Michael Saylor, the Government Chairman of MicroStrategy, has outlined a Bitcoin technique to place america as a worldwide chief within the digital financial system.

This transfer comes as his firm expanded its Board of Administrators from six to 9 members, incorporating distinguished crypto advocates to strengthen its strategic give attention to digital property.

Saylor Advocates for Bitcoin Reserve

On December 20, Saylor defined that his imaginative and prescient revolves round implementing a Strategic Bitcoin Reserve (SBR) to deal with financial challenges, improve the greenback’s dominance, and create unprecedented progress alternatives within the digital asset sector.

“A strategic digital asset coverage can strengthen the US greenback, neutralize the nationwide debt, and place America as the worldwide chief within the Twenty first-century digital financial system — empowering hundreds of thousands of companies, driving progress, and creating trillions in worth,” Saylor wrote on X.

Saylor’s proposal outlines how a strong digital asset coverage might create a capital markets renaissance, unlocking trillions in worth. He envisions a $10 trillion digital foreign money market driving demand for US Treasuries whereas fostering progress in digital property.

He additionally believes that increasing this market might enhance the digital financial system’s valuation from $1 trillion to $590 trillion, with america main the cost.

“Establishing a Bitcoin reserve [is] able to creating $16–81 trillion in wealth for the US Treasury [and] offering a pathway to offset nationwide debt,” Saylor mentioned.

Regardless of these daring claims, critics like enterprise capitalist Nic Carter stay skeptical. Carter argues that the SBR idea lacks readability and will destabilize markets fairly than strengthen the greenback.

He factors to Bitcoin’s volatility, referencing its current value dip from over $108,000 to $92,000, as proof that it might not be a dependable reserve asset. Moreover, Carter believes such a transfer might undermine the greenback’s international place fairly than improve it.

“I don’t help a Strategic Bitcoin Reserve, and neither do you have to,” Carter said.

New MicroStrategy Board Members Deliver Crypto Experience

In response to a December 20 SEC submitting, the board of Bitcoin-focused firm has elected new board members. The brand new additions embrace Brian Brooks, former Binance US CEO and a distinguished determine in crypto regulation; Jane Dietze, Chief Funding Officer at Brown College; and Gregg Winiarski, Chief Authorized Officer at Fanatics Holdings.

These new board members carry numerous experience throughout finance, know-how, and rising markets, aligning with MicroStrategy’s broader strategic aims. Brooks, particularly, is famend for his regulatory and crypto experience. He has held management roles at prime crypto corporations, together with Coinbase and BitFury Group, and has additionally served because the Appearing Comptroller of the Forex.

In the meantime, Dietze has additionally served on the crypto asset administration agency Galaxy Digital board, whereas Winiarski has expertise with a privately held international digital sports activities platform.

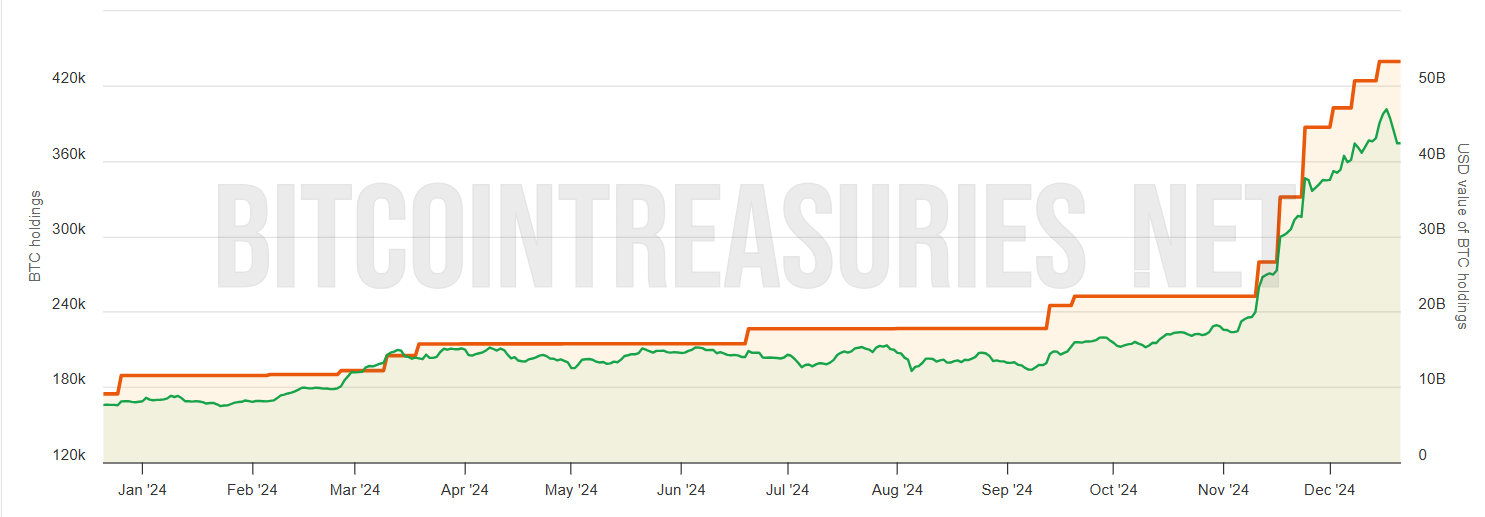

MicroStrategy is the biggest publicly traded company holder of Bitcoin. In response to Bitcoin Treasuries information, the corporate presently holds 439,000 Bitcoin valued at over $43 billion.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.