Uniswap (UNI) worth is down 20% within the final 24 hours, persevering with its bearish trajectory after shedding the $10 billion market cap it held simply days in the past, now sitting at $7.2 billion. The sharp decline has pushed UNI right into a important zone, with technical indicators reflecting robust downward momentum and the potential for additional losses.

A looming dying cross within the EMA strains alerts a potential deeper correction, with key assist ranges at $9.64 and $8.5 being intently watched. On the upside, a reversal may see UNI concentrating on resistance ranges at $13.5 and $16.2, with the potential of rising towards $19 if bullish momentum positive factors traction.

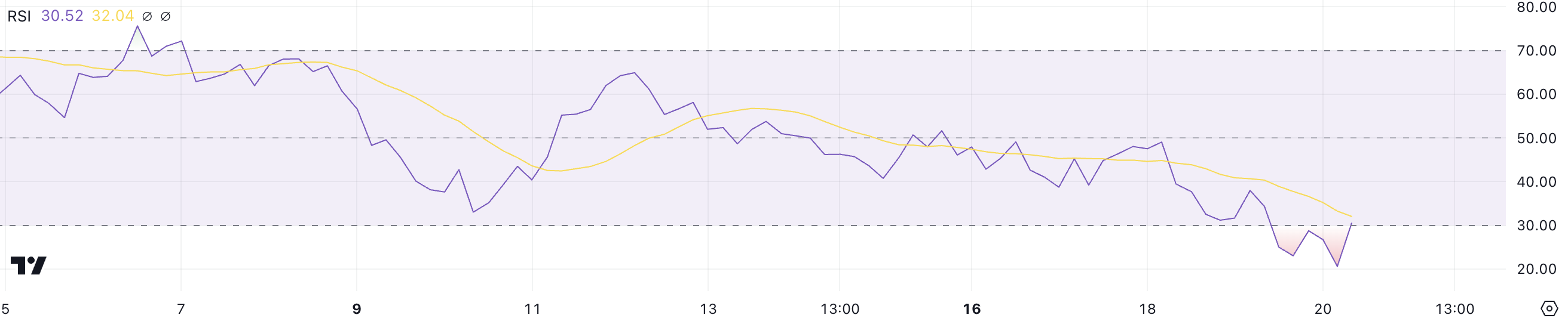

Uniswap RSI Is Recovering From Oversold Zone

The RSI (Relative Energy Index) for Uniswap presently stands at 30.5, a slight restoration from ranges round 20 seen a number of hours in the past. An RSI beneath 30 is taken into account oversold, indicating extreme promoting strain and the potential of short-term undervaluation.

UNI latest dip into oversold territory suggests intense promoting exercise. Nonetheless, the slight rebound to 30.5 alerts that promoting momentum may very well be easing, with the potential for consumers to re-enter the market steadily.

The RSI measures the power and pace of worth actions, oscillating between 0 and 100. Its thresholds assist interpret market situations: an RSI beneath 30 alerts oversold situations and potential for a worth rebound, whereas an RSI above 70 signifies overbought situations and potential promoting strain.

With Uniswap RSI hovering simply above the oversold threshold, the worth could try and stabilize or see a light bounce. Nonetheless, if the RSI fails to rise meaningfully above 30, it may point out continued bearish strain and restricted restoration within the brief time period.

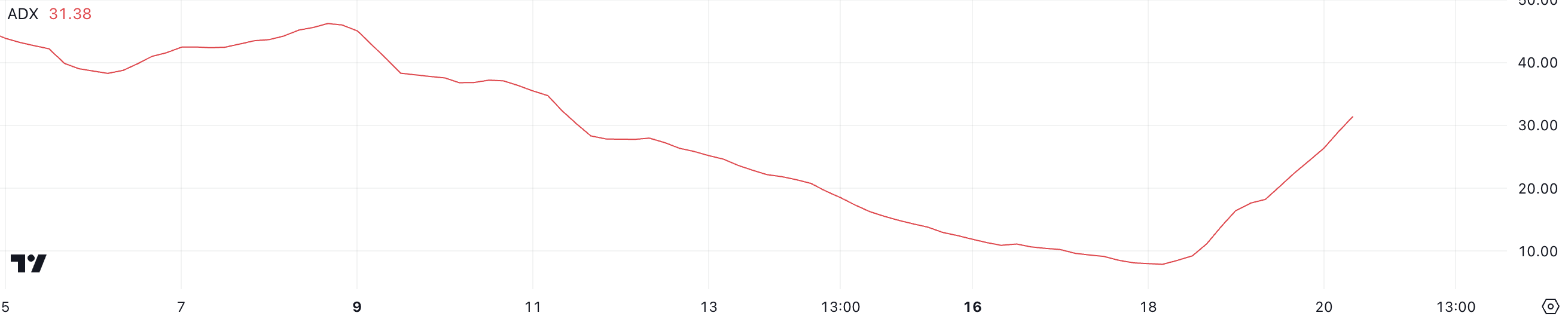

Uniswap Downtrend Is Very Sturdy Proper Now

The ADX (Common Directional Index) for UNI is presently at 31.38, a big improve from beneath 10 simply two days in the past. This sharp rise signifies that the power of the present development has intensified significantly over a brief interval.

Since UNI worth is presently in a downtrend, the elevated ADX means that bearish momentum is gaining traction, making additional downward worth motion probably within the close to time period.

The ADX measures the power of a development, no matter its path, on a scale from 0 to 100. Values beneath 20 point out a weak or directionless development, values between 20 and 40 recommend a average development, and values above 40 signify a robust development.

With UNI’s ADX at 31.38, the present downtrend is reasonably robust and nonetheless constructing momentum. Within the brief time period, this stage implies continued strain on UNI worth except consumers step in to counter the prevailing bearish development.

UNI Value Prediction: The Altcoin Can Fall Under $10 Quickly

UNI’s EMA (Exponential Shifting Common) strains presently show a bearish setup, with the shortest-term EMA nearing a possible cross beneath the longest-term EMA. This sample, generally known as a dying cross, typically alerts intensified bearish momentum and will set off a sharper correction.

If the dying cross happens, Uniswap worth could check the assist stage at $9.64. If this stage fails to carry, it may fall additional to $8.5, marking a deeper decline.

Nonetheless, if UNI worth can reverse the bearish development and construct a robust uptrend, it may first problem the resistance at $13.5.

A profitable break above this stage may pave the way in which for a transfer to $16.2, with the potential to rise additional towards $19 if bullish momentum persists.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.