With Bitcoin now making six-figure territory really feel regular and better costs a seeming inevitability, the evaluation of key on-chain information gives helpful insights into the underlying well being of the market. By understanding these metrics, traders can higher anticipate value actions and put together for potential market peaks and even any upcoming retracements.

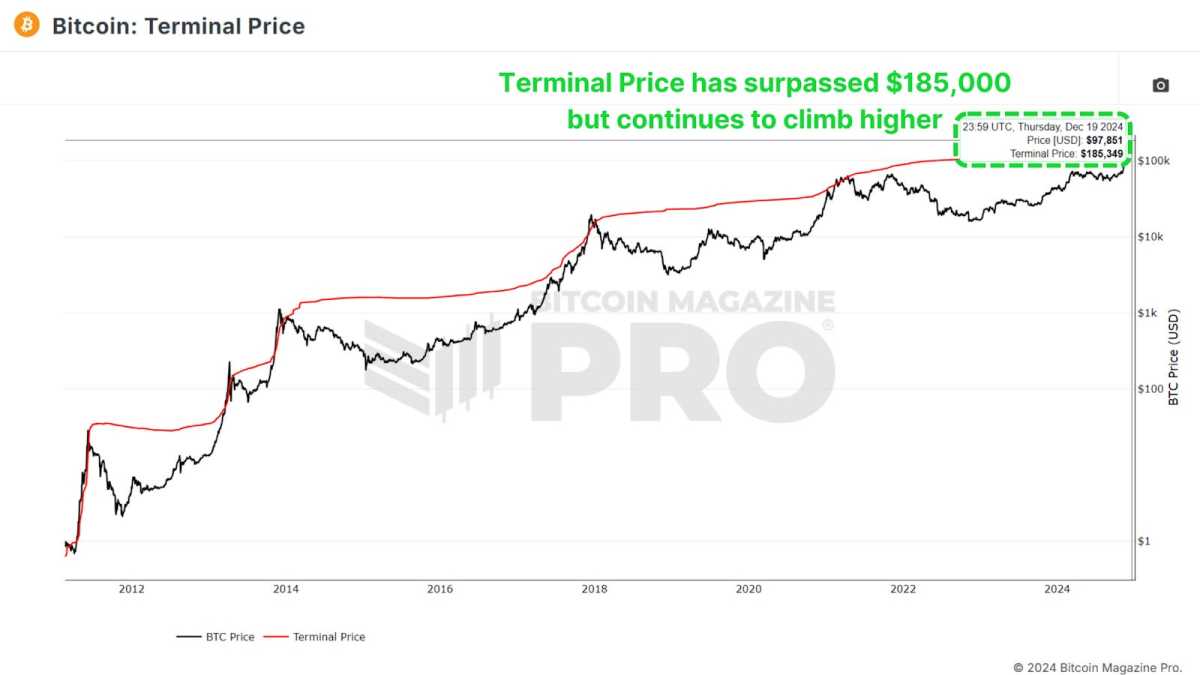

Terminal Value

The Terminal Value metric, which includes the Coin Days Destroyed (CDD) whereas factoring in Bitcoin’s provide, has traditionally been a dependable indicator for predicting Bitcoin cycle peaks. Coin Days Destroyed measures the rate of cash being transferred, contemplating each the holding period and the amount of Bitcoin moved.

View Stay Chart 🔍

Presently, the terminal value has surpassed $185,000 and is more likely to rise towards $200,000 because the cycle progresses. With Bitcoin already breaking $100,000, this implies we should have a number of months of constructive value motion forward.

