In anticipation of the EU’s looming Markets in Crypto Belongings (MiCA) rules, European exchanges are delisting Tether (USDT) en masse. This may increasingly severely hinder the EU market’s capability to capitalize on the crypto bull market.

Donald Trump’s election within the US is already benefiting Tether alongside the broader crypto trade, however market chaos within the EU might disrupt funding.

Tether Prepares for MiCA

It has been clear for a number of months now that Tether’s USDT, the most important stablecoin, won’t meet MiCA compliance. In response to a brand new report, EU exchanges have till December 30 to delist the asset. Nevertheless, apprehension is rising within the European crypto group, as Tether’s retreat could have an outsized influence on the area:

“I perceive why it’s been executed to a sure extent, nevertheless it’s fairly exclusionary and fairly limiting for EU shoppers themselves as a result of [USDT] is probably the most liquid stablecoin by a rustic mile, claimed Usman Ahmad, chief govt officer of crypto buying and selling agency Zodia Markets Holdings Ltd.

Basically, Tether is a really helpful stablecoin for EU crypto enterprise operations and a crucial supply of liquidity. Though the area has a excessive degree of improvement and curiosity, some European monetary merchandise are dwarfed by the US-centric bull market.

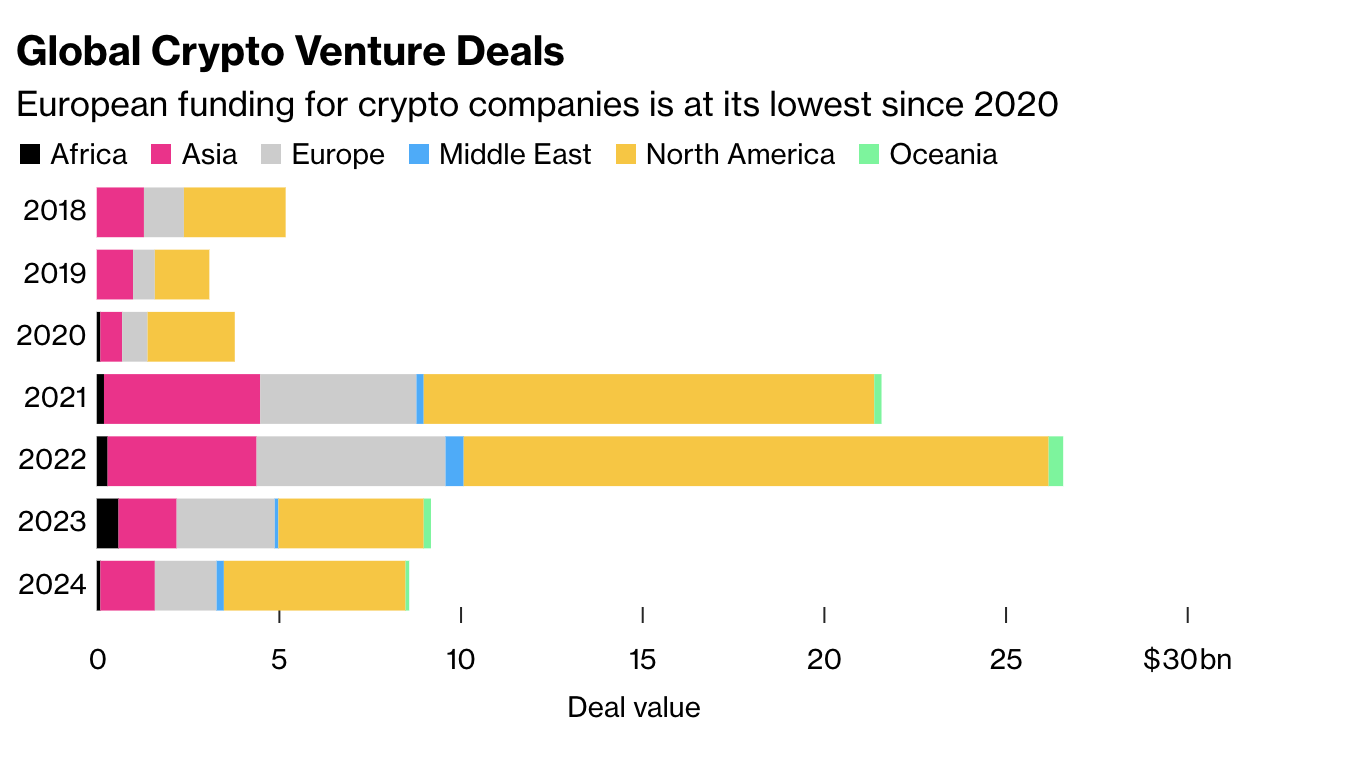

Normally, EU crypto investments have been dropping in 2024 in comparison with different regional markets, and MiCA may trigger them to fall even additional.

Tether has been making ready for MiCA by curbing European providers, and as an alternative investing closely in new stablecoins that meet EU compliance necessities. A number of key opponents, nonetheless, view this as a crucial alternative to scale back Tether’s dominance this market.

In the meantime, there are considerations that this potential regulatory chaos within the EU is coming exactly when different regional crypto markets are booming. Since Donald Trump received the US Presidential Election, the nation’s crypto trade has been thriving. Tether’s allies are receiving new appointments underneath Trump, and the agency is noticeably profiting on this area.

European buyers must hope that the chaos surrounding MiCA and the Tether exit won’t depress total funding charges. Crypto is coming into a brand new degree of institutional and regional acceptance worldwide, however Europe might nonetheless lose out.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.