US spot Bitcoin and Ethereum exchange-traded funds (ETFs) witnessed a pointy decline on Dec. 19, with vital outflows disrupting long-standing streaks of investor inflows.

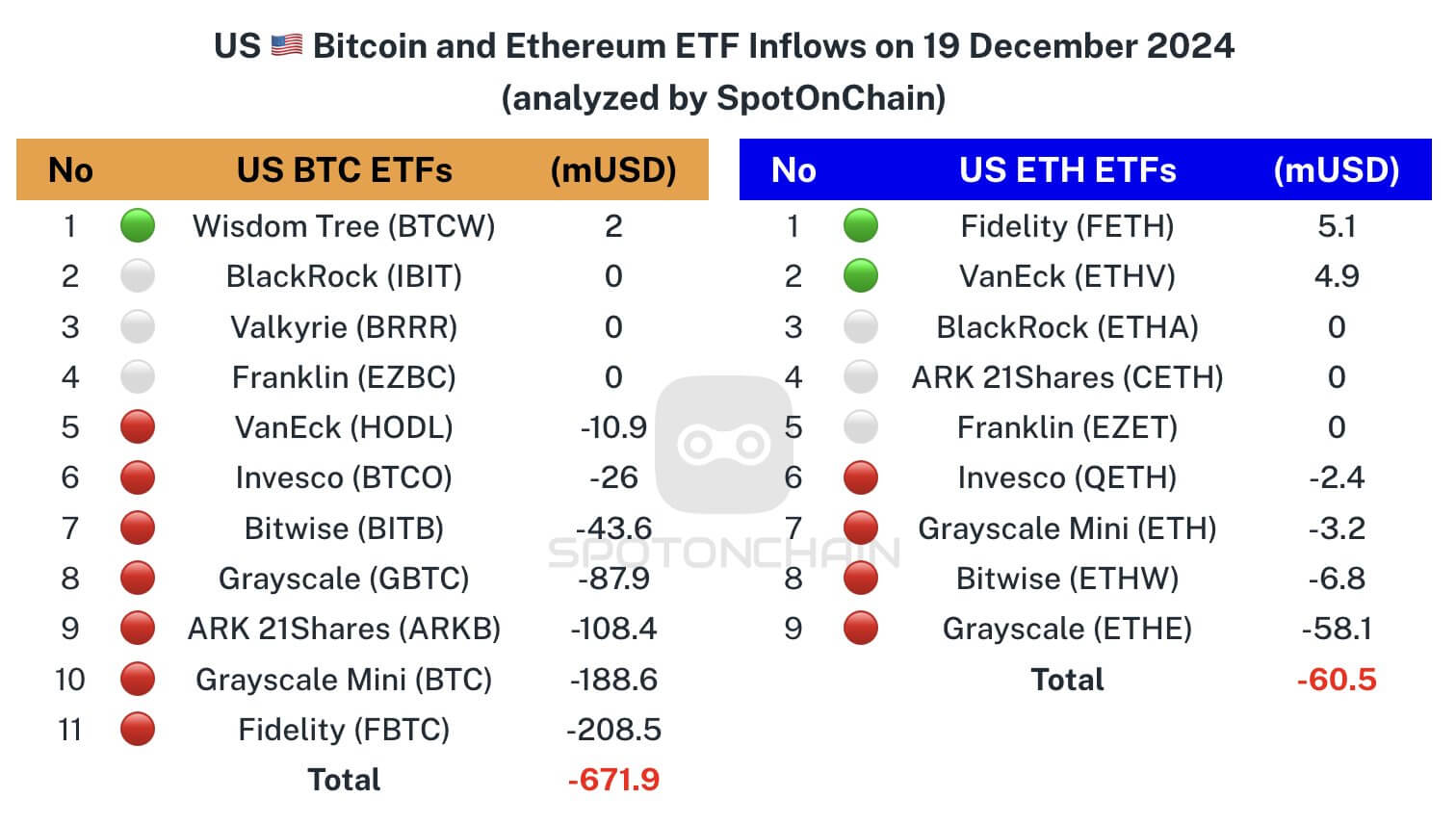

Knowledge from SpotOnChain revealed that the Bitcoin ETFs recorded their most important single-day outflows since their launch in January. The earlier report was set in Might with a $563 million outflow. Buyers withdrew $671.9 million from the funds, breaking a 15-day streak of inflows.

Constancy’s FBTC led the sell-off with $208 million in outflows, adopted by Grayscale Bitcoin Mini Belief and ARK 21Shares’ ARKB, which noticed outflows of $188 million and $108 million, respectively.

Regardless of the widespread withdrawals, WisdomTree’s BTCW bucked the development, recording $2 million in modest inflows. BlackRock’s IBIT and different ETFs remained flat, with no notable adjustments.

Ethereum ETFs finish streak

Spot Ethereum ETFs weren’t spared, with outflows totaling $60.47 million and ending an 18-day streak of inflows.

Grayscale’s ETHE was hit hardest, dropping $58.13 million, whereas Bitwise’s ETHW adopted with $6.78 million in outflows. Grayscale’s Ethereum Mini Belief and Invesco’s QETH noticed losses exceeding $5 million.

On the upside, Constancy’s FETH and VanEck’s ETHV attracted inflows of $5.1 million and $4.9 million, respectively.

Nonetheless, these good points didn’t offset the broader market decline, as different Ethereum ETF merchandise recorded zero flows.