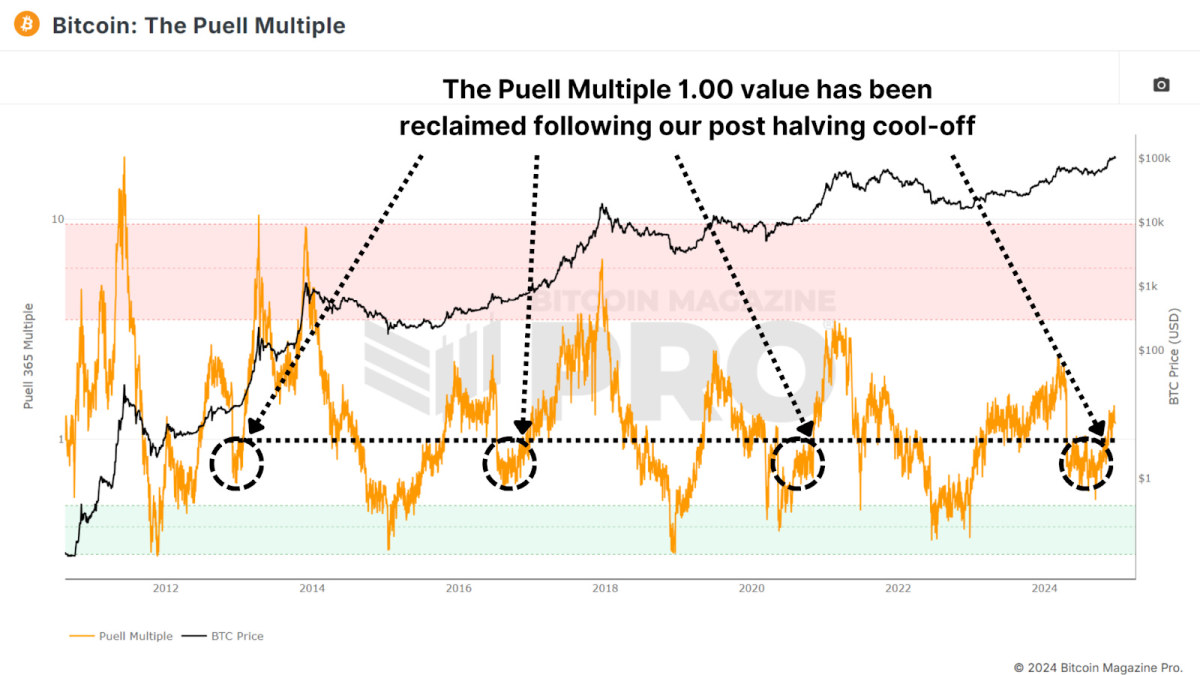

Puell A number of

The Puell A number of evaluates every day miner income (in USD) relative to its 365-day shifting common. After the halving occasion, miners skilled a pointy drop in income, making a interval of consolidation.

View Stay Chart 🔍

Now, the Puell A number of has climbed again above 1, signaling a return to profitability for miners. Traditionally, surpassing this threshold has indicated the later levels of a bull cycle, typically marked by exponential value rallies. An analogous sample was noticed throughout all earlier bull runs.

