- Bitcoin’s fastened provide stays a key promoting level, reinforcing its place as a digital retailer of worth.

- The opportunity of altering Bitcoin’s provide cap stays extremely theoretical.

Not like the limitless U.S. greenback, Bitcoin’s 21 million provide cap is its biggest asset. With shortage baked into its design, each Bitcoin [BTC] turns into extra precious as demand grows. That is exactly why many see Bitcoin as a hedge towards inflation.

However what if this shortage isn’t as fastened as we expect? What if, even hypothetically, Bitcoin’s provide cap might be modified? May the thought of turning Bitcoin into a conventional, inflation-prone asset change into a actuality?

The controversy is heating up – and it’s extra actual than ever.

Is Bitcoin shedding its greatest promoting level?

Technically, Bitcoin’s basis rests on a extremely advanced blockchain mechanism, making the thought of altering its provide cap appear nearly absurd. Nevertheless, with the latest “Willow” controversy shaking the market, it may be untimely to dismiss such statements as pure hypothesis.

So, when BlackRock, by a video, questions the permanence of Bitcoin’s provide cap, it’s value inspecting this narrative intently.

Within the video, BlackRock highlighted Bitcoin’s fastened provide of 21 million as a key mechanism to regulate inflation. Nevertheless, it additionally included a cautionary word, stating that there’s “no assure” the availability cap will stay unchanged.

However why ought to this matter to you? What might a change to Bitcoin’s provide cap imply in the long term?

