A college schooling is usually thought of to be one of the best path to superior lifetime earnings and monetary freedom. Precise earnings appear to bear this out. Individuals with a four-year diploma make way more over their lifetimes than these with out—about 75% in line with this examine by the Federal Reserve Financial institution of San Francisco. However this path should be weighed in opposition to options. Bitcoin can be a wonderful funding, with a 71% common compound annual progress price (CAGR) over the previous ten years. The expansion trajectory of bitcoin has created another path to monetary freedom. What if we invested in bitcoin as an alternative of time and tuition for college? Which might yield extra over a profession?

Valuing college schooling

The worth of a college schooling has vastly outpaced inflation, with tuition going up greater than 250% in inflation-adjusted {dollars} up to now 40 years and 830% in nominal phrases. Moreover, many observers declare that universities have shifted focus over time towards politicization and controlling speech greater than free inquiry and leisure of scholars greater than high quality schooling, main many dad and mom to query the funding. Mother and father and college students are rightly asking now whether or not college is definitely worth the funding. Confidence in greater schooling has dropped precipitously from 57% in 2015 to 36% in 2023. College students are starting to vote with their toes; faculty enrollment has dropped within the US for current highschool graduates from a excessive of 70% in 2009 to 61% in 2023. Mother and father and college students are searching for different choices.

Even the 75% faculty wage premium is deceptive. The fact is that the group of scholars who obtain a four-year diploma are usually smarter and tougher working than those that go to work proper out of highschool. This quantity doesn’t inform us what the premium could be for a person pupil who may obtain a four-year diploma however chooses to not.

In his ebook The Case Towards Training, Bryan Caplan makes the case that the school wage premium drops significantly when contemplating a person pupil somewhat than the group. His intensive information evaluation exhibits that the school wage premium drops in half when isolating a person pupil of comparable skill in highschool and faculty. That’s, the school wage premium is nearer to 38% for a person. The identical particular person who would earn $1M over a lifetime of wages and not using a diploma could be anticipated to earn $1.38M with a level.

Even this adjustment overestimates the added worth of school, the place Caplan calculates that roughly 80% of the added worth is merely signaling—demonstrating to employers that the coed is the form of pupil who has the traits to attain a four-year diploma and achieve success within the office. Solely 20% is definitely added worth from schooling.

Along with the price of college and the comparatively small features, college students sacrifice 4 years of misplaced wages whereas they’re at school. This 4 years might be invested not solely in getting cash however in gaining precious expertise that will make them extra aggressive and helpful within the market after 4 years.

Valuing bitcoin funding

Bitcoin represents a completely new asset class—a digital asset whose provide stays completely scarce no matter demand. As governments reveal a whole incapability to say no to borrowing and printing new fiat cash, each subtle buyers and unusual persons are searching for an asset that may’t be inflated by any highly effective particular person, authorities, or financial institution. Because the world continues the method of changing into accustomed to bitcoin and including it to their holdings, absolute shortage means the value of bitcoin can solely development up in the long run. That is borne out in bitcoin’s superior returns over its lifetime that has exceeded each different widespread asset class in 11 out of 14 years. Bitcoin’s 71% CAGR over the previous 10 years has dwarfed the 11% that the S&P 500 has yielded in the identical interval.

Bitcoin has superior shortage, portability, and verifiability in comparison with gold. It has a really low price of possession and little jurisdictional threat. It has some immunity to regulatory threat in comparison with different property. The properties of bitcoin strongly counsel that it’ll considerably eat into the prevailing retailer of worth of gold, bonds, actual property, and shares.

Michael Saylor has not too long ago printed a 21-year worth forecast for bitcoin. His bear case estimates a 21% CAGR, a base case 29%, and a bullish case 37%. If bitcoin has returns like this, college students and fogeys want to contemplate this various intently earlier than investing tuition cash up entrance and forgoing 4 years of earnings and sensible talent improvement.

One other worth mannequin, the power-law mannequin promoted by @Giovann35084111 and others, has demonstrated exceptional constancy to cost over the historical past of bitcoin. This mannequin predicts extra speedy progress early on with regularly lowering returns as bitcoin matures. It posits that the value of bitcoin on common will increase in proportion to time raised to the sixth energy, the place time refers to complete time because the genesis block. This mannequin tasks a couple of 45% CAGR within the coming yr, falling regularly to round 25% in ten years.

Evaluating the 2

We take a look at each choices as funding in capital—a college schooling as an funding in human capital and bitcoin as an funding in an appreciating capital asset.

The price of a college schooling entails each direct prices and alternative prices: 1) paying 4 years of college tuition and a pair of) forgoing 4 years of earnings and precious job expertise. The payoff is an anticipated wage premium of 38% over a profession. The choice we contemplate right here is to spend money on bitcoin starting on Day 1 the funds that had been saved for tuition. As well as, we assume that oldsters pay dwelling bills for 4 years in both state of affairs. Thus, dwelling bills aren’t added to the price of the college possibility and aren’t subtracted from the non-university wages. As an alternative, all of web wage is used to purchase bitcoin on the finish of every yr for the 4 years that the dad and mom would have in any other case supported a pupil at college.

We assume in each situations that the wage grows by 3% per yr. That is meant to account for inflation in addition to actual progress. Greenback values and fashions are assumed to be in nominal values and aren’t adjusted for inflation. Since we’re evaluating two situations throughout the identical time-frame, the precise degree of inflation has little or no influence on the relative efficiency of the 2.

Tuition varies dramatically throughout college classes. For the yr 2024-2025, in-state tuition at a ranked public college within the U.S. averages $11K per yr. Out-of-state tuition runs $25K per yr. College students attending a personal faculty can pay an eye-watering $44K per yr. And Ivy League tuition will set households again $65K per yr. Neighborhood faculties price lower than four-year universities. As well as, some college students will qualify for scholarships and different monetary help. And a few might reside in locations the place tuition is free (properly—paid for by additional fiat cash printing).

Let’s contemplate two instances—an in-state public college and free tuition. We assume within the bitcoin various that the quantity of yearly tuition is used to buy bitcoin yearly as a form of dollar-cost averaging to unfold the danger of the time of entry available in the market.

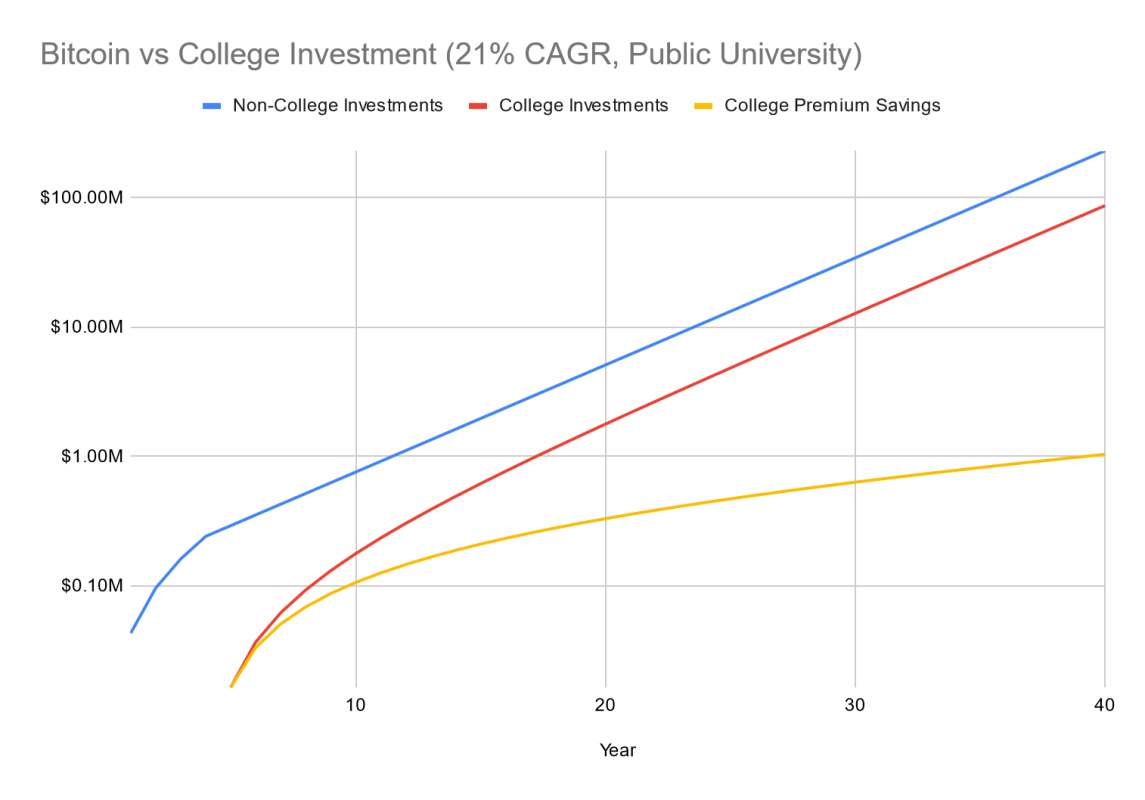

For the bitcoin worth mannequin, we contemplate two situations: the Saylor bear case (21% CAGR) and the power-law mannequin that begins with a better return and regularly falls over time, in line with its historic power-law curve.

