Hypothesis is rising that MicroStrategy (MSTR) might halt Bitcoin (BTC) purchases in January resulting from a rumored blackout interval on issuing shares or convertible debt.

A blackout interval for publicly traded corporations is a short lived timeframe throughout which particular actions involving the corporate’s securities are restricted. These restrictions are sometimes self-imposed.

MicroStrategy’s Bitcoin Buy May Gradual Down in Q1 2025

A preferred enterprise capitalist claimed that Govt Chairman Michael Saylor faces restrictions in January that would forestall the issuance of latest convertible debt for funding additional Bitcoin acquisition.

Nonetheless, this might disappoint many MSTR buyers who intently comply with the corporate’s aggressive Bitcoin buy technique.

“Saylor has a blackout interval all of January and can’t subject any new converts to purchase BTC. Mad lad goes for it by Dec 31, after which alt season, “ Vance Spencer wrote on X (previously Twitter).

Some observers prompt the rumored prohibition would possibly stem from insider buying and selling laws. Whereas the SEC doesn’t forbid buying and selling by insiders after a fiscal quarter ends, many corporations undertake blackout durations to keep away from the looks of impropriety.

These durations typically final two weeks to a month and sometimes finish a few days after quarterly earnings bulletins. Others speculated that the restriction might apply solely to “on the market” (ATM) share gross sales, not convertible debt issuances.

“I believe $MSTR blackout durations are overhyped in period and anticipated influence. I’m not satisfied MicroStrategy will cease shopping for Bitcoin or cease the ATM for the interval from shut of the quarter to the discharge of quarterly report (~40 days). I perceive common 8K filings and press releases fulfill all Truthful Disclosure necessities, and so they’ve established a norm for doing so of their market exercise up to now,” one other analyst wrote.

One other concept linked the potential blackout to MicroStrategy’s inclusion within the NASDAQ 100 index on December 23, suggesting inner committee suggestions might have led to the pause.

MicroStrategy’s subsequent earnings report is predicted between February 3 to five, 2025. Analysts consider any blackout interval might span the whole month of January or start mid-month on January 14.

“Quarter up to now, $MSTR treasury operations delivered a BTC Yield of 46.4%, a internet good thing about ~116,940 BTC. At $105K per BTC, that equates to ~$12.28 billion for the quarter,” Michael Saylor wrote on X (previously Twitter).

Microstrategy at the moment holds $46.02 billion price of Bitcoin, sitting on an unrealized revenue of over $18.9 billion. The corporate purchased over $3 billion price of BTC in December alone, at costs of over $100,000. This exhibits how extraordinarily bullish Michael Saylor’s firm is on the biggest cryptocurrency.

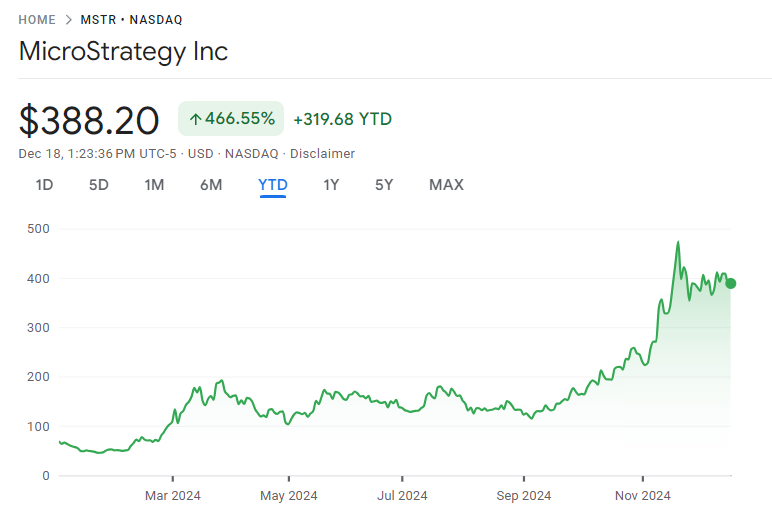

Bitcoin’s bullish cycle this 12 months has mirrored on MicroStrategy’s efficiency within the inventory market. MSTR inventory worth is up by over 460% year-to-date.

This rally has pushed the corporate into the listing of high 100 publicly listed companies within the US. The inventory was lately added to the illusive Nasdaq-100, and it’s doubtlessly in competition for the S&P 500 subsequent 12 months.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.