- Bitcoin usually reveals an inverse correlation with the greenback. A weaker greenback boosts BTC’s enchantment.

- Whereas previous developments can present perception, 2024 has launched new dynamics.

The latest Bitcoin [BTC] crash from its $108K all-time excessive to $92K in simply three days serves as a stark reminder of the ‘anticipated’ volatility traders anticipate in 2025.

A key takeaway: the greenback index surged to a yearly excessive of 108 – a degree final seen in July 2022 – regardless of the Fed easing borrowing charges, reinforcing the perceived ‘danger’ tied to Bitcoin investments.

So, as we transfer towards 2025, is Bitcoin set to turn into an excellent riskier wager because the Federal Reserve speculates or may this be the perfect second to leap in, figuring out the crypto market likes to defy mainstream expectations?

Greenback beneath the radar

Because the third and closing FOMC charge minimize of 2024 concluded, each shares and Bitcoin skilled an enormous sell-off. In response, the greenback surged to a yearly excessive.

Usually, Bitcoin and the greenback present an inverse correlation. A better greenback index suggests traders are shifting in the direction of ‘safe-haven’ belongings like bonds and yields, reasonably than betting on ‘riskier’ belongings like Bitcoin.

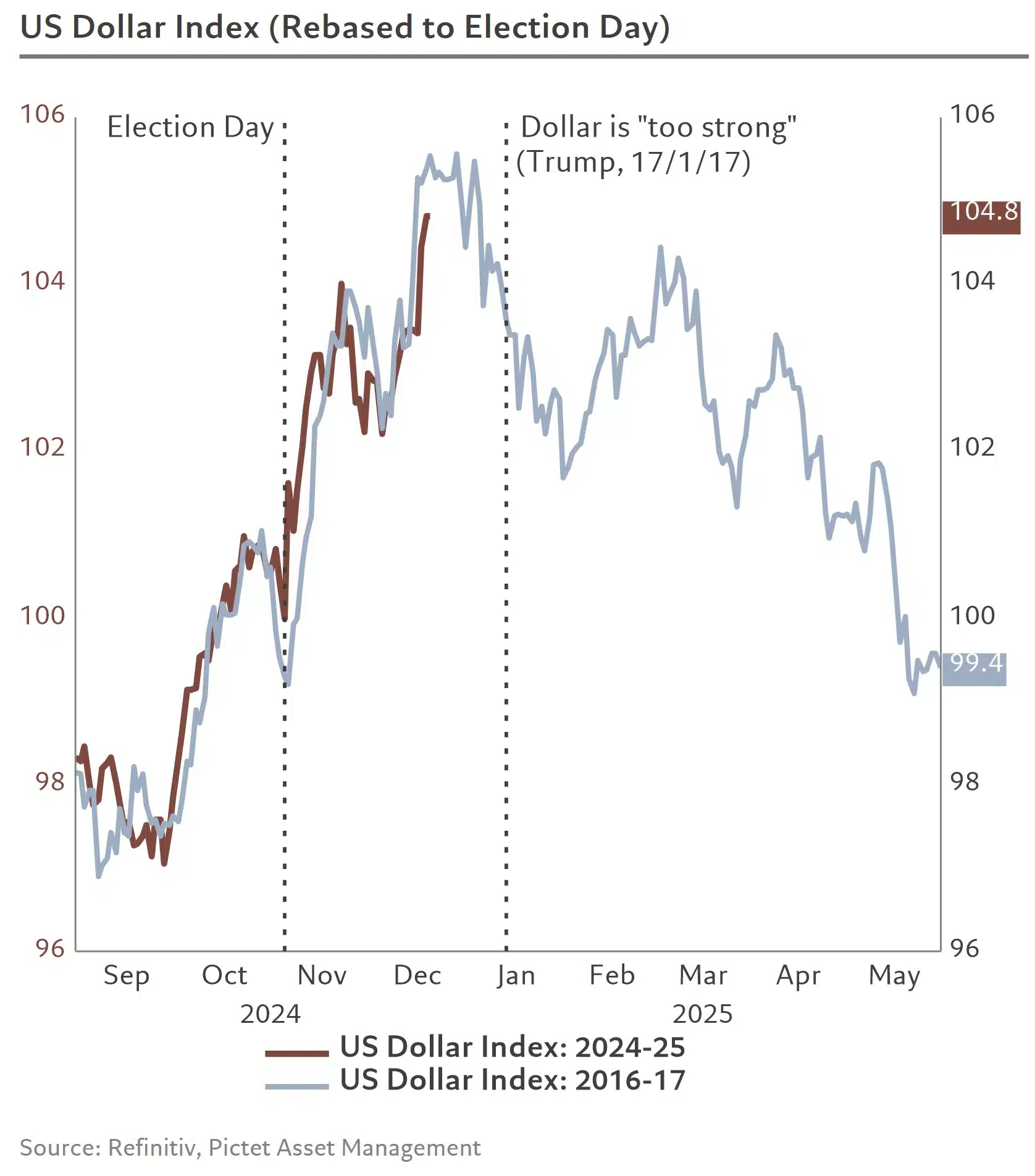

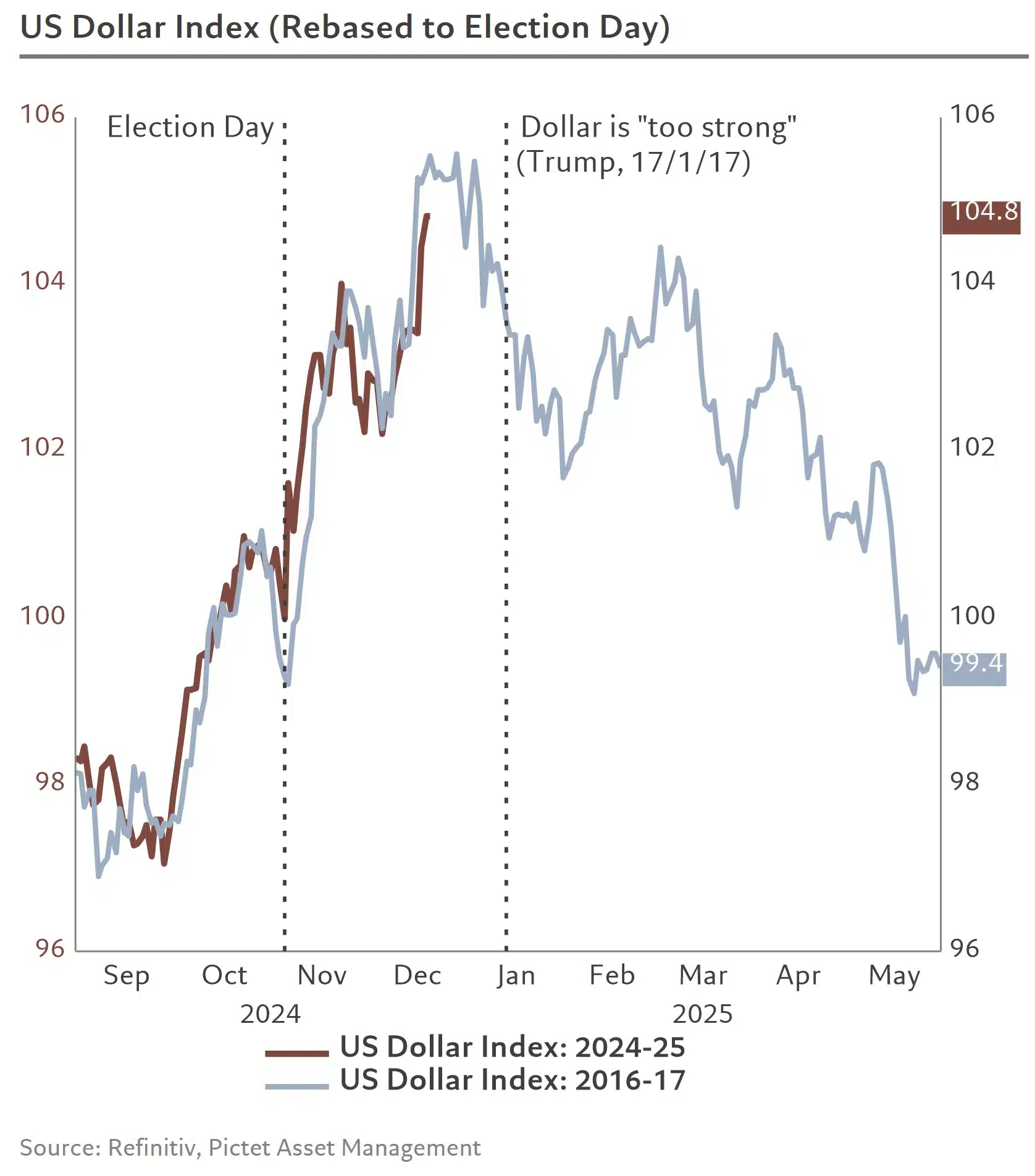

Apparently, this sample mirrors the 2016 market response when Trump gained his first presidential election. Again then, as the ultimate quarter unfolded, the greenback index spiked to 103, marking a yearly excessive.

Supply : Refinitiv

However the months that adopted took a shocking flip. By Might, the greenback had erased a lot of its positive factors, retreating to pre-election ranges. The influence on Bitcoin? It closed 2017 at $13,000, marking a staggering 1200% YTD development.

