The variety of US banks saddled with main points continues to climb, in keeping with new numbers from the Federal Deposit Insurance coverage Company (FDIC).

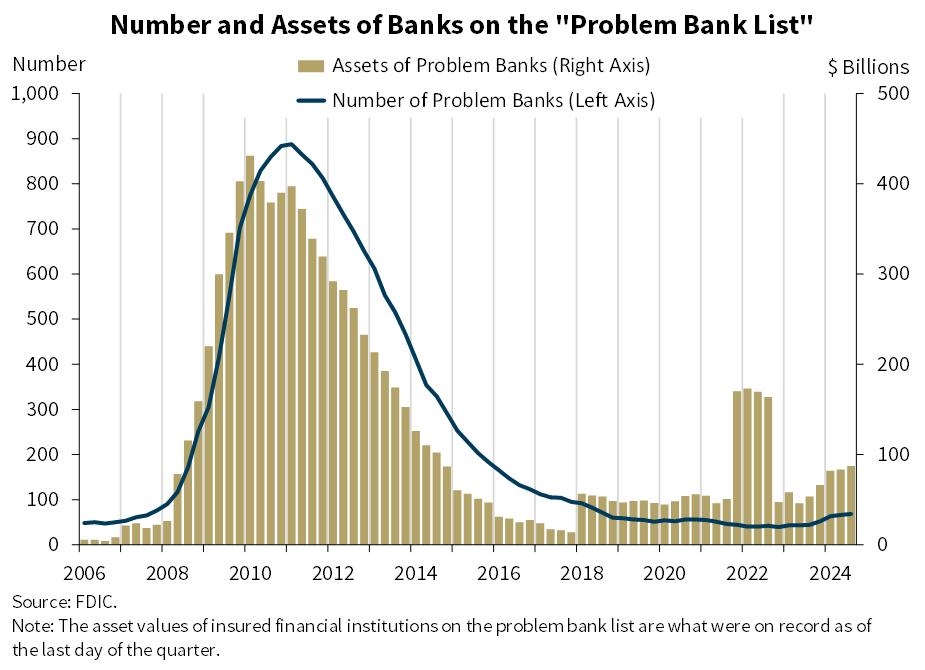

In its Quarterly Banking Profile report, the FDIC says the variety of US lenders on its “Drawback Financial institution Checklist” rose to 68 in Q3.

The determine represents the fifth quarterly enhance within the variety of banks receiving a ranking of 4 or 5 on the CAMELS ranking system since Q2 of 2023.

A lender with a CAMELS ranking of 4 signifies that the agency is experiencing monetary, operational or managerial weaknesses – or a mixture of such points – that might moderately threaten its soundness if unresolved. In the meantime, a financial institution with a 5 rating on the CAMELS system suggests it’s critically falling quick in a number of areas and requires abrupt remedial consideration.

“Whole property held by downside banks rose $3.9 billion to $87.3 billion. Drawback banks characterize 1.5 % of complete banks, which is inside the regular vary of 1 to 2 % of all banks throughout non-crisis durations”

In the meantime, the quantity of unrealized losses on banks’ steadiness sheets has dropped.

The FDIC says banks are burdened with $364 billion in paper losses as of the third quarter of this yr, largely as a result of publicity to the residential actual property and Treasury markets.

Unrealized losses characterize the distinction between the worth banks paid for securities and the present market worth of these property.

The banks’ paper losses declined within the third quarter by $148.9 billion from $512.9 billion reported in Q2.

Nonetheless, FDIC Chair Martin J. Gruenberg says the lower in banks’ paper losses final quarter is just non permanent.

In keeping with Gruenberg, modifications in longer-term rates of interest for the reason that finish of Q3 point out that US banks are probably now holding unrealized losses at nearer to half a trillion {dollars}.

“Will increase in longer-term rates of interest for the reason that finish of the third quarter would probably reverse most of those enhancements in unrealized losses if measured as we speak.”

Whereas Gruenberg reiterates the resilience of the banking trade, the FDIC chair notes {that a} handful of headwinds proceed to threaten US lenders.

“The trade nonetheless faces vital draw back dangers from the continued results of inflation, volatility in market rates of interest, and geopolitical uncertainty. These points may trigger credit score high quality, earnings and liquidity challenges for the trade.

As well as, weak spot in sure mortgage portfolios, notably workplace properties, bank cards, auto and multifamily housing loans, continues to warrant shut monitoring. These points will stay issues of ongoing supervisory consideration by the FDIC.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses you could incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney