Bitcoin reached a brand new all-time excessive (ATH) earlier this week, briefly surpassing $108,000. Nevertheless, the crypto king has since confronted a pullback, dropping beneath $96,000.

Whereas the decline displays short-term profit-taking, it doesn’t negate the cryptocurrency’s long-term potential, which continues to garner consideration.

Bitcoin Is Altering Fingers

Mid-term Bitcoin holders, significantly those that have held BTC for six to 12 months, are main the present profit-taking pattern. These buyers accrued throughout prior cycles and at the moment are seizing the chance to lock in positive aspects.

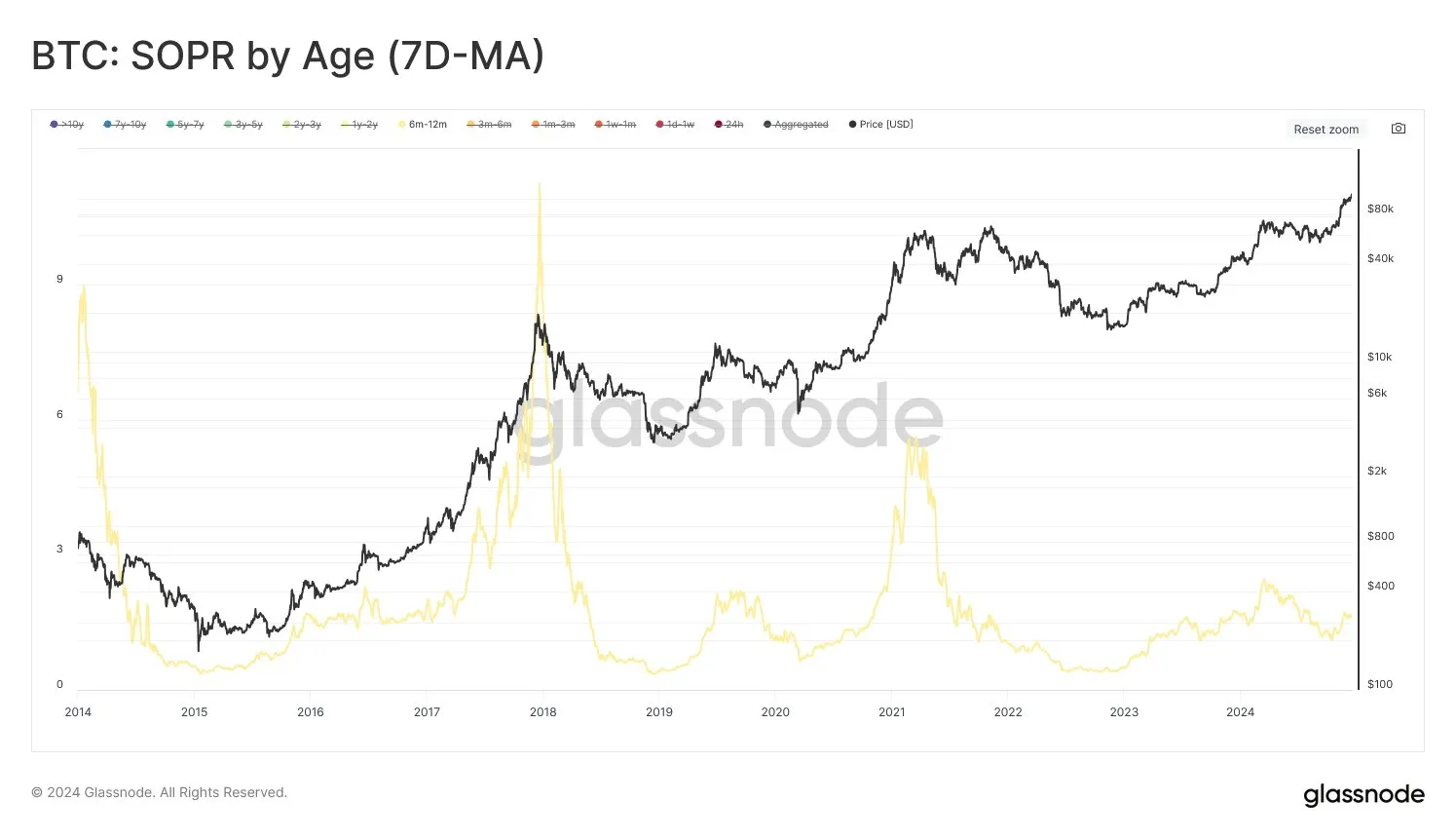

This conduct mirrors the 2015-2018 bull market when the Spent Output Revenue Ratio (SOPR) remained beneath 2.5 for an prolonged interval, ultimately giving solution to a euphoric rally.

As seen in prior bull markets, heavy profit-taking from these holders is more likely to result in a section of exhaustion. For Bitcoin to take care of its upward momentum, elevated demand and the entry of latest consumers are essential. With out these components, the bull run may face challenges in sustaining its trajectory.

