The spot Ethereum exchange-traded fund (ETF) launched by the world’s largest asset supervisor earlier this 12 months now holds a considerable trove of ETH, having just lately surpassed a million tokens.

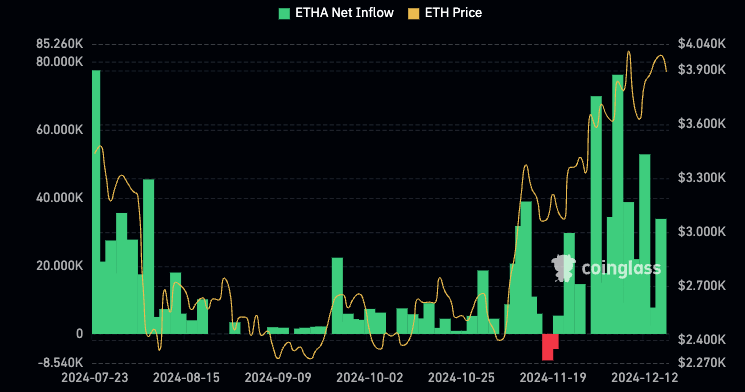

In response to information from BlackRock’s web site, the iShares Ethereum Belief ETF (ETHA) the fund now holds 1.025 million ETH value a market worth of over $4 billion after seeing important inflows over the previous few weeks, in line with CoinGlass information.

The fund is designed to trace the worth of Ether, and permits traders to achieve publicity to the cryptocurrency with out having to handle their very own wallets.

The quantity of ETH held by BlackRock’s ETF suggests institutional investor confidence in Ethereum has been rising as they accumulate further tokens, at a time wherein ETH is struggling to surpass the 44,000 mark whereas Bitcoin has rallied previous the $100,000 line and has managed to stay above it.

As CryptoGlobe reported Juan Leon, senior funding strategist at Bitwise Asset Administration, believes Ethereum is primed for a major resurgence in 2025. In a weblog submit revealed Dec. 17, Leon argued that Ethereum, regardless of being overshadowed in 2024, stands to achieve tremendously from the $100 trillion marketplace for real-world property.

Leon pointed to a pivotal shift occurring in current weeks. In response to Leon, over the previous 10 days, spot Ethereum ETFs have attracted $2 billion in web inflows, a stark distinction to the $250 million recorded over the previous 4 months. Leon attributes this to renewed investor confidence in Ethereum.

The strategist believes Ethereum’s function in tokenization might generate over $100 billion in annual charges, far outpacing its present earnings. He additionally sees favorable rules, significantly from the SEC, as a catalyst for Ethereum’s progress in 2025.

Featured picture by way of Unsplash.