- SOL has remained dominant this 12 months.

- It has, nevertheless, declined previously few days, now buying and selling under $200.

Solana’s[SOL meteoric rise from its cycle low in November 2022 continues to dominate headlines. It has attracted unprecedented liquidity and outperformed Ethereum[ETH] and Bitcoin[BTC] in key metrics, positioning itself as a high contender for the 12 months.

A more in-depth take a look at capital inflows, realized cap, and value efficiency reveals the extent of SOL’s rising dominance.

Solana outperforms ETH and BTC

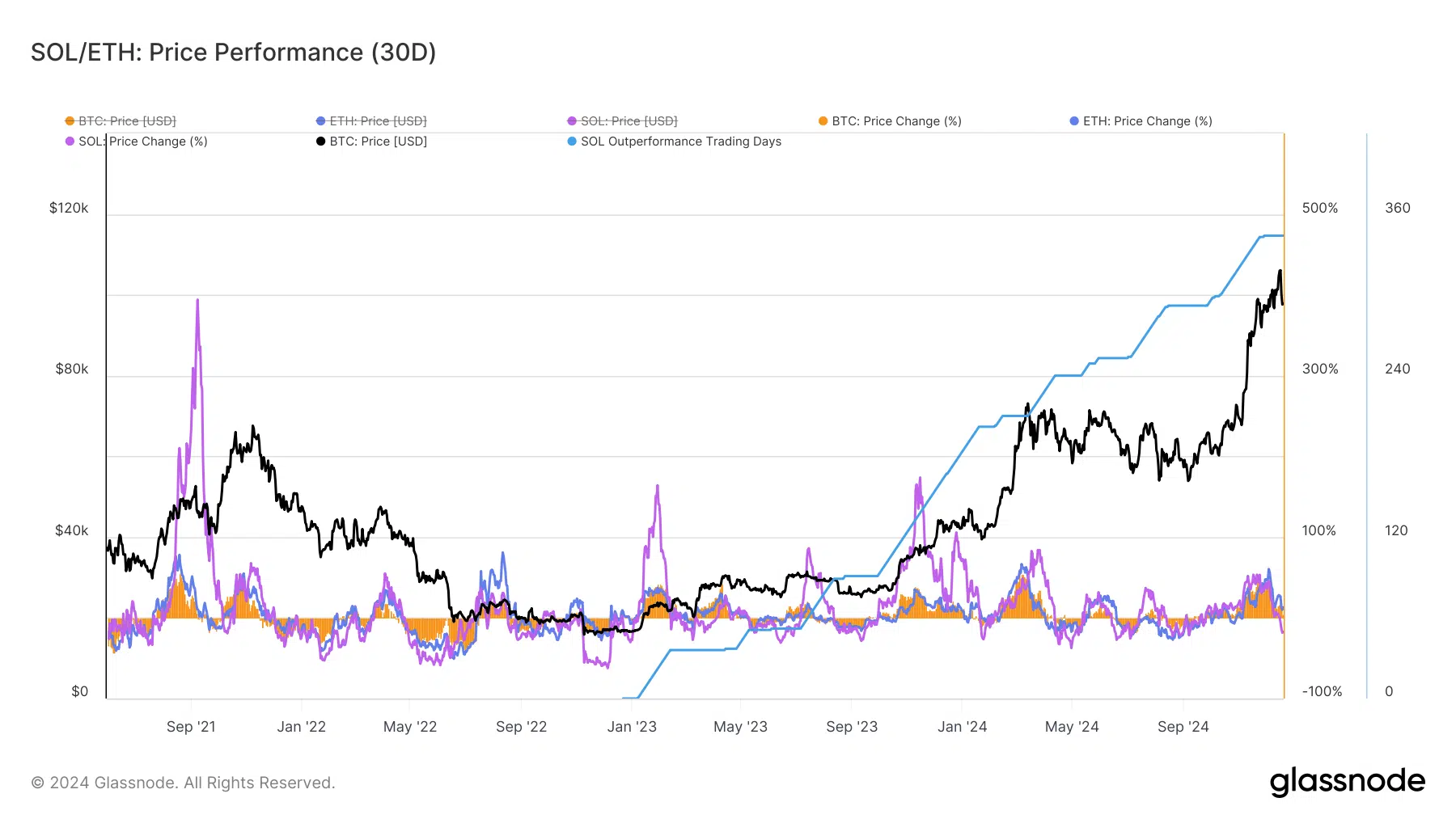

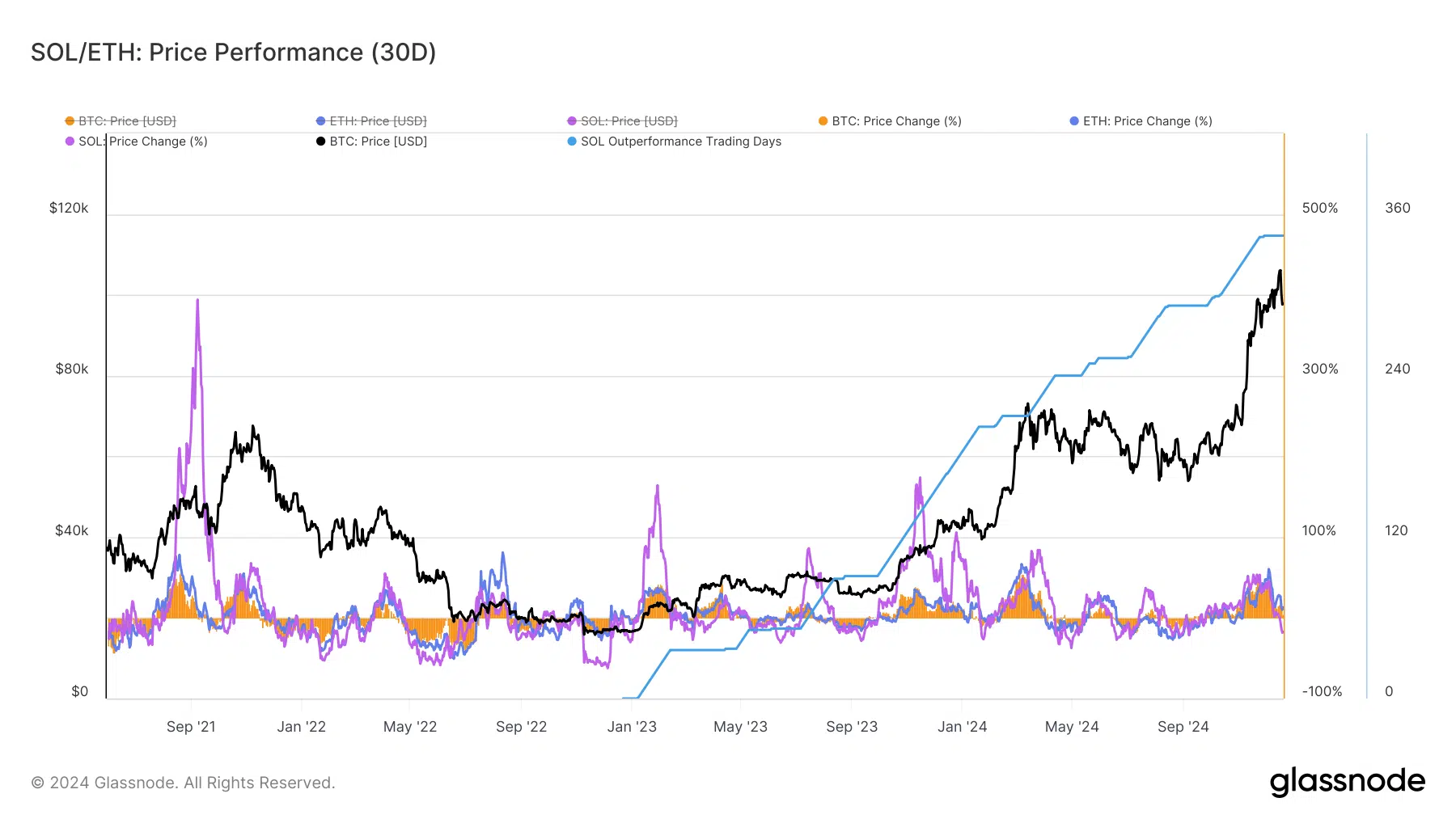

Evaluation of the Solana value chart, per knowledge from Glassnode, confirmed that its efficiency has been outstanding. The evaluation confirmed that since its low of $9.64, SOL has surged by 2,143%, considerably outperforming Ethereum and Bitcoin on 344 of 727 buying and selling days since November 2022.

Supply: Glassnode

The Value Efficiency chart exhibits SOL’s sustained upward trajectory, pushed by robust investor confidence and elevated community utility.

This constant outperformance additionally demonstrates SOL’s potential to draw retail and institutional capital. Regardless of minor corrections, its development signifies that additional value positive aspects are possible, particularly because the community has continued to see new developments.

MVRV hints at additional development

The MVRV Excessive Deviation Pricing Bands chart evaluation highlights Solana’s present market positioning. Traditionally, breakouts above the +1 commonplace deviation band have coincided with macro market tops, triggering vital profit-taking and provide distribution.

Supply: Glassnode

As of this writing, Solana is consolidating between the imply and +0.5 commonplace deviation bands, signaling a comparatively heated market however with appreciable room to run.

This means that whereas investor profitability is growing, it has not but reached extremes that usually result in sharp corrections. This steadiness factors to sustained development potential within the medium time period as new capital continues to circulation in.

Solana surpasses Ethereum in realized cap