In accordance with AMBCrypto, the same financial shift may unfold in 2025. Why? Trump’s dislike for top rates of interest, his ongoing assist for Bitcoin, rising nationwide debt, inflationary strain, and daring tax cuts.

These components may put important strain on the greenback within the coming months. In such a local weather, each Bitcoin and shares may soar—one thing Elon Musk would seemingly again, given his personal capitalistic ventures.

Transferring ahead, monitoring these developments will probably be key. A repeat of the 2017 cycle may push Bitcoin to newer highs, supported by a weakening greenback and higher adoption.

So, is now the time to spend money on Bitcoin?

Wanting on the market over the previous few days, the reply appears to be a transparent ‘Sure.’ Bitcoin’s restoration after the crash has been sturdy, with a stable 2% leap within the final 24 hours.

Nonetheless, anticipating a clean, uninterrupted journey to the highest could be too optimistic. With the ‘surprising’ meltdown nonetheless recent, investor danger urge for food is on the decline.

Brief-term pullbacks are virtually sure. In case you’re in it for the lengthy sport, diving in now may very well be a sensible transfer, particularly with the important thing components lining up in Bitcoin’s favor.

Learn Bitcoin [BTC] Worth Prediction 2024-2025

Regardless of indicators of concern from retail traders, MicroStrategy (MSTR) stays bullish, believing Bitcoin may quickly overshadow the greenback within the coming yr.

The latest crash may simply be the ‘actuality verify’ traders wanted—a wholesome retracement earlier than the following transfer upward.

With institutional funding in Bitcoin stronger than ever, retail capital is more likely to observe as soon as FOMO kicks in. The anticipated financial shift in 2025 may set the stage for Bitcoin to make its subsequent massive leap.