BitMEX CEO Arthur Hayes means that Trump’s administration ought to transfer from the Gold customary and incline extra in the direction of establishing a strategic Bitcoin reserve.

Hayes means that the easiest way for the US to attain financial prosperity is for the Treasury Division to create extra {dollars} by devaluing the worth of gold to construct a Bitcoin reserve.

Hayes Suggests Trump to Shift from the Gold Commonplace

In response to Hayes’ newest Substack article, this devaluation would enable the Federal Reserve’s Treasury Normal Account (TGA) to obtain a greenback credit score.

This credit score can later be injected into the economic system straight. It eliminates the necessity for diplomatic efforts to influence different nations to devalue their currencies towards the US greenback. The bigger the gold devaluation, the larger the credit score can be.

At present, the treasury values gold at $42,22/oz. From Hayes’ perspective, that is overvalued. He explains that if incoming Treasury Secretary Scott Bessent would take into account a $10,000 to $20,000/ouncesrevaluation, then the TGA’s stability would instantly develop.

“Rapidly and dramatically weakening the greenback is step one in the direction of Trump and Bessent attaining their financial objectives. Additionally it is one thing they’ll accomplish in a single day with out consulting home legislators or overseas finance ministry heads. Provided that Trump has one 12 months to point out progress on a few of his objectives to assist Republicans preserve their maintain on the Home and Senate, my base case is a $/gold devaluation within the first half of 2025,” Hayes wrote.

What Would a Bitcoin Reserve Imply for the US Economic system?

Arthur Hayes argues that the technique would inherently enhance the worth of Bitcoin and different cryptocurrencies if the Treasury decides to make use of the greenback credit to buy BTC.

Provided that the US already owns the most important quantity of gold than every other nation-state, it might do the identical by making a Bitcoin reserve. This is able to consequently assert the nation’s monetary supremacy by way of possession over the world’s strongest digital asset.

Because the trade extensively considers Bitcoin to be onerous cash attributable to its mounted provide cap, Hayes argues that the strongest authorities fiat forex could be the one whose central financial institution owns the most important reserve of BTC.

In flip, a authorities that holds a big quantity of Bitcoin would naturally implement insurance policies that favor the expansion of the cryptocurrency trade.

“If the US authorities creates extra {dollars} through a gold devaluation and makes use of a few of these {dollars} to purchase Bitcoin, its fiat worth will rise. It will in flip spur aggressive sovereign purchases by different nations who should play catchup with the US. The worth of Bitcoin then would rise asymptotically, as a result of why would anybody promote Bitcoin and obtain fiat, which the federal government is actively devaluing?” Hayes defined in his article.

It’s additionally essential to contemplate that the US is just not the one nation contemplating a strategic Bitcoin Reserve. As BeInCrypto reported earlier, Russian lawmakers are additionally suggesting the identical.

Japan’s lawmakers additionally made comparable strategies earlier this month, and Vancouver, Canada, has already accredited a Bitcoin Reserve plan for town council. So, it’s seemingly that if the US doesn’t make the transfer quickly, its worldwide opponents will.

But, realistically, Hayes doesn’t count on the Treasury to buy Bitcoin. Nonetheless, a gold devaluation would create {dollars} anyway, which could be reinserted into the economic system as items and companies or used as monetary property.

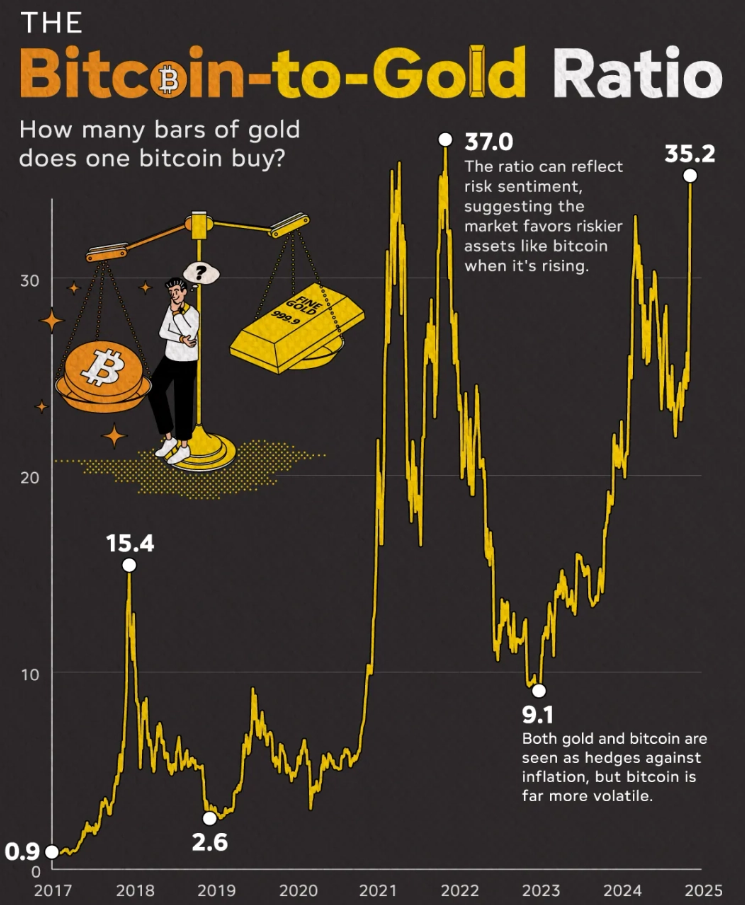

Hayes’ sentiment does align with the market stats, as Bitcoin ETFs at the moment maintain extra property below administration than Gold ETFs. These funds have been buying and selling for lower than a 12 months.

How A lot Time Does Trump Have?

Hayes confirmed weariness over crypto buyers’ excessive expectations for a way shortly the incoming Trump administration can enact adjustments that may profit the crypto market.

He predicted that Trump would want no less than a 12 months to handle underlying home and worldwide points.

On the similar time, the president-elect might want to present outcomes nearly instantly, contemplating that the majority legislators will begin to marketing campaign for mid-term elections solely a 12 months after Trump’s inauguration.

If persistence runs skinny and sentiment turns destructive shortly, Hayes expects there to be purchaser’s regret amongst buyers.

“The market will immediately get up to the fact that Trump has at greatest one 12 months to enact any coverage adjustments on or round January twentieth. This realization will result in a vicious sell-off in crypto and different Trump 2.0 fairness trades,” he mentioned.

Due to how little time Trump truly has to create change, Hayes emphasizes that gold devaluation is essentially the most time-efficient solution to generate cash and stimulate the economic system.

“The persons are impatient as a result of they’re determined. Trump is an astute politician and is aware of his base. To me, meaning he should go massive early, which is why my cash is on a large greenback vs. gold devaluation early into his first 100 days in workplace. It’s a straightforward solution to make manufacturing prices globally aggressive in America shortly,” he concluded.

Hayes is just not the one one who shares this angle. Final month, Republican Senator Lummis additionally proposed that the Fed promote a portion of its gold to purchase 1 million BTC and fund a Bitcoin Reserve.

Disclaimer

Following the Belief Challenge tips, this characteristic article presents opinions and views from trade consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its workers. Readers ought to confirm info independently and seek the advice of with an expert earlier than making choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.