- Cardano, Stellar, and Chainlink have leveraged the “Trump pump” to flee their slumps

- The large query – Which of those three will lead the cost in 2025?

Because the 12 months involves an finish, the push to diversify portfolios is in full swing. Whether or not the market closes on a bullish excessive or a bearish dip continues to be unsure, however one factor is evident – This last quarter has been a game-changer.

After years of stagnation, affected person HODLers are lastly reaping the rewards. Among the many main comeback tales are Cardano [ADA], Stellar [XLM], and Chainlink [LINK]. For them, this rally feels just like the breakthrough they’ve been ready for.

However should you had been to wager “lengthy” on simply certainly one of these altcoins, which one actually deserves a spot in your portfolio for the long-term?

The competitors is fierce

For each Stellar and Cardano, the current “Trump pump” has been probably the most important catalyst. Every coin broke free from lengthy durations of consolidation, drawing in traders who had been ready for an indication of life.

Cardano made headlines by breaking the $1 barrier, a big psychological threshold that many altcoins are nonetheless combating to cross. Stellar, not far behind, nearly hit $0.60

However simply as shortly as they rose, a correction adopted. The pump had delivered large earnings, prompting many to money out earlier than the market turned.

The identical sample was evident on LINK’s day by day chart the place the value shot up, solely to be adopted by a pullback. Now, all three of those cash are sitting close to key help ranges, testing the waters for a rebound.

With the market now within the pink, the subsequent transfer hinges on Bitcoin’s restoration. Traditionally, LINK has thrived alongside Bitcoin rallies, however with its community changing into extra centralized and the market turning unpredictable, 2025 might look very completely different.

Will the ‘underdogs’ rise and dethrone LINK, or will it reclaim its dominance because the market settles?

Cardano, Stellar or Chainlink – Whose dip must you dig?

In the case of investing in crypto, fundamentals are all the things. With the market’s fixed volatility, short-term value swings are inevitable. Nonetheless, should you’re in it for the lengthy haul, you could deal with what actually issues.

Take LINK, for instance. Not too long ago, Chainlink noticed a 23% single-day surge as information resurfaced that World Liberty Monetary (WLF) had purchased over $1 million in LINK.

Why does this matter? Giant purchases like these act as ‘security nets,’ offering a cushion throughout pullbacks. Additionally, they provide smaller traders confidence that greater gamers imagine within the asset’s long-term potential.

