- The quantity of huge transactions has elevated in the previous few days.

- ETH noticed a slight rebound within the final 24 hours.

Ethereum[ETH] whales are making waves once more, withdrawing huge quantities of ETH from Binance shortly after the market rebounded.

Evaluation confirmed that 4 recent wallets eliminated 8,440 ETH price $28.43 million within the final buying and selling session, and one other ten recent wallets adopted go well with, withdrawing 17,698 ETH price $61.66 million within the present one.

These important strikes point out attainable whale accumulation, a habits usually linked to bullish value motion. By analyzing current value developments and on-chain metrics, we discover whether or not Ethereum’s provide dynamics are setting the stage for its subsequent rally.

On-chain information confirms whale exercise

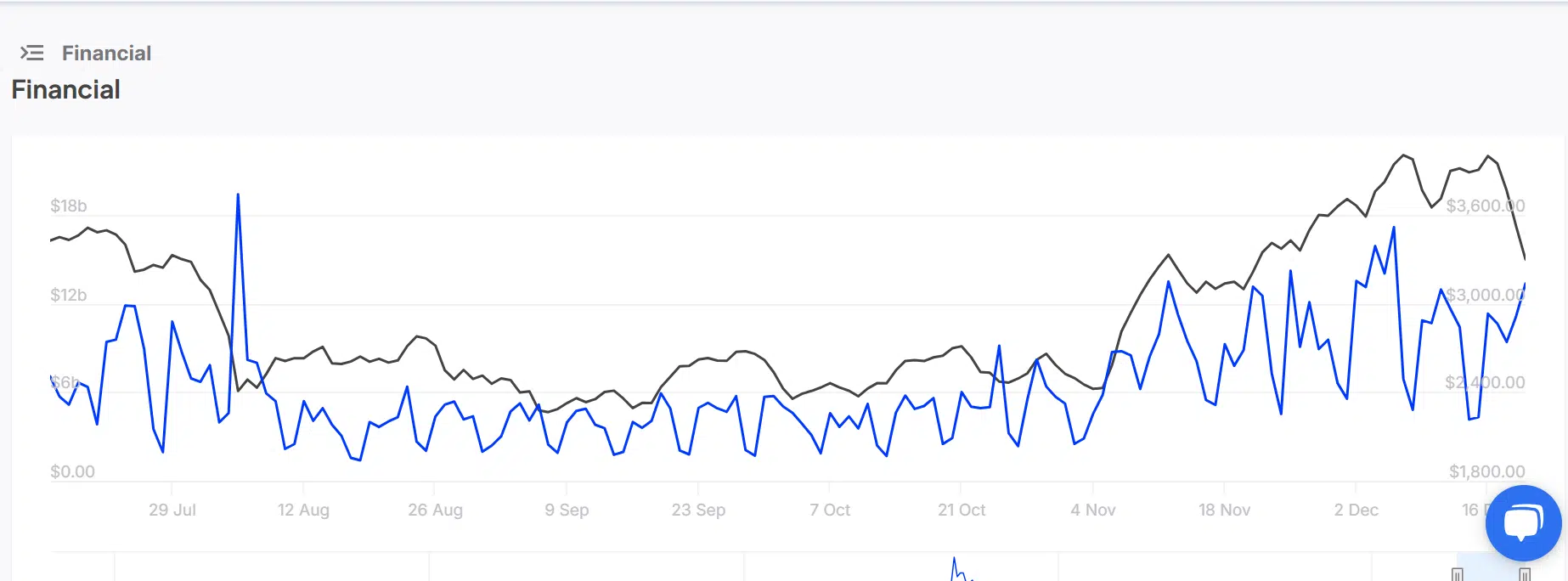

Evaluation of the Ethereum Massive Transactions chart from IntoTheBlock highlights a spike in high-value transfers. The spike coincided with the numerous withdrawals from Binance, which Lookonchain highlighted.

Supply: IntoTheBlock

The chart confirmed that between the 18th and twentieth of December, massive transactions elevated by over $4 billion. On the finish of the final buying and selling session, the quantity of huge transactions was $13.35 billion.

