Crypto analyst TradinSides has revealed that the current XRP crash to $2 might have ended the bearish 2nd wave. With that out of the way in which, the crypto analyst talked about the components that would drive the wave 3 impulsive transfer to the upside.

XRP Worth Crash Ends Bearish 2nd Wave

In a TradingView submit, TradingSides acknowledged that the XRP worth retest of the $2 stage might be the tip of the second wave within the Elliot Wave of XRP’s bullish cycle. With Wave 2 doubtless executed, Wave 3’s impulsive transfer to the upside will happen anytime from now. The crypto analyst outlined 5 components on which this bullish potential is predicated.

First, the analyst cited the current launch of Ripple’s RLUSD as one of many components that would drive the Wave 3 transfer for the XRP worth. The stablecoin launch has undoubtedly offered a bullish outlook for XRP, particularly contemplating how its worth surged following the RLUSD launch on December 17.

One other issue that the crypto analyst listed is Donald Trump’s embrace of altcoins. The US president-elect has already declared his pro-crypto stance and is predicted to create a regulatory-friendly surroundings for these altcoins as soon as he takes workplace on January 20. The XRP worth might make important features on the again of this occasion, as Ripple was one of many main crypto donors to Donald Trump’s marketing campaign and his incoming inauguration.

XRP market cap at present at $128 billion. Chart: TradingView.com

TradinSides additionally listed the appointment of pro-crypto Paul Atkins as one other issue that gives bullish potential for the XRP worth. Atkin’s administration is predicted to finish the Fee’s regulation-by-enforcement strategy to the crypto trade.

This might result in the SEC dropping its attraction towards Ripple, one other issue the crypto analyst talked about might present a significant increase for the XRP worth. Lastly, the analyst outlined the approval of the XRP ETFs as an element that would drive XRP’s third wave to the upside.

Evaluation Of Increased Timeframes

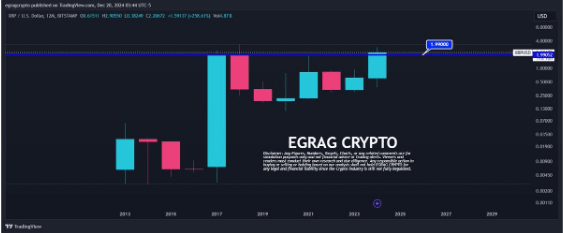

In an X submit, crypto analyst Egrag Crypto offered an in-depth XRP worth evaluation primarily based on the upper timeframes. For the yearly candle, the analyst famous {that a} shut above $1.99 could be a game-changer. He added that the $1.99 goal marks the 2017-yearly candle physique closure, and a detailed above that might be a historic second for XRP.

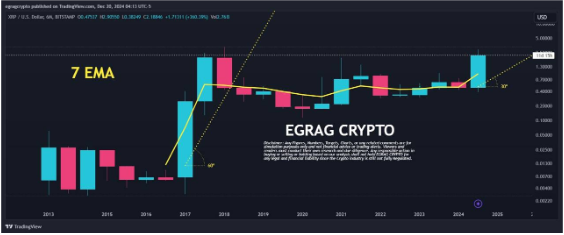

Whereas analyzing the six-month chart, Egrag Crypto acknowledged that the XRP worth is now steadier, with decrease threat and extra steady development than within the 2017 cycle. He predicts that XRP will expertise extra sustainable worth development this time round.