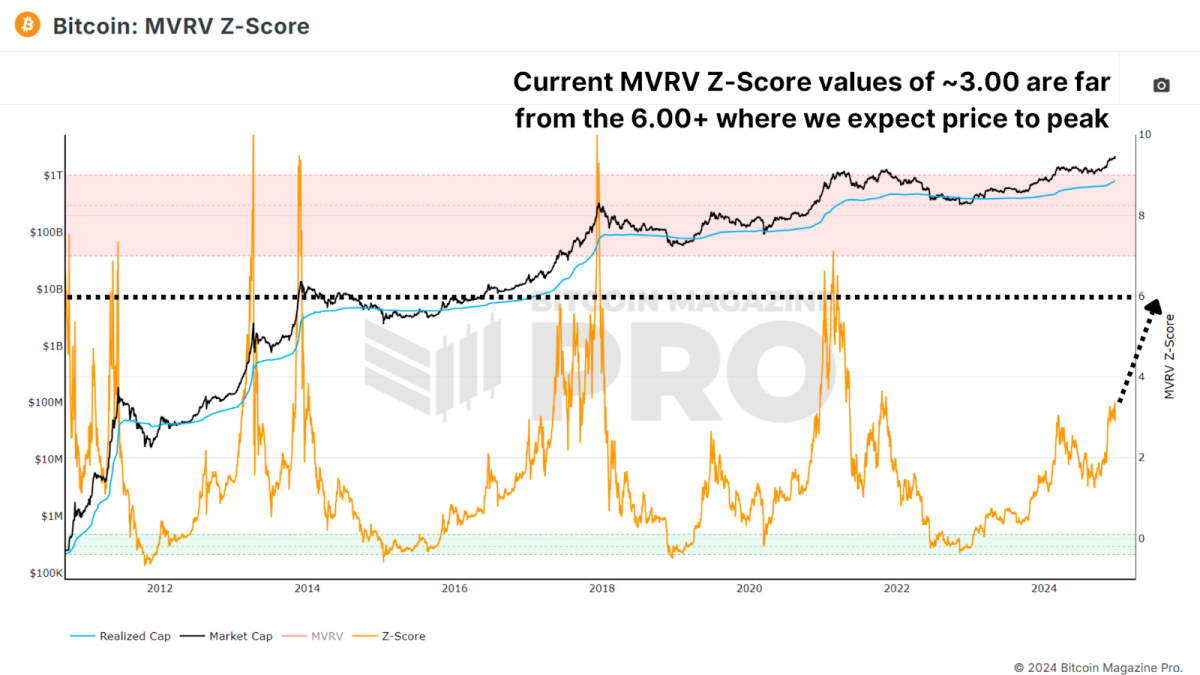

MVRV Z-Rating

The MVRV Z-Rating measures the market worth relative to the realized worth (common price foundation of Bitcoin holders). Standardized right into a Z-Rating to account for the asset’s volatility, it’s been extremely correct in figuring out cycle peaks and bottoms.

View Stay Chart 🔍

Presently, Bitcoin’s MVRV Z-Rating stays beneath the overheated purple zone with a price of round 3.00, signaling that there’s nonetheless room for development. Whereas diminishing peaks have been a pattern in latest cycles, the Z-Rating means that the market is much from reaching a euphoric high.