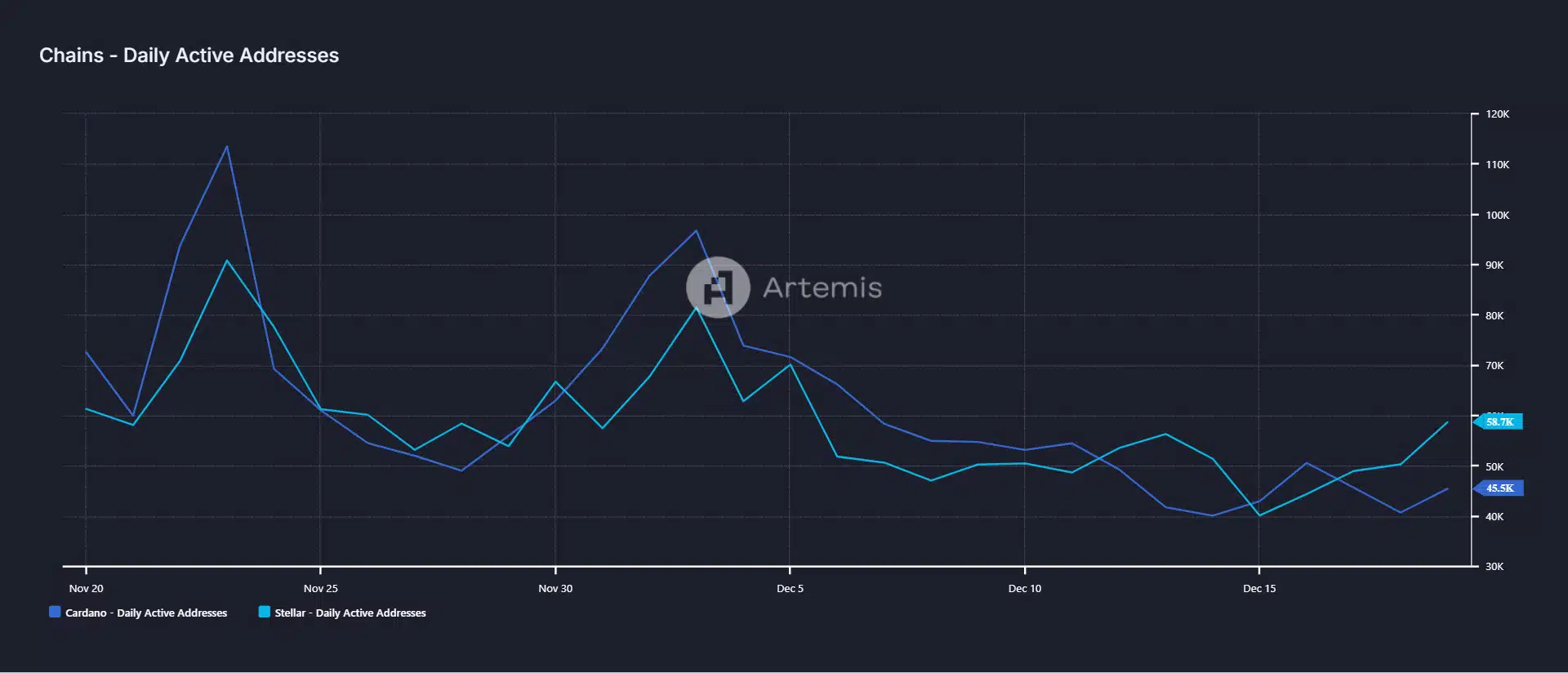

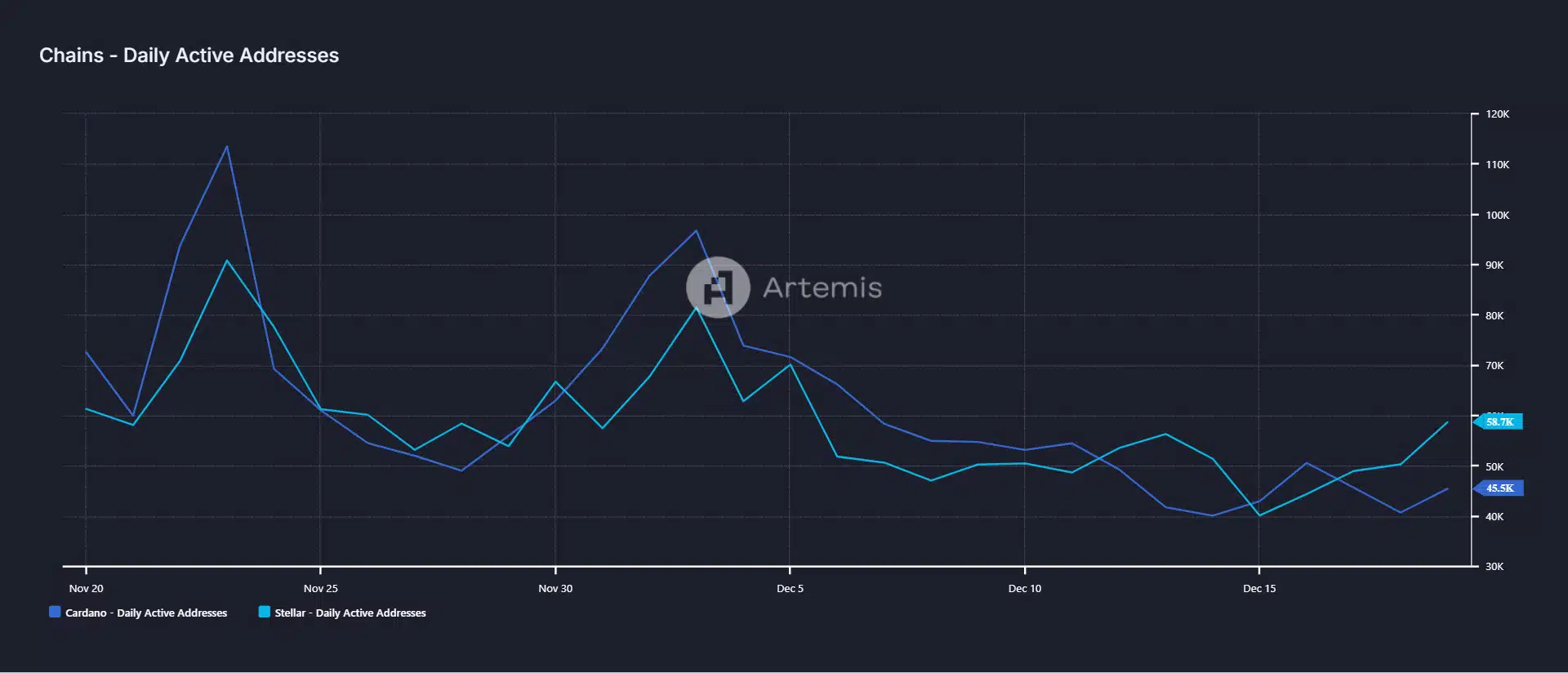

Now, let’s shift to Cardano. Whereas it made headlines by breaking the $1-mark, the story isn’t as clear-cut. Up to now month, Cardano’s day by day energetic addresses have dropped by 40%. Regardless of whale accumulation, its value has remained in a downtrend, signaling potential manipulation.

Quite the opposite, Stellar has proven larger stability, with solely a minor 5% discount in its energetic addresses.

Supply : Artemis Terminal

Nonetheless, investing in each Cardano and Stellar might include greater dangers, particularly because the market heads into 2025. So, with larger stability and institutional adoption, Chainlink stands out because the safer wager for now.

Is your portfolio inexperienced? Try the LINK Revenue Calculator

This can be much more obvious when BTC rebounds and we see how capital flows into Chainlink—An indicator of its rising dominance available in the market.