Bitcoin mining giants Marathon Digital Holdings and Hut 8 have capitalized on Bitcoin’s current correction by making multi-billion-dollar investments within the flagship cryptocurrency.

On Dec. 19, the businesses introduced purchases totaling over 16,000 BTC for $1.6 billion, equal to 37 days of Bitcoin issuance.

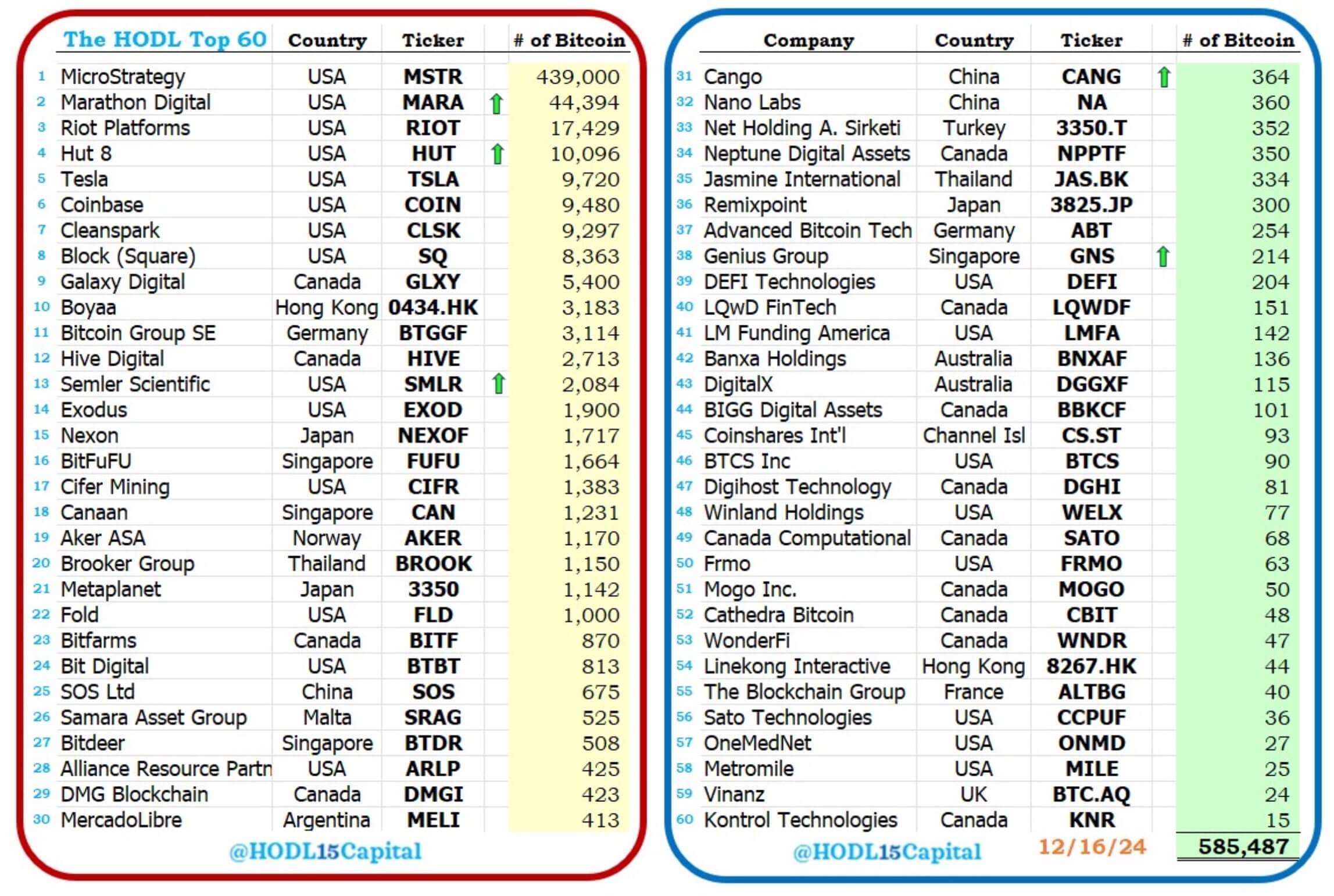

Marathon led the best way by buying 15,574 BTC at a median worth of $98,529 per coin, investing roughly $1.53 billion. This addition elevated the corporate’s Bitcoin holdings to 44,394 BTC, price $4.45 billion on the present spot worth of $100,151.

Marathon is the second-largest publicly traded Bitcoin holder, behind solely MicroStrategy, which holds 439,000 BTC.

In the meantime, Hut 8 acquired 990 BTC for $100 million, paying a median of $101,710 per Bitcoin. This transaction raised Hut 8’s complete Bitcoin reserves to 10,096 BTC. The corporate now holds extra Bitcoin than Tesla and is the fourth public firm to carry greater than 10,000 Bitcoin on its steadiness sheet.

These investments got here on the heels of a pointy market decline spurred by a US Federal Reserve charge adjustment. Bitcoin’s worth dropped by greater than 5%, hitting a low of $96,781 earlier than recovering to $98,750, based on CryptoSlate’s information.