On Monday, December 16, Ethereum (ETH) worth climbed above $4,000 once more, with historic knowledge suggesting that the return could possibly be the start of a protracted bull market. This growth comes as a number of analysts opine that ETH might observe in Bitcoin’s (BTC) steps after the latter reached one other all-time excessive.

However will these bullish predictions maintain? This on-chain evaluation appears to be like at key historic knowledge of Ethereum which have influenced its worth motion.

Ethereum Buyers Are Again in “Perception” Mode

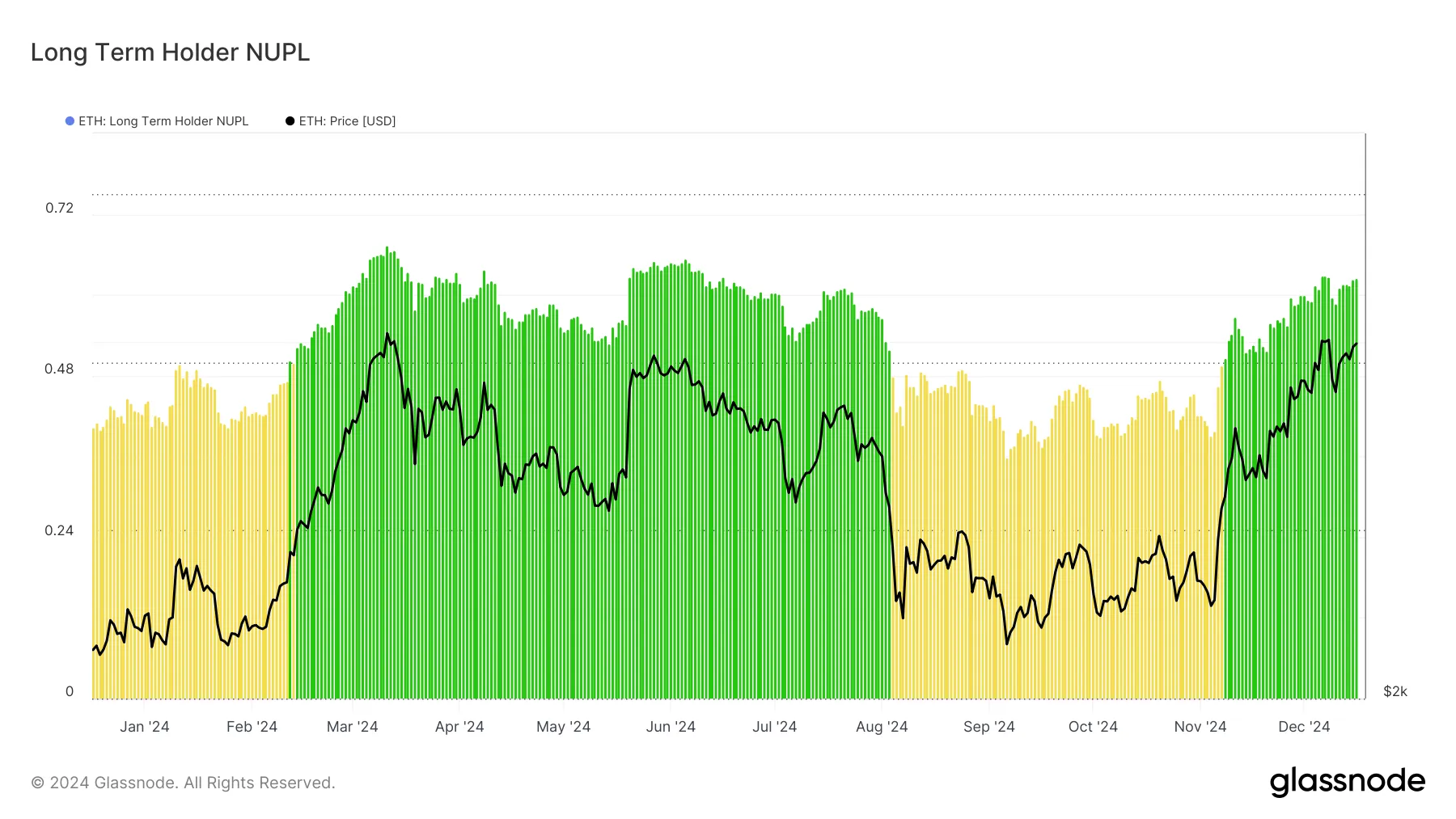

In line with Glassnode, Ethereum’s return to $4,000 has improved the sentiment of Lengthy-Time period Holders (LTH) towards the cryptocurrency. In getting the present notion round ETH, BeInCrypto evaluated the Lengthy-Time period Holder-Web Unrealizes Revenue/Loss (LTH-NUPL),

The LTH-NUPL assesses the habits of buyers who’ve held a cryptocurrency for greater than 155 days. This metric is split into a number of elements: capitulation (pink), hope (orange), optimism (yellow), perception (inexperienced), and euphoria (blue).

Utilizing Ethereum’s Historic knowledge, capitulation represents a bear market, and generally, ETH’s worth fails to file a notable improve throughout this era. The section between hope and optimism highlights a interval of exiting the bear market, whereas perception signifies the early bull market section. Lastly, euphoria signifies when the cryptocurrency is near the cycle high.

As seen above, Ethereum’s LTH-NUPL presently sits within the perception area, indicating that ETH’s worth might have additional room to develop. In previous cycles, Ethereum has seen substantial positive aspects upon coming into the euphoria zone. With ETH nonetheless within the perception section, the cryptocurrency could possibly be on observe to climb nicely past $4,000 within the coming weeks.

The Market Worth to Realized Worth (MVRV) ratio is one other metric that helps an extra worth hike for ETH. This ratio assesses whether or not a cryptocurrency is undervalued or overvalued by assessing its market profitability.

Usually, the upper the MVRV ratio, the extra doubtless holders are to promote. Whether it is low, it will increase the probabilities of HODLing. In line with Santiiment, Ethereum’s 30-day MVRV ratio is 8.73%, which is decrease than the 22.61% it reached in March.

This means that ETH remains to be near being undervalued and reinforces the concept of a better worth within the coming weeks and months.

ETH Worth Prediction: Time to Get Nearer to $5,000

Ethereum’s worth continues to carry sturdy help round $3,075 on the day by day chart, a stage that performed a key position in driving the current rally. ETH has additionally cleared the $4,003 resistance, indicating continued bullish momentum.

The Bull Bear Energy (BBP) indicator, which measures purchaser energy in opposition to sellers, stays in constructive territory, reinforcing the upward pattern.

If the pattern holds, this bulls’ dominance suggests ETH’s worth might climb towards $4,400. Nonetheless, if bears regain management, ETH might reverse its positive aspects and drop towards the $3,578 stage.

Disclaimer

According to the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.