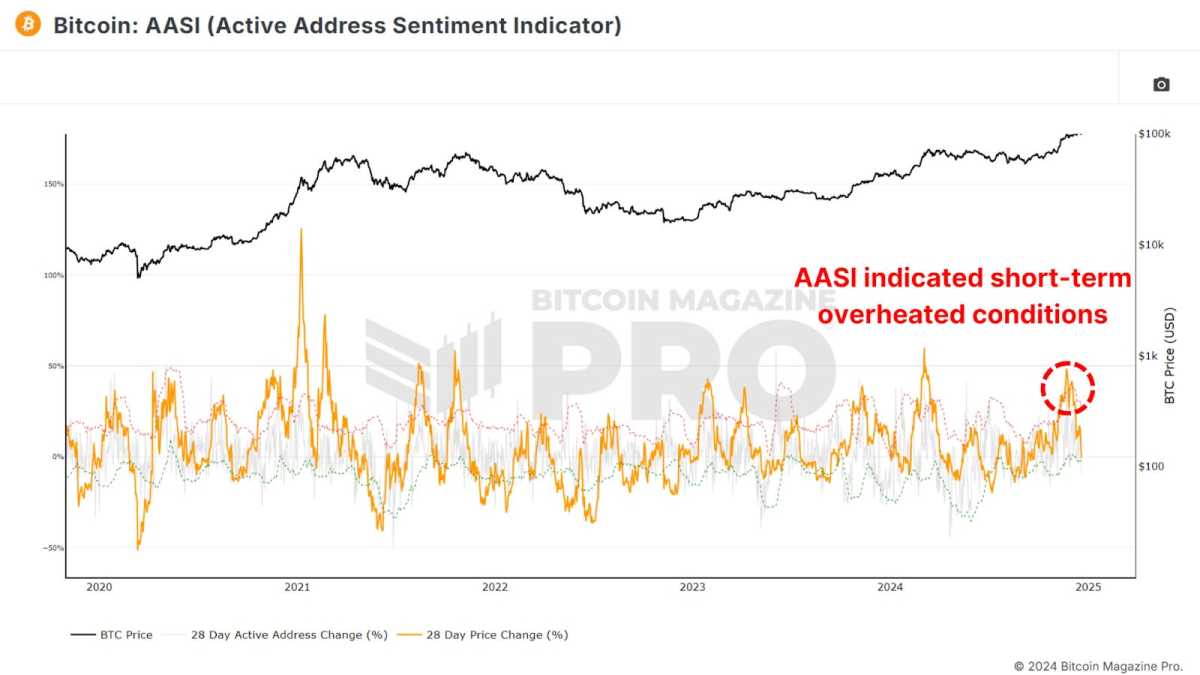

Lively Tackle Sentiment

This metric tracks the 28-day share change in energetic community addresses alongside the value change over the identical interval. When value development outpaces community exercise, it suggests the market could also be short-term overbought, because the constructive value motion is probably not sustainable given community utilization.

View Stay Chart 🔍

Latest information reveals a slight cooling after Bitcoin’s fast climb from $50,000 to $100,000, indicating a wholesome consolidation interval. This pause is probably going setting the stage for sustained long-term development and doesn’t point out we must be medium to long-term bearish.

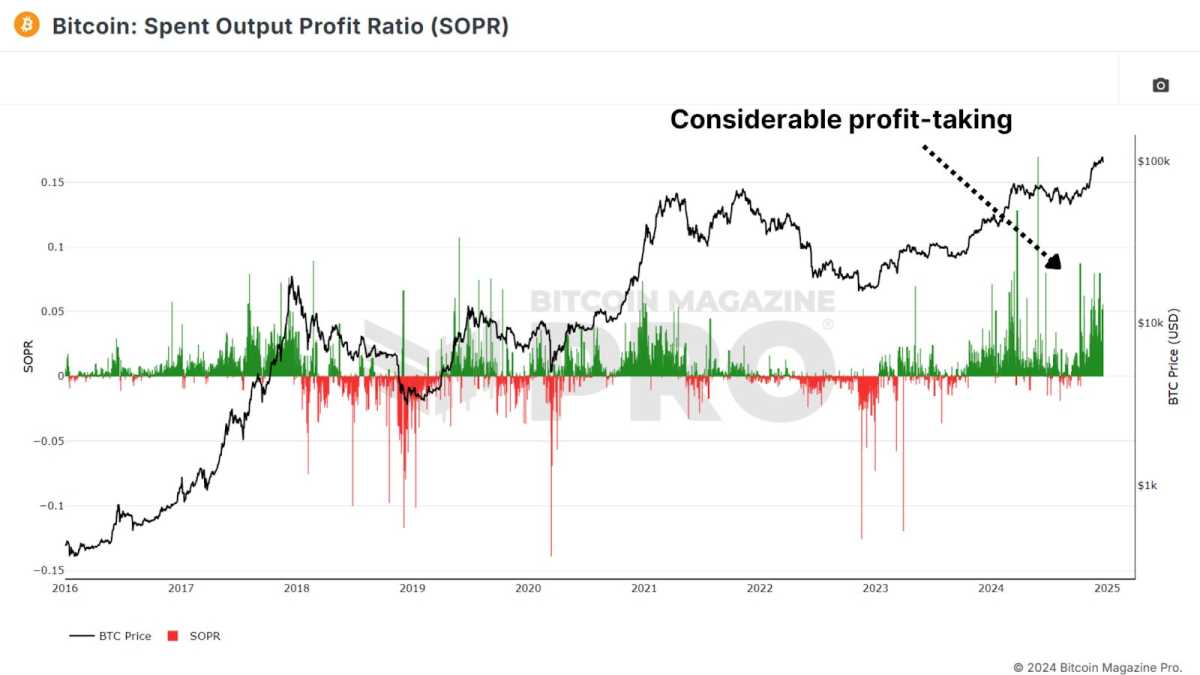

Spent Output Revenue Ratio

The Spent Output Revenue Ratio (SOPR) measures realized income from Bitcoin transactions. Latest information reveals an uptick in profit-taking, doubtlessly indicating we’re coming into the latter levels of the cycle.