Huge whale withdrawals sign accumulation

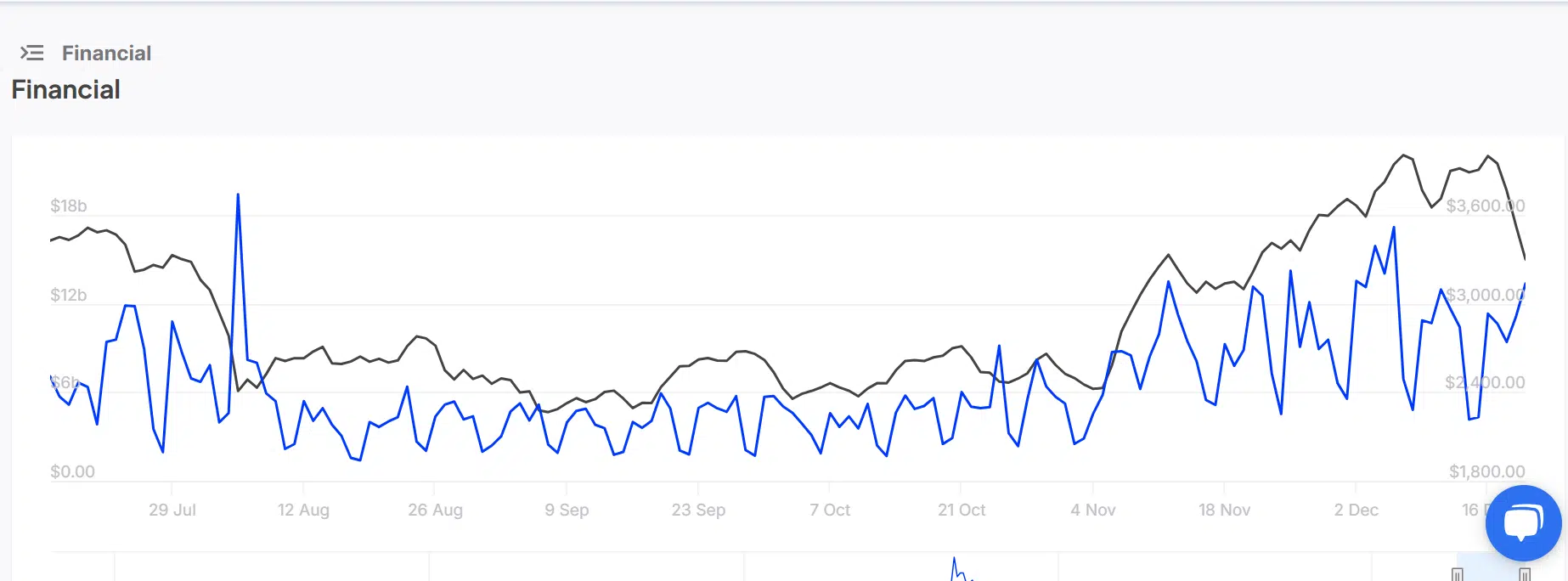

The withdrawal of over 26,000 ETH, totaling $90 million inside hours, suggests strategic accumulation. Evaluation of the Ethereum Trade Netflow chart additional helps these withdrawals.

The chart highlights a major web outflow from exchanges, with extra ETH leaving than getting into. This pattern reduces the accessible provide on exchanges, usually signaling decreased promoting strain and rising confidence amongst massive holders.

Supply: CryptoQuant

Such withdrawals into recent wallets are usually related to long-term holding methods or staking. This habits aligns with historic patterns the place whale accumulation precedes important value rallies.

Diminished provide on exchanges, mixed with heightened whale motion, alerts robust market participation, reinforcing the narrative of accumulation amid a recovering market.

Ethereum value stabilizes above key ranges

The Ethereum value chart confirmed that ETH was stabilizing close to $3,470 after a short pullback. Regardless of current corrections, the worth stays above the 50-day Transferring Common (MA), signaling continued bullish momentum.

Moreover, the Ichimoku Cloud indicator reveals that ETH continues to be buying and selling inside a bullish territory, with robust help of round $3,400.

Supply: TradingView

The mixture of whale accumulation and ETH’s technical power suggests the asset is primed for a possible breakout, particularly if demand continues to outpace provide.

– Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Ethereum’s current whale exercise and optimistic technical indicators counsel it’s well-positioned for its subsequent transfer. As change reserves dwindle and huge holders accumulate ETH, the stage is about for a possible breakout.

Whereas short-term consolidation stays attainable, broader market dynamics point out a bullish outlook for Ethereum.