic shift in U.S. financial coverage, putting Bitcoin on par with (and even forward of) gold as a cornerstone of nationwide wealth storage.

With ETFs already driving shortage, a U.S. governmental transfer to safe a big strategic Bitcoin reserve would enlarge these results. Think about that solely 2.25 million BTC can be found on exchanges right this moment. Ought to america intention to accumulate practically half of that in a comparatively quick timeframe, the supply-demand imbalances would grow to be extraordinary. This situation might unleash a hyper-bullish mania, pushing Bitcoin’s value into beforehand unthinkable territory. At that time, even $1 million per BTC may be seen as rational, a pure extension of the asset’s function in world finance and nationwide strategic reserves.

Conclusion: A Confluence of Bullish Forces

From near-term ETF inflows surpassing new issuance fivefold, to longer-term structural shifts like a possible U.S. Bitcoin reserve, the basics are stacking in Bitcoin’s favor. The rising shortage, mixed with the multiplier impact of enormous patrons coming into the market, units the stage for exponential value appreciation. What was as soon as thought of unrealistic—a Bitcoin value of $1 million—now sits inside the realm of risk, underscored by tangible knowledge and highly effective financial forces at play.

The journey from right this moment’s ranges to a brand new period of Bitcoin value discovery entails extra than simply hypothesis. It’s supported by a tightening provide, unyielding demand, rising institutional acceptance, and even the potential imprimatur of the world’s largest economic system. Towards this backdrop, surpassing 1 million BTC in ETF holdings earlier than 2025 could also be only the start of a a lot bigger story—one that might reshape world finance and reimagine the very idea of a reserve asset.

For the newest insights on Bitcoin ETF knowledge, month-to-month inflows, and evolving market dynamics, discover Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding selections.