Crypto hacks and frauds led to over $2.3 billion in losses this 12 months, highlighting the persistence of safety vulnerabilities within the trade. This determine spans 165 incidents, marking a 40% enhance from the earlier 12 months.

Whereas the entire is decrease than the $3.7 billion misplaced in 2022, the continued rise in assaults alerts that the trade’s defenses stay insufficient towards the superior threats.

Ethereum and Entry Management Failures Dominate Losses

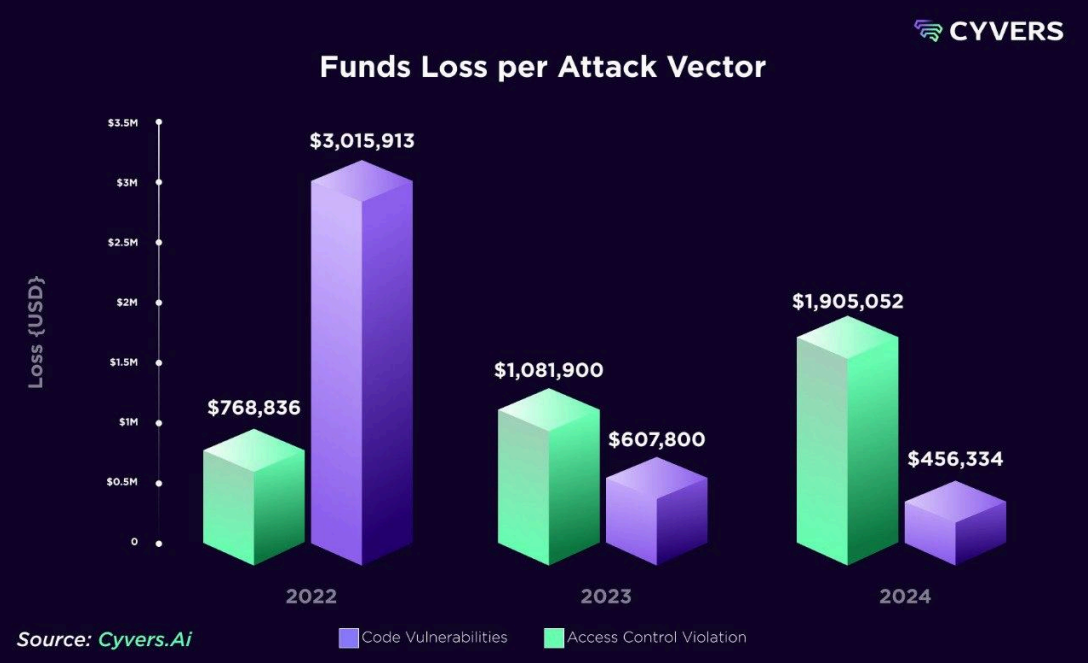

In response to Cyvers’ annual report, entry management vulnerabilities stood out as a major driver of losses, accountable for 81% of the entire stolen funds.

Though these incidents accounted for simply 41.6% of the circumstances, their outsized affect displays the risks of mismanaged safety protocols. Ethereum was probably the most affected blockchain this 12 months, recording over $1.2 billion in losses.

A fairly disturbing pattern this 12 months was the prevalence of “Pig Butchering” scams. These elaborate fraud schemes swindled over $3.6 billion from unsuspecting customers, with most exercise targeting the Ethereum blockchain.

“The surge in entry management breaches and complex scams like Pig Butchering underscores the significance of implementing AI-powered danger evaluation, transaction validation, and anomaly detection instruments. Safety should evolve to remain forward of more and more complicated and coordinated assault,” Cyvers informed BeInCrypto.