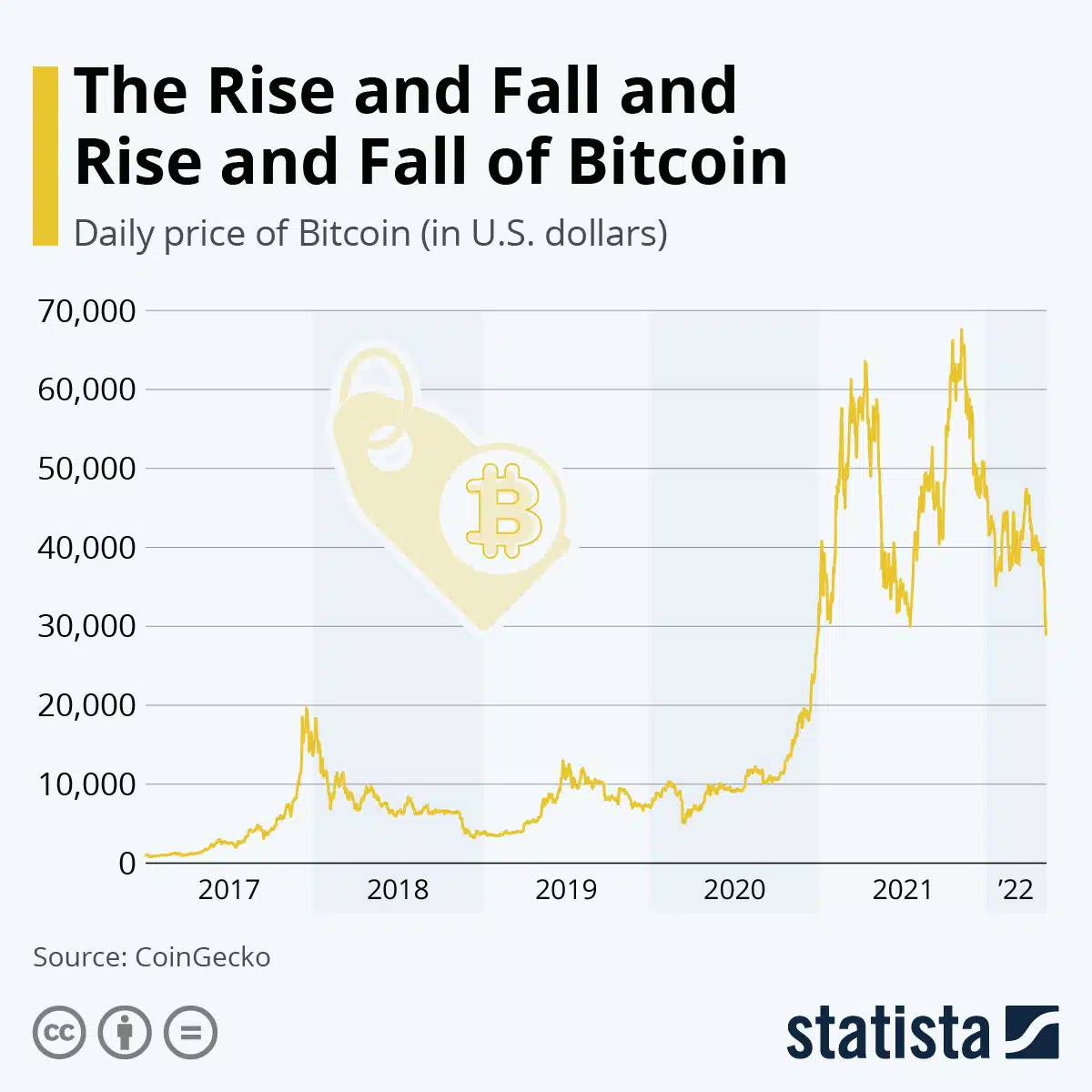

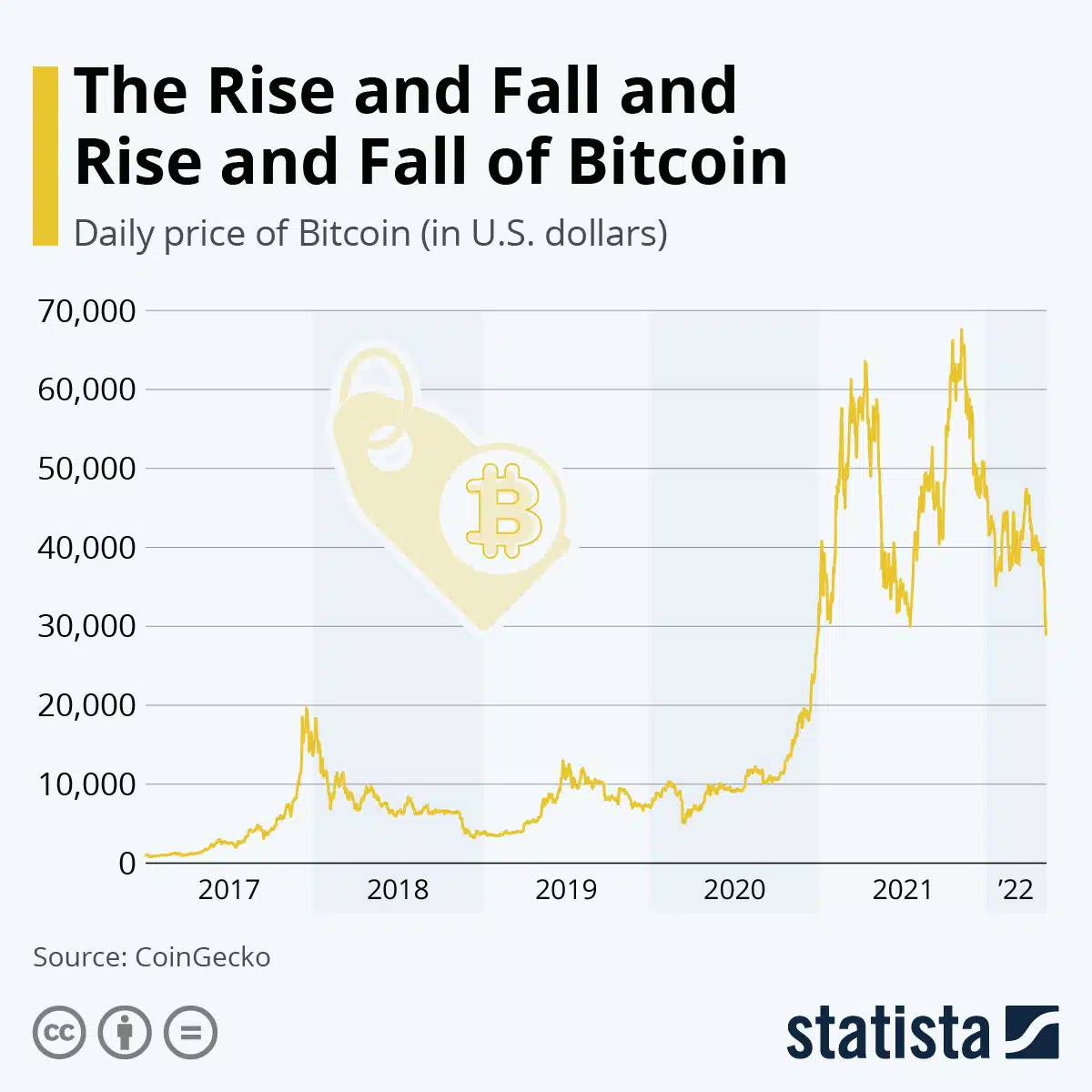

For context, Bitcoin’s explosive rise to an all-time excessive of $108K is a testomony to the ability of provide and demand. Not like fiat currencies that may be printed at will, driving inflation, Bitcoin’s 21 million cap creates actual shortage.

So, in a world the place inflation looms giant, shortage makes Bitcoin a horny hedge – therefore why it’s sometimes called “digital gold.” The post-pandemic outlook gives a transparent instance of this.

From $7,000 in January 2020 to $38,000 in February 2020, Bitcoin surged by a staggering 400% in only one month. This explosive rise wasn’t only a fluke – it was the pandemic that thrust Bitcoin into the highlight.

Supply : CoinGecko

With conventional investments (bonds, yields, shares) faltering beneath low-interest charges and restricted returns, Bitcoin’s fastened provide emerged as the largest promoting level.

So, if the cap have been eliminated, it could now not be Bitcoin – it could resemble one thing completely much like a conventional, inflation-prone monetary system.

So, is Bitcoin’s provide cap in danger?

Clearly, the 21 million cap is central to Bitcoin’s id. Technically, altering it could require a tough fork, a course of demanding consensus from miners, node operators, and buyers alike.

However right here’s the place issues get fascinating. As Bitcoin’s block rewards proceed to halve each few years, miners’ earnings additionally take a major hit.

Presently, they earn 3.125 BTC per block, however this reward is halved roughly each 4 years, with the following halving set for 2028.

As these rewards shrink, miners might want to rely extra on increased transaction charges or rising Bitcoin costs to stay worthwhile. In flip, this would possibly result in requires a provide change.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

However historical past means that miners alone don’t maintain all the ability. Take the Blocksize Conflict of 2016-2017: whereas a majority of miners supported rising BTC’s block measurement, the broader group rejected it, opting as an alternative for layer-2 scaling options just like the Lightning Community.

Due to this fact, whereas the potential for altering Bitcoin’s provide cap stays extremely theoretical, the dialog is way from over.

As we glance towards 2025, with the Fed chair’s warnings about inflation in thoughts, might Bitcoin’s shortage be leveraged to change into a fair stronger hedge towards financial uncertainty? Or will a strengthening greenback pull the rug out from beneath Bitcoin’s worth?

It’s actually one thing to consider.