Bitcoin miner Riot Platforms has bought 667 BTC value $69 million, in line with current SEC filings. The acquisition was made at a median value of $101,135 per Bitcoin.

With this buy, Riot’s whole Bitcoin holdings have climbed to 17,429 BTC, which, at right now’s value, is valued at roughly $2 billion.

Riot is Intently Following MicroStartegy’s Bitcoin Buy Technique

Riot initially shifted its enterprise focus to Bitcoin mining in 2018, working from its Oklahoma facility. The corporate has since expanded its technique, mirroring MicroStrategy Chairman Michael Saylor’s strategy to Bitcoin buy and initiating share buybacks to extend crypto reserves.

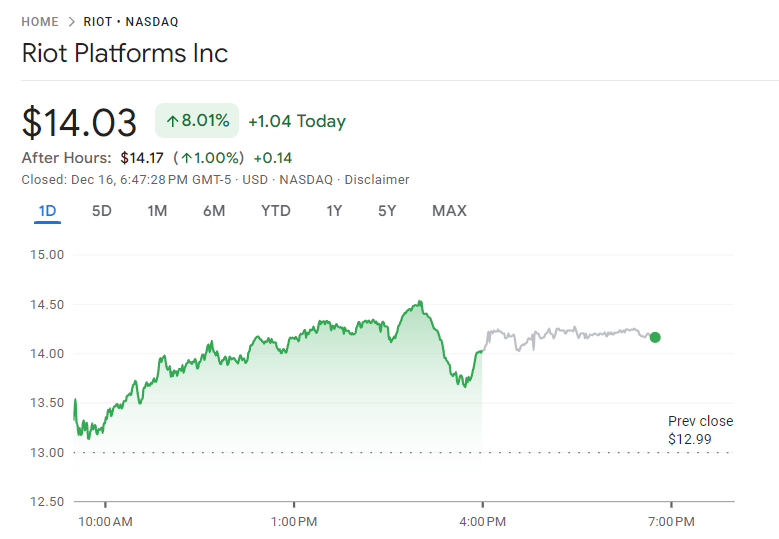

Following the announcement, Riot’s inventory value surged practically 8% right now. The agency’s mixed mining operations and strategic Bitcoin acquisitions have considerably boosted its BTC yield.

Additionally, Riot reported a 36.7% Bitcoin yield for This fall thus far and a year-to-date yield of 37.2%. This yield metric highlights the expansion in BTC holdings relative to share dilution.

The strategy of elevating capital by means of share rights for Bitcoin purchases stays a subject of debate. Nevertheless, main miners like Riot and Marathon Digital (MARA) have continued this observe.

Final week, MARA acquired 11,774 BTC for $1.1 billion, utilizing funds from a zero-coupon convertible notice providing.

In the meantime, MicroStrategy additionally introduced its newest Bitcoin buy right now. The corporate acquired 15,350 BTC for $1.5 billion at a median value of $100,386 per BTC.

With this buy, MicroStrategy now holds $27.1 billion value of BTC. The corporate reported a This fall Bitcoin yield of 46.4% and a year-to-date yield of 72.4%, reflecting its aggressive Bitcoin buy technique.

MicroStrategy’s inventory (MSTR) has mirrored Bitcoin’s robust efficiency this yr, rising practically 500% year-to-date. The expansion has positioned Michael Saylor’s firm among the many prime 100 publicly traded corporations in the USA.

“Everybody buys Bitcoin on the value they deserve. BTC doesn’t wait. It merely transfers wealth to those that see,” Michael Saylor lately wrote on X (previously Twitter).

Saylor has lengthy inspired public corporations so as to add Bitcoin to their portfolios. Regardless of his a number of proposals, Microsoft shareholders lately rejected a proposal to incorporate Bitcoin in its treasury.

Nevertheless, its competitor, Amazon’s shareholders, have taken a unique stance. They proposed allocating a part of Amazon’s $88 billion money reserves to Bitcoin as a hedge towards inflation.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.