Right here’s what on-chain knowledge says relating to which section of the Bitcoin market has been taking part in promoting on the newest excessive costs.

90-Day+ Bitcoin Traders Have Been Exhibiting Exercise Lately

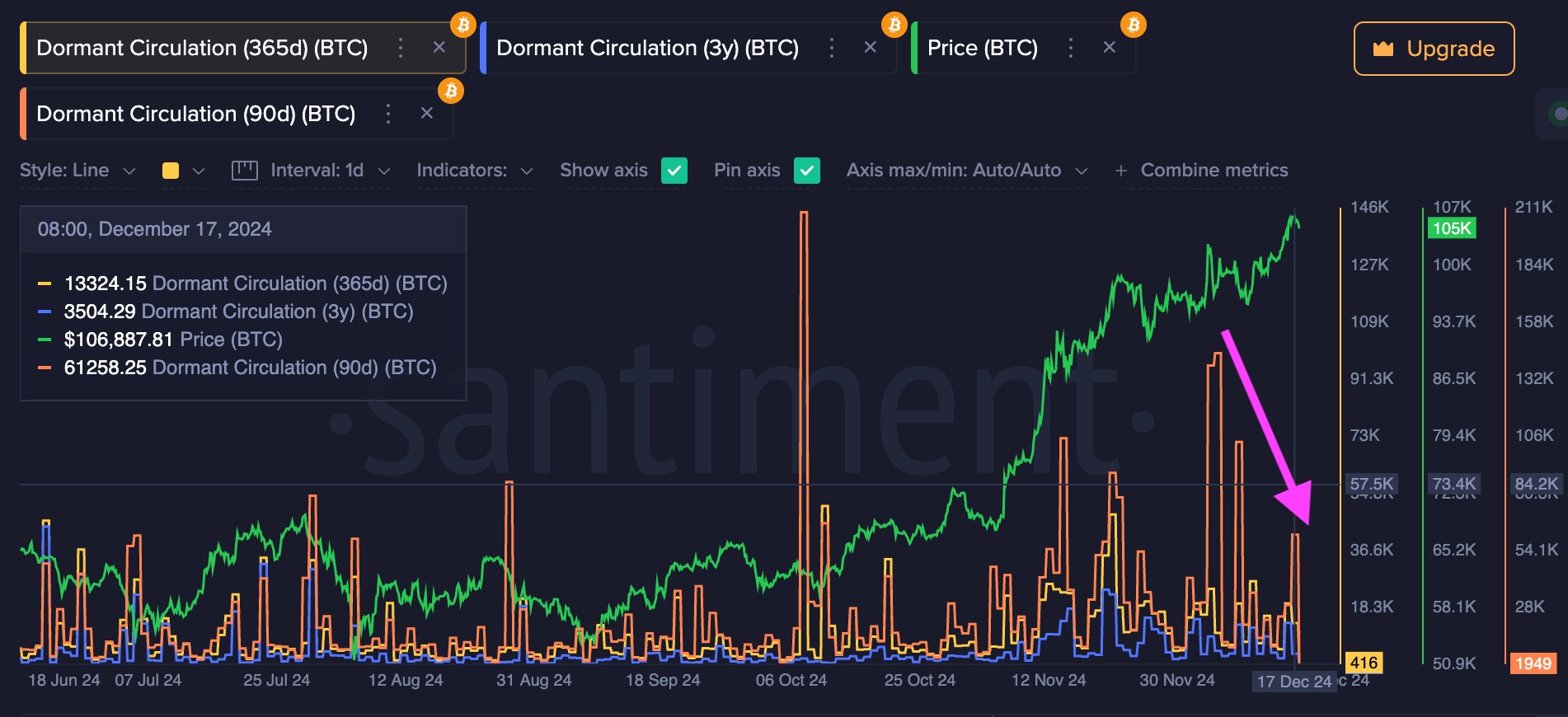

As identified by YouTuber denome in an X put up, just one section of the Bitcoin market remains to be taking part in profit-taking. The info shared by the consumer is from the on-chain analytics agency Santiment. Extra particularly, the chart is for the Dormant Circulation indicator.

The Dormant Circulation retains observe of the full variety of tokens being moved on the blockchain after having been dormant for at the least a given size of time.

Beneath is the chart for the metric, which exhibits the development in its worth for 3 totally different timeframes over the previous few months:

The worth of the metric seems to have been excessive for the 90+ days cohort in latest days | Supply: @denomeme on X

Within the graph, the three variations of Dormant Circulation listed are: 90 days, three hundred and sixty five days, 3 years. Notice that these are the beginning factors of the intervals for which the metric tracks; the 90-day, as an illustration, measures the transactions of cash that had been held for greater than 90 days previous to the transfer.

From the chart, it’s obvious that the Dormant Circulation surged to notable ranges for the 90+ days and 365+ days cash because the cryptocurrency’s rally occurred final month.

At one level, the distinction between the spikes of the 2 wasn’t even that a lot, so a bulk of the transactions that had been being counted by the 90+ days model had been in reality of cash older than three hundred and sixty five days. Thus, it appears the veteran cohort of the Bitcoin market, referred to as the long-term holders (LTHs), had been busy with promoting.

The 90-day Dormant Circulation has remained at notable ranges this month because the bullish momentum of the asset has continued with its value exploring above the $100,000 stage.

Not like final month, nevertheless, the 365-day model of the indicator hasn’t registered any spikes, implying cash aged between 90-days and 365-days are those being bought. This vary is half made up by the older of the short-term holders (STHs) and half by the youthful of the LTHs.

Contemplating that the broader LTH cohort hasn’t been taking part in any promoting, although, it’s possible {that a} majority of the transactions are in reality of cash belonging to the STHs.

Based mostly on the development witnessed previously month, it appears a number of the HODLers had been hasty in taking their income earlier, however now the cohort believes Bitcoin nonetheless has the potential to run past the latest highs, so its members are holding off on promoting.

The STHs are identified to signify the fickle-minded facet of the market that simply sells, so it’s no shock that they’re nonetheless taking income amid the $100,000+ hype run.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $104,200, up greater than 6% over the previous week.

Seems like the worth of the coin has been on the way in which up over the previous few days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com