Fantom (FTM) value is down over 12% within the final 24 hours because the community transitions to its new token, Sonic. This sharp decline has intensified FTM’s ongoing downtrend, with technical indicators just like the ADX highlighting strengthening bearish momentum.

In the meantime, the variety of whale wallets holding between 1 million and 10 million FTM has steadily declined, reflecting diminished confidence amongst giant holders. With FTM transferring close to crucial assist at $0.84, merchants are intently looking forward to a possible break decrease to $0.64 or a restoration that might goal resistance ranges at $1.13 and past.

Fantom’s Present Downtrend Is Displaying Its Energy

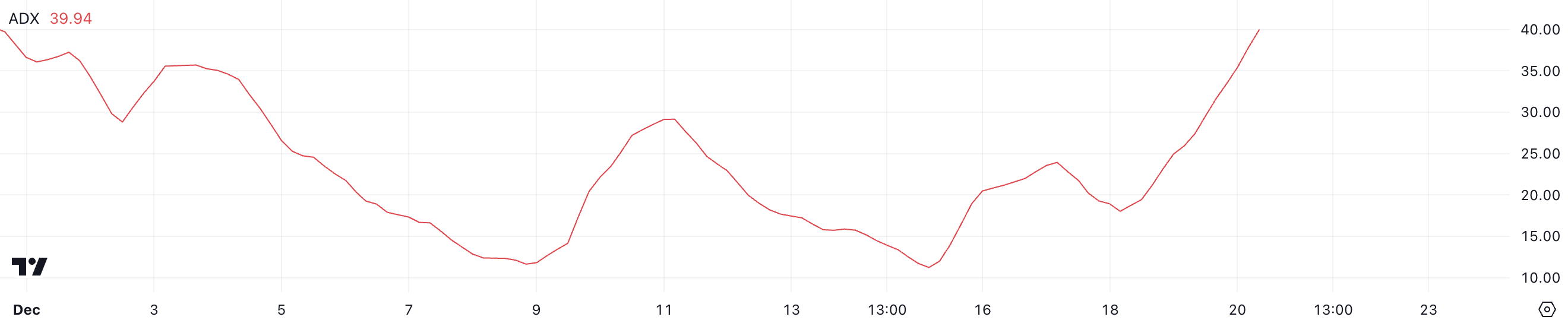

The ADX (Common Directional Index) for FTM is at present at 39.94, a pointy improve from beneath 20 simply two days in the past. This surge signifies that the energy of the present development has grown considerably in a brief interval.

Since FTM value is at present in a downtrend, the elevated ADX means that the bearish momentum is changing into extra pronounced, making it probably that the worth will proceed to face downward strain within the close to time period.

The ADX measures the energy of a development, no matter its route, on a scale from 0 to 100. Values beneath 20 point out a weak or directionless development, values between 20 and 40 recommend a average development, and values above 40 mirror a powerful development.

With FTM’s ADX close to 40, the downtrend is approaching sturdy ranges, signaling sustained promoting strain. Within the quick time period, until vital shopping for curiosity emerges, FTM value is more likely to face continued declines, with merchants intently monitoring assist ranges for potential stabilization.

Whales Are Not Accumulating FTM

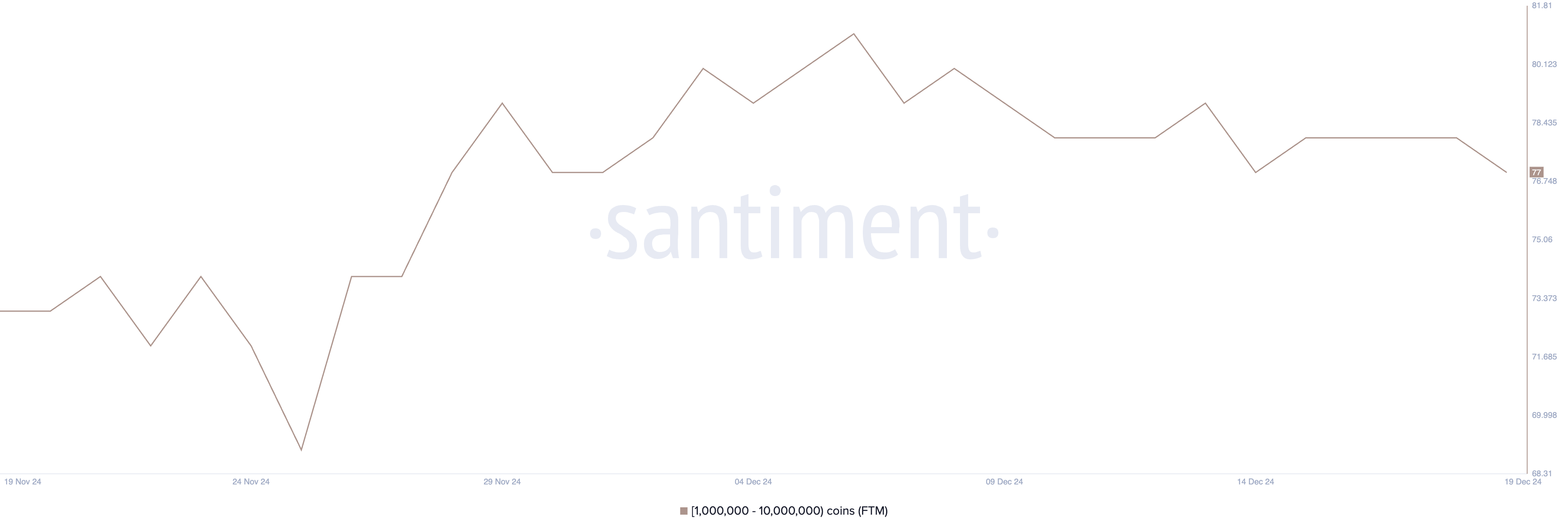

The variety of wallets holding between 1 million and 10 million FTM has dropped to 77, marking its lowest degree since December 1. Monitoring these wallets, also known as “whales,” is essential as a result of they will considerably affect the market as a result of giant quantity of tokens they management.

Adjustments within the variety of these wallets typically mirror shifts in sentiment amongst main holders, which might precede notable value actions.

This variety of whales reached a month-high of 81 on December 6 however has steadily declined since, with none main token dumps being noticed.

This gradual lower suggests an absence of aggressive promoting however may point out diminished confidence amongst giant holders. Within the quick time period, this development may sign underlying weak point for Fantom, as declining whale participation typically aligns with decrease shopping for assist and potential value stagnation or additional declines.

Fantom Value Prediction: Can FTM Right By 33% Subsequent?

Fantom is at present buying and selling inside a variety outlined by a assist degree of round $0.84 and a resistance degree of $1.

If the $0.84 assist fails to carry, the worth may drop considerably. The following key assist is at $0.64, representing a possible 33% correction from present ranges.

Then again, if FTM value manages to interrupt above the $1 resistance, it may sign a shift in sentiment, opening the trail for an increase to $1.13.

Ought to bullish momentum persist past this level, Fantom value may doubtlessly take a look at the subsequent resistance at $1.32, marking a powerful restoration. The power to interrupt above $1 and maintain an uptrend would rely closely on elevated shopping for curiosity and a reversal within the present sturdy downtrend.

Disclaimer

Consistent with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.