View Stay Chart 🔍

One caveat to think about is the rising use of Bitcoin ETFs and spinoff merchandise. Buyers could also be shifting from self-custody to ETFs for ease of use and tax benefits, which might affect SOPR values.

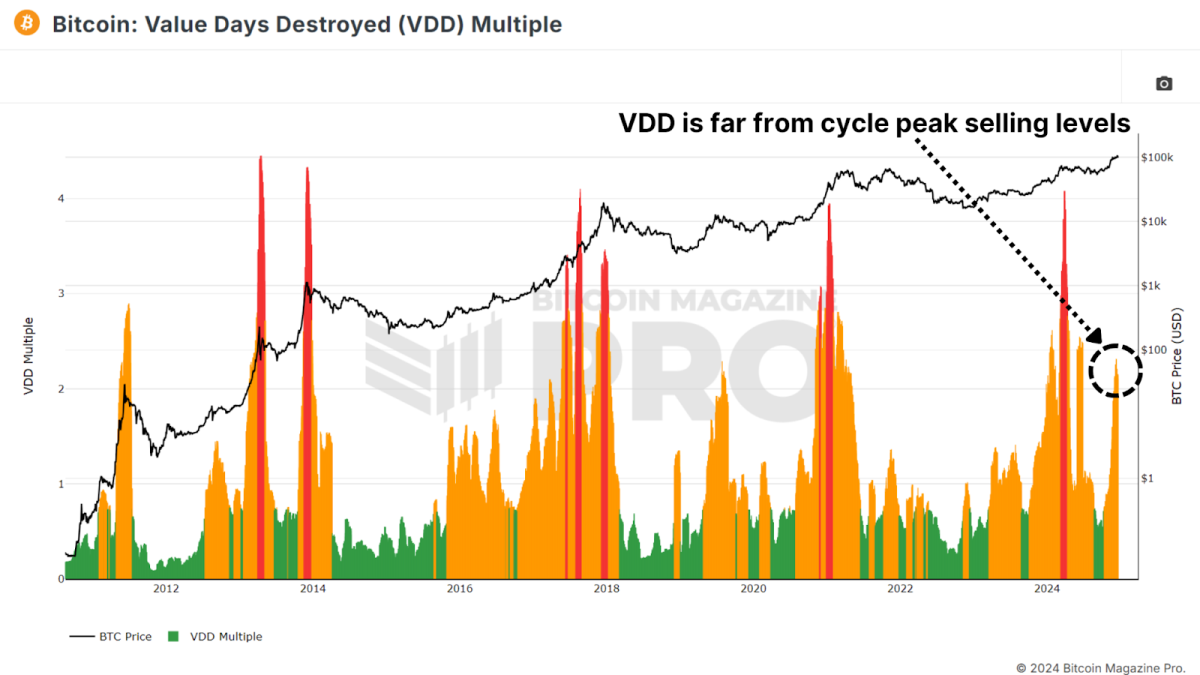

Worth Days Destroyed

Worth Days Destroyed (VDD) A number of expands on CDD by weighting bigger, long-term holders. When this metric enters the overheated purple zone, it typically alerts main value peaks because the market’s largest and most skilled contributors start cashing out.

View Stay Chart 🔍

Whereas Bitcoin’s present VDD ranges point out a barely overheated market, historical past suggests it might maintain this vary for months earlier than a peak. For instance, in 2017, VDD indicated overbought circumstances practically a yr earlier than the cycle’s high.

Conclusion

Taken collectively, these metrics recommend that Bitcoin is coming into the latter levels of its bull market. Whereas some indicators level to short-term cooling or slight overextension, most spotlight substantial remaining upside all through 2025. Key resistance ranges for this cycle could emerge between $150,000 and $200,000, with metrics like SOPR and VDD offering clearer alerts as we strategy the height.

For a extra in-depth look into this subject, try a latest YouTube video right here: What’s Taking place On-chain: Bitcoin Replace

Disclaimer: This article is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding selections.