We examine outcomes over a 40-year profession (4 college years + 36 working years for the college case). We assume that the bottom non-college take-home pay is $30K per yr, and the annual faculty premium is calculated in order that the overall lifetime premium is 38%. We assume the non-college path saves the bitcoin bought with tuition cash and the primary 4 years of take-home pay and nothing after that. The faculty path purchases bitcoin with the school wage premium every year and lives off of the identical take-home pay because the non-college path.

In every plot we present three values over time:

- Non-School Investments: Greenback worth of bitcoin from purchases made out of saved tuition and wages earned in first 4 years

- School Investments: Greenback worth of bitcoin from purchases made out of faculty wage premium every year

- School Premium Financial savings: Greenback worth of cumulative financial savings from faculty wage premium (not invested in bitcoin)

To present the school possibility essentially the most favorable attainable remedy, we assume that the school wage premium can be invested in bitcoin every year.

Outcomes

Even within the Saylor bear case (21% CAGR), investing tuition cash and the primary 4 years of earnings in bitcoin far outperforms the school wage premium over a profession. The faculty wage premium by no means catches up even after 40 years. Due to the bitcoin funding in each situations, each are very engaging. If we outline monetary freedom as having $5M in bitcoin financial savings, that’s achieved in 20 years for the non-college path and in 25 years for the school route. By comparability, merely saving the school premium in fiat with out investing in bitcoin is an abysmal technique, returning lower than 1/200 of the non-college path and about 1/100 of the school path with bitcoin funding.

Now let’s suppose your pupil will get free tuition, both by means of a scholarship or government-subsidized tuition. In that case the one benefit the non-college route has is to save lots of 4 years of earnings earlier than being on the identical footing as the school route.

The outcomes present that even on this case the non-college route yields a greater return just by having the ability to make investments 4 years of wage as an alternative of deferring superior wage by 4 years.

What if the bitcoin energy regulation continues to match the appreciation of bitcoin? We contemplate each public college tuition and free tuition.

On this case the non-college path dramatically outperforms the school path, whether or not or not tuition is free. The general public college tuition various with the ability regulation achieves monetary freedom ($5M) in solely 15 years from highschool—at age 33.

Different situations

What occurs if these situations are overly optimistic for the efficiency of bitcoin? If we drop the bitcoin CAGR all the way in which all the way down to 10% for the general public college case, the 2 situations mainly break even. If we go all the way in which all the way down to a 5% CAGR, it nonetheless takes 18 years for the school path to repay relative to the non-college path.

What if the school path prepares the coed for a extra profitable profession—like engineering, medication, or regulation—the place the school path could be the solely possibility for these careers and the place the school wage premium could also be a lot greater? Within the case of a public college with a 21% bitcoin CAGR, the premium should be 113% to achieve the breakeven level over a 40-year profession.

That’s not the entire story. Medication and regulation require much more years of deferred wages and much more tuition than a four-year diploma. Assuming eight years of deferred wages and eight years of public college tuition (absolutely an underestimate for medical or regulation faculty tuition), the school wage premium should be a towering 300% simply to interrupt even. Engineering seems to be the candy spot right here—preparation for an expert profession in 4 years with a larger-than-average anticipated wage premium. Even right here, nonetheless, the required breakeven premium of 113% is a tall order.

When you’d like to analyze different situations, here’s a Google Sheet the place you possibly can experiment with the parameters and even take a look at the formulation I used to create these calculations.

Broader concerns

This evaluation narrowly focuses on the monetary payoff of a capital funding. It doesn’t contemplate private satisfaction derived from the choice paths, motivation, the networking advantages of a college, the non-public progress expertise of a college vs. working straight from highschool, and plenty of different elements. It additionally doesn’t contemplate the potential volatility of bitcoin, both in regards to the uncertainty or the extra stress of using the bitcoin rollercoaster.

If the thesis regarding bitcoin appreciation is wherever near correct, these findings counsel {that a} non-university path with a bitcoin financial savings technique is prone to be financially advantageous in comparison with a college schooling path even with a bitcoin financial savings technique. This conclusion frees up college students and fogeys to present extra subjective consideration to different paths which will match their persona, values, and objectives. Bitcoin not solely offers a path for monetary freedom however a path towards higher freedom in profession selections much less constrained by monetary or tutorial elements.

This can be a visitor submit by Stan Reeves. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.