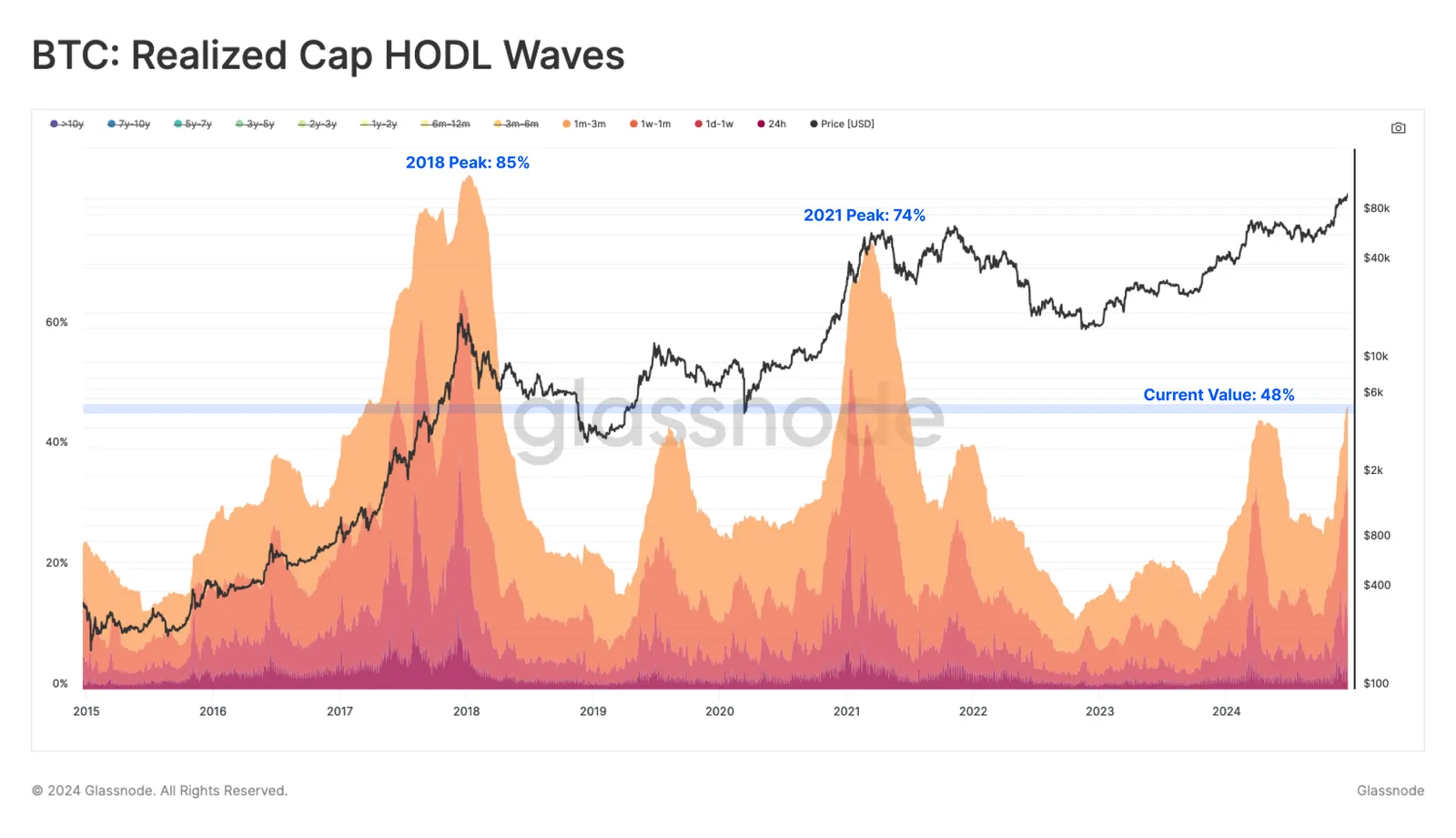

The HODL waves present a noticeable improve in wealth held by lately moved Bitcoin, indicating an increase in demand-side exercise. Cash beforehand held by long-term buyers are being distributed to new consumers, demonstrating that recent capital is coming into the market. This pattern highlights the rising curiosity in Bitcoin regardless of current worth fluctuations.

Nevertheless, the proportion of wealth held by newer buyers has not but reached ranges seen through the peak of prior ATH cycles. Whereas the present metrics present optimistic indicators, Bitcoin’s macro momentum hinges on whether or not this demand continues to develop. Sustained accumulation by new market members can be key to driving future worth rallies.

BTC Worth Prediction: Restoration Forward

Bitcoin is predicted to search out fast help round $95,000. Presently buying and selling at $95,144, the cryptocurrency may get well if market sentiment stays optimistic.

The subsequent important milestone for Bitcoin is flipping $95,668 into help. Attaining this could possible pave the best way for a transfer again above $100,000. Breaking previous this psychological barrier would sign renewed confidence and bullish momentum, probably drawing in further consumers.

Failure to carry the $95,000 vary or elevated profit-taking may push Bitcoin decrease. In such a state of affairs, the subsequent important help stage sits at $89,800. A decline thus far may invalidate the bullish thesis, signaling a possible bearish section for the market.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.