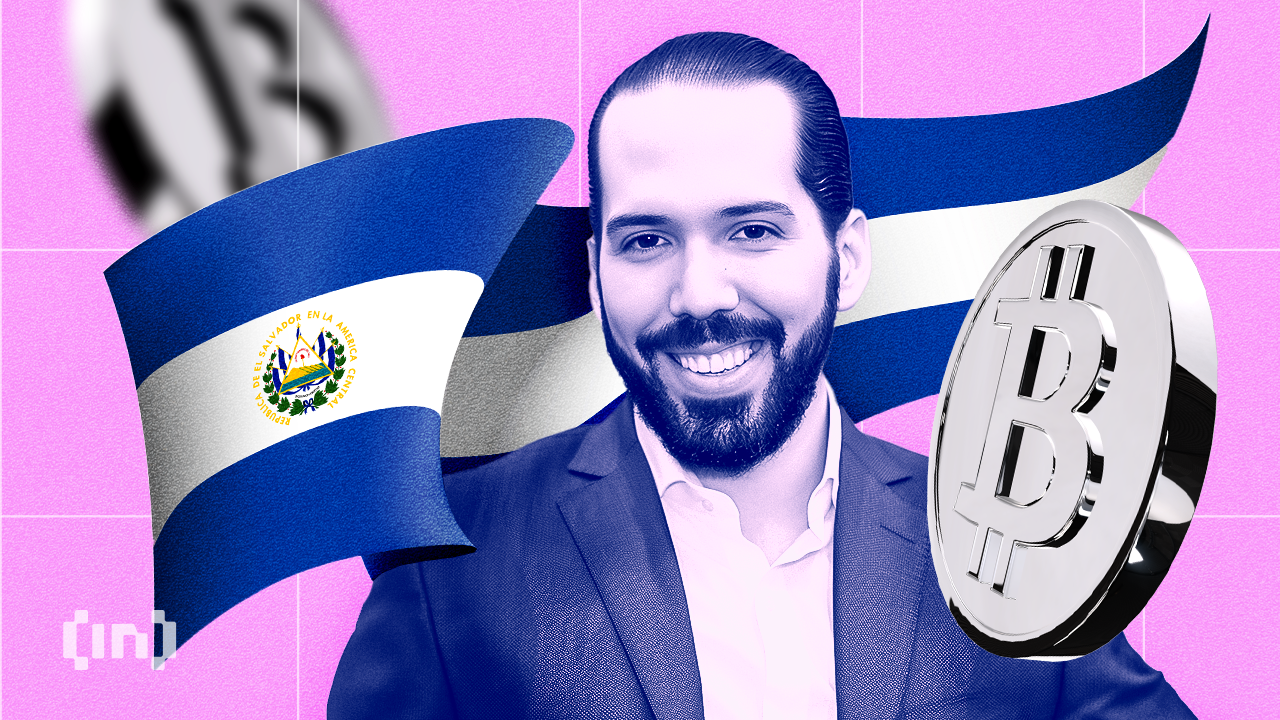

El Salvador has reached a staff-level settlement with the Worldwide Financial Fund (IMF) for a $1.4 billion Prolonged Fund Facility (EFF) association.

The 40-month deal goals to handle the nation’s fiscal challenges whereas supporting financial reforms and long-term development.

El Salvador’s IMF Deal Consists of Bitcoin, Tax, and Fiscal Reforms

As a part of the settlement, El Salvador will amend its Bitcoin Regulation to make Bitcoin acceptance voluntary moderately than obligatory for retailers. Taxes can be payable completely in US {dollars}, and the federal government plans to cut back its involvement with the state pockets, Chivo.

“The IMF principally went from, “take away the Bitcoin Regulation or else,” to “make using your already elective foreign money formally elective and wind down your app that no one likes anyway.” El Salvador made the IMF give up to its Bitcoin Regulation,” commented one person.

These changes replicate efforts to handle IMF issues about Bitcoin’s volatility and dangers.

The nation additionally dedicated to vital fiscal reforms. It plans to cut back the fiscal deficit by 3.5% factors of GDP over three years by means of spending cuts and tax will increase. Moreover, El Salvador goals to extend overseas reserves from $11 billion to $15 billion, guaranteeing better monetary stability.

The IMF acknowledged the nation’s regular financial development, pushed by sturdy remittances and a lift in tourism. The settlement seeks to reinforce public funds, promote sustainable growth, and preserve monetary stability.

“Bitcoin use in El Salvador was at all times voluntary and its utilization has by no means been increased and continues to develop. The IMF’s level is useless on arrival. Chivo is one in all dozens of wallets utilized in El Salvador. Its presence or non-presence is meaningless. Once more, pay taxes in USD? Yea, no matter dude. Saving charges in Bitcoin and utilizing Bitcoin as collateral to purchase property is exploding increased in ES. El Salvador’s success is because of Bitcoin, not the failed insurance policies of the IMF,” added Max Keiser.

In securing this association, El Salvador legislation opens the door to further loans from different worldwide monetary establishments, doubtlessly growing whole financing to over $3.5 billion.

This deal concludes 4 years of negotiations with the IMF, throughout which Bitcoin’s function within the economic system was a key concern. The IMF’s Govt Board is predicted to evaluate and approve the settlement within the coming weeks. This growth represents a important step for El Salvador because it balances financial modernization with monetary stability.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.