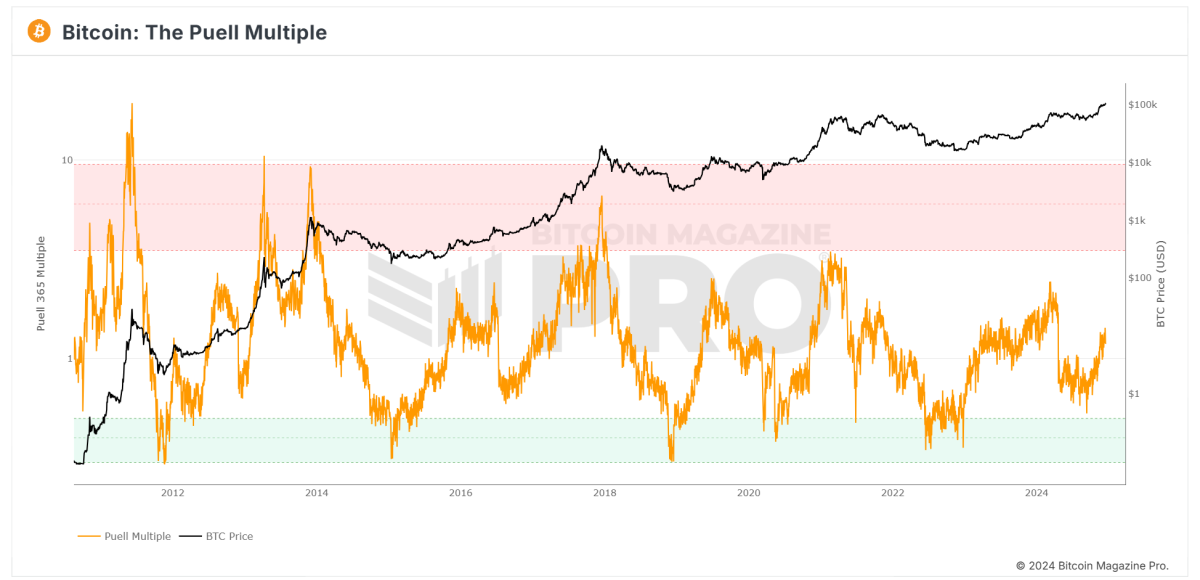

On this planet of Bitcoin investing, understanding market cycles is essential to figuring out shopping for alternatives and recognizing potential worth peaks. One indicator that has stood the take a look at of time on this regard is the Puell A number of. Initially created by David Puell, this metric examines Bitcoin’s valuation via the lens of miner income, providing insights into whether or not Bitcoin is perhaps undervalued or overvalued in comparison with its historic norms.

This text will clarify what the Puell A number of is, the right way to interpret it, and what the present studying on the chart suggests for traders. For a real-time have a look at this device, take a look at the Puell A number of chart on Bitcoin Journal Professional.

What’s the Puell A number of?

The Puell A number of is an indicator that compares Bitcoin miners’ every day income to its long-term common. Miners, because the “provide aspect” of Bitcoin’s economic system, should promote parts of their BTC rewards to cowl operational prices like power and {hardware}. This makes miner income a essential issue influencing Bitcoin’s worth dynamics.

How is the Puell A number of Calculated?

The method is easy:

Puell A number of = Each day Issuance Worth of BTC (in USD) ÷ 365-Day Shifting Common of Each day Issuance Worth

By evaluating present miner revenues to their yearly common, the Puell A number of identifies intervals the place miner income are unusually excessive or low, signaling potential market tops or bottoms.

Learn the Puell A number of Chart

The Puell A number of chart makes use of colour zones to make interpretation simple:

- Purple Zone (Overvaluation)

- When the Puell A number of enters the crimson zone (above 3.4), it suggests miner revenues are considerably increased than standard.

- Traditionally, this has coincided with Bitcoin worth peaks, indicating potential overvaluation.

- Inexperienced Zone (Undervaluation)

- When the Puell A number of drops into the inexperienced zone (under 0.5), it alerts that miner revenues are unusually low.

- These intervals have traditionally aligned with Bitcoin market bottoms, providing prime shopping for alternatives.

- Impartial Zone

- When the Puell A number of hovers between these ranges, Bitcoin’s worth is often in a gradual vary relative to historic norms.

Present Insights: What’s the Puell A number of Telling Us?

Trying on the present Puell A number of chart from Bitcoin Journal Professional:

- The Puell A number of (orange line) is trending upward however stays properly under the crimson overvaluation zone.

- This implies that Bitcoin is not but in an overheated part, the place costs traditionally peak.

- On the identical time, the metric is much above the inexperienced undervaluation zone, signaling we’re not in a market backside part.

What Does This Imply for Traders?

The present Puell A number of studying factors to Bitcoin being in a mid-market cycle:

- Bullish Momentum: With the metric rising steadily, the market seems to be transferring right into a bullish part, although it stays removed from “overheated.”

- No Fast Peak: The dearth of a crimson zone studying suggests there should still be room for upside progress earlier than a significant correction.

Traders ought to monitor this chart intently within the coming months, notably as Bitcoin approaches its subsequent halving occasion in 2028, which might additional affect miner revenues.

Why the Puell A number of Issues for Bitcoin Traders

The Puell A number of affords a novel perspective on Bitcoin’s market cycles by specializing in the availability aspect (miner income), reasonably than simply demand. For long-term traders, this device could be invaluable for:

- Figuring out Shopping for Alternatives: The inexperienced zone highlights intervals of undervaluation.

- Recognizing Market Peaks: The crimson zone has traditionally aligned with main worth tops.

- Navigating Market Cycles: Combining the Puell A number of with different indicators can assist traders time their entries and exits extra strategically.

Keep Forward of the Market with Bitcoin Journal Professional

For skilled traders and Bitcoin fans seeking to deepen their evaluation, instruments just like the Puell A number of chart on Bitcoin Journal Professional present important insights into Bitcoin’s valuation tendencies.

By understanding the Puell A number of and its historic significance, you may make knowledgeable selections and higher navigate Bitcoin’s distinctive market cycles.

Disclaimer: This text is for informational functions solely and doesn’t represent monetary recommendation. All the time conduct your individual analysis earlier than making funding selections.