Solana’s realized cap evaluation, relative to Ethereum and Bitcoin, underscores its robust liquidity development.

Since December 2022, Solana has persistently recorded greater realized cap positive aspects, showcasing its potential to draw new capital even throughout market downturns.

Supply: Glassnode

The evaluation reveals that Solana’s internet capital inflows have matched and exceeded Ethereum’s for the primary time. This development, pushed by heightened investor curiosity and community exercise, exhibits SOL’s rising affect within the crypto market. The continued capital injection into Solana highlights its place as a most popular funding alternative, even amongst conventional Ethereum holders.

SOL faces weekly decline amid broader consolidation

Regardless of Solana’s stellar long-term efficiency, the coin noticed a notable decline this week. SOL began the week buying and selling close to $225, however has since dropped under the important $200 stage, indicating a short-term correction.

The Choppiness Index (CHOP) studying of 46.68 highlights a interval of consolidation, reflecting market indecision.

The 50-day Transferring Common at $220.06 now serves as resistance, whereas assist seems close to the $180-$190 zone, the place vital purchaser curiosity might emerge. Buying and selling quantity has elevated throughout this dip, suggesting heightened market exercise as traders take into account their subsequent transfer.

Supply: TradingView

Whereas this decline might concern short-term merchants, it aligns with profit-taking developments following Solana’s prolonged rally. The MVRV Excessive Deviation Pricing Bands point out SOL stays inside growth-supportive ranges, avoiding the overheated territory seen in earlier peaks. ‘

This retracement might present a more healthy base for additional upward momentum as Solana’s fundamentals and community exercise stay robust.

– Learn Solana (SOL) Value Prediction 2024-25

Whereas profit-taking pressures might emerge, its potential to draw vital liquidity and keep upward momentum suggests room for development. SOL’s prospects grow to be stronger as traders more and more look past Bitcoin and Ethereum.