- The US BTC ETFs flipped gold ETFs in AUM as BTC topped $108K.

- BTC may soar as excessive as 122% in opposition to gold within the mid-term.

Bitcoin [BTC], the digital gold, has turn into a greater various retailer of worth in opposition to bodily gold, not less than primarily based on current market shifts within the US.

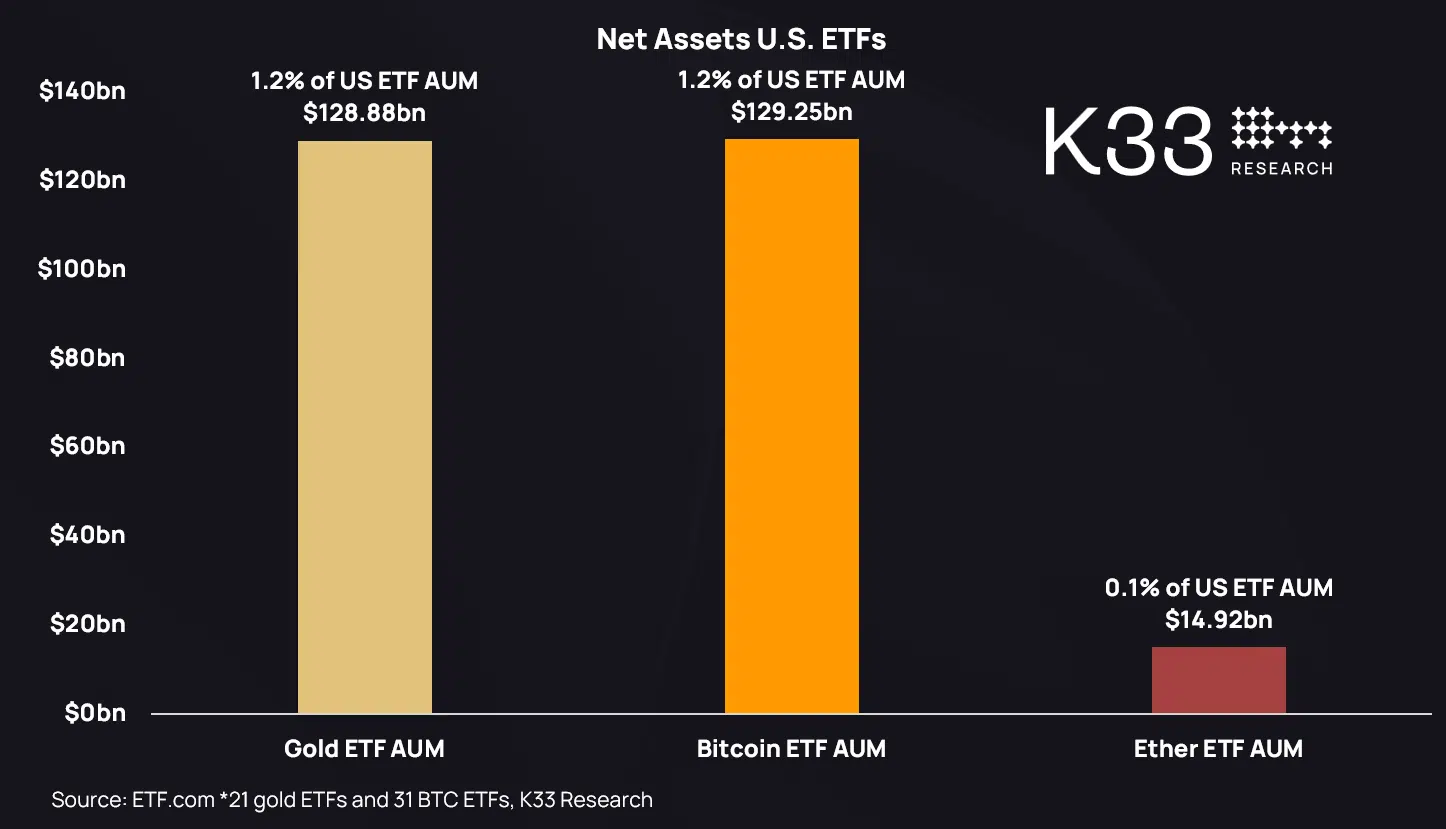

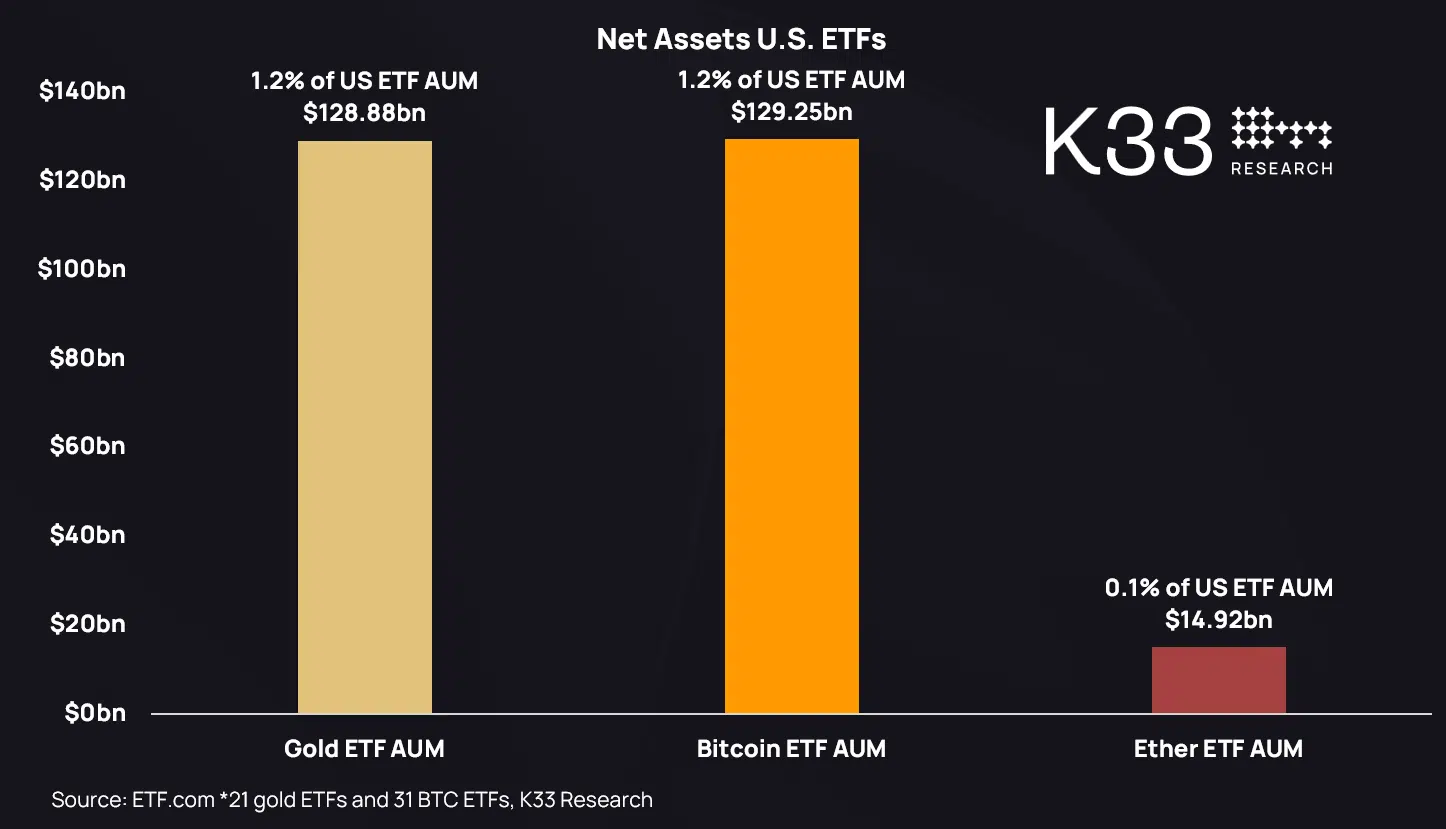

Based on Vetle Lunde, an analyst at crypto-focused K33 Analysis, the US BTC ETFs’ property below administration (AUM) surged to $129.3 billion, surpassing US gold ETFs’ $128.9 billion.

Supply: K33 Analysis

The report excessive for BTC ETFs’ AUM adopted BTC’s leap to a brand new all-time excessive (ATH) above $108K earlier within the week.

BTC flips gold

Bloomberg’s Erick Balchunas confirmed Lunde’s replace, however famous that $129 billion concerned all US BTC ETFs, together with spot and Futures.

Though gold maintained a slight lead on the spot ETFs in opposition to BTC, Balchunas underscored BTC’s progress in a 12 months was outstanding. He stated,

“If you happen to embody all bitcoin ETFs (spot, futures, levered) they’ve $130b vs $128b for gold ETFs. That stated, in case you simply take a look at spot, btc is $120b vs $125b for gold. Both approach, unreal we even discussing them being this shut at 11 months”

On his half, famend dealer Peter Brandt projected that BTC may outperform gold by an additional 122%, citing a bullish cup and deal with sample fashioned by the BTC/gold ratio.

The ratio, which tracks BTC’s relative efficiency in opposition to gold, climbed to a brand new excessive of 40 and broke above the cup and deal with sample.

This might set the tempo for Brandt’s goal – A possible 122% BTC rally in opposition to gold.

Supply: X

That stated, BTC’s choice in its place retailer of worth may achieve extra momentum if the US establishes a BTC reserve.

Because the US elections, BTC has outperformed gold by practically 60% and could possibly be simply the beginning of a bigger transfer for market share as a retailer of worth and hedging various.