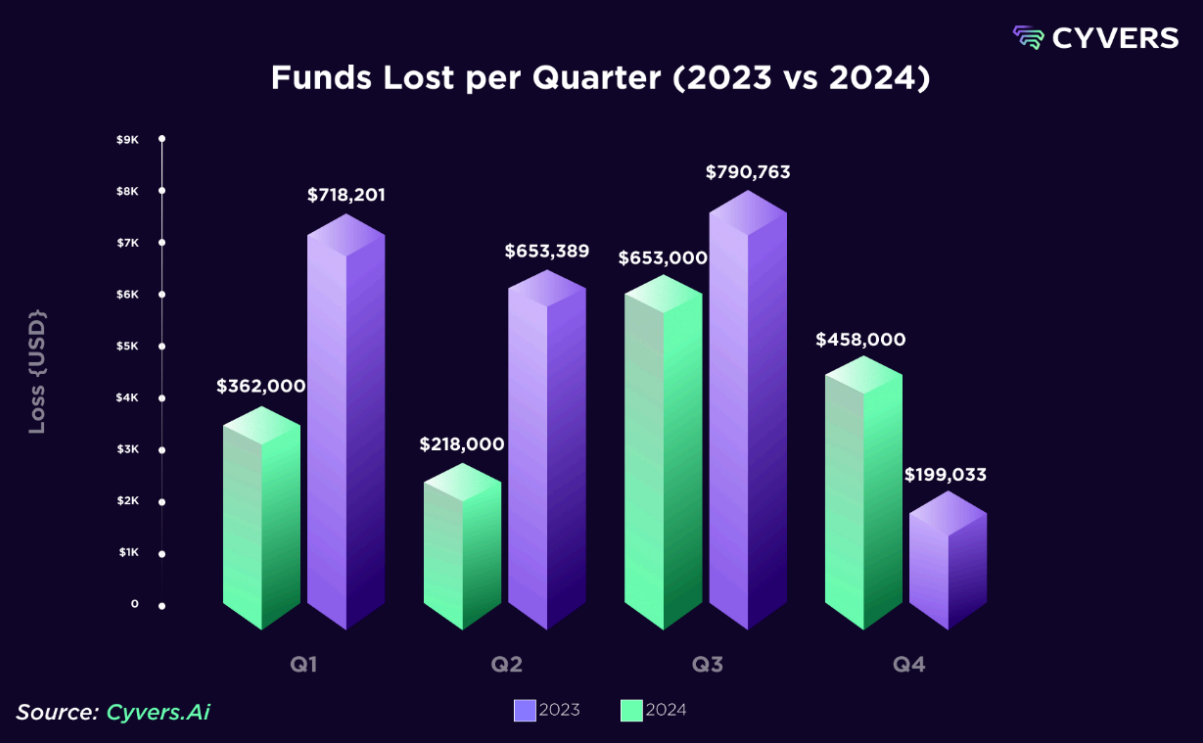

Additionally, sensible contract vulnerabilities dominated the assault panorama, significantly in DeFi. The third quarter of 2024 was the worst for losses, with $790 million stolen throughout this era.

“If crypto platforms wish to keep away from changing into the subsequent sufferer of hackers, they should deploy strong detection and prevention methods and combine them with their disaster response mechanisms. As Cyvers knowledge reveals, 9 out of 10 sensible contracts that have been hacked have been audited and lots of of them have underwent strict penetration exams. This, clearly, was not sufficient,” Cyvers researchers famous.

Against this, This fall recorded considerably decrease exercise, suggesting a short lived lull in malicious operations.

Greatest Crypto Hacks of 2024: WazirX, Radiant Capital, and DMM Bitcoin

The 12 months’s largest particular person incidents supplied stark reminders of the vulnerabilities throughout the crypto ecosystem.

In July, Indian crypto change WazirX suffered a devastating hack, shedding roughly $234.9 million. Attackers exploited weaknesses within the change’s multisignature (multisig) wallets, gaining unauthorized entry to funds.

Multisig wallets, which require a number of personal keys for transaction approvals, are sometimes seen as safer. Nonetheless, this incident demonstrated how poor implementation of such methods can result in catastrophic breaches.

WazirX quickly halted buying and selling and withdrawals to comprise the injury and initiated a complete safety audit. Regardless of these efforts, the change stays offline because it seeks regulatory approval to renew operations.

“We’re striving to acquire the courtroom’s sanction of the Scheme on the earliest possible timeline. Topic to authorized and regulatory necessities, the platform to renew buying and selling post-effective Scheme date,” WazirX lately wrote on X (previously Twitter).

In November, Indian authorities arrested a suspect linked to the hack, although the mastermind stays at massive. Investigators criticized Liminal Custody, a agency accountable for securing WazirX’s digital wallets, for failing to offer crucial info through the probe.

Radiant Capital, a distinguished blockchain lender, was one other high-profile sufferer this 12 months. In October, the platform misplaced over $50 million in a multi-chain assault.

Hackers reportedly gained entry to 3 of the platform’s personal keys, enabling them to empty belongings throughout a number of networks, together with Arbitrum, Binance Sensible Chain, Base, and Ethereum.

The assault has been attributed to North Korean-backed actors, who’re more and more focusing on the crypto sector with superior techniques. Radiant Capital’s breach displays the heightened dangers related to cross-chain operations and the pressing want for higher personal key administration.

In the meantime, the Japanese cryptocurrency change DMM Bitcoin confronted one of the vital extreme incidents in 2024. In Might, the platform misplaced roughly 4,502.9 Bitcoin, valued at $320 million on the time, after attackers compromised a non-public key. Regardless of extended efforts to get better stolen belongings and reassure prospects, DMM Bitcoin introduced its closure in December.

The change has since begun transferring consumer accounts to SBI VC Commerce, marking a grim conclusion to its operations. The incident highlights the devastating affect of insufficient key safety, significantly for centralized platforms.

CeFi Dangers and Rising Threats from Superior Applied sciences

Centralized monetary platforms (CeFi) proceed to face important challenges. Single factors of failure, similar to centralized reserves and inadequate oversight of key administration, make these platforms engaging targets for attackers.

The reliance on multisignature wallets, which have confirmed susceptible underneath sure situations, additional aggravates these dangers. Rising applied sciences, together with quantum computing and synthetic intelligence, are anticipated to accentuate threats by enabling more and more complicated assault strategies.

These developments necessitate proactive safety measures to maintain tempo with the dynamic risk panorama. Consultants have famous that incidents just like the WazirX and Radiant Capital breaches may seemingly have been prevented with the usage of proactive risk monitoring options.

“We are able to assess with certainty that such distinguished assaults, just like the $235 million WazirX hack and the $50 million Radiant Capital hack may have been prevented and 100% of the funds may have been saved, had the businesses used such options,” Cyvers informed BeInCrypto

The sharp enhance in malicious exercise this 12 months displays the crucial want for stronger defenses throughout the cryptocurrency ecosystem. Platforms missing real-time monitoring and preemptive safety instruments stay extremely susceptible to breaches, placing consumer funds in danger.

The trade should prioritize adopting superior safety measures and fostering higher collaboration between stakeholders to handle these ongoing threats successfully.

“Zero-day assaults are unpredictable and will not be primarily based on earlier, recognized, practices. With out real-time monitoring and detection mechanisms, and pre-emptive instruments – crypto platforms can’t deal with such assaults and thwart in real-time,” Cyvers specialists famous.

Because the crypto sector continues to develop, so too will the ingenuity of attackers looking for to use its vulnerabilities. This 12 months’s incidents have made it clear that reactive measures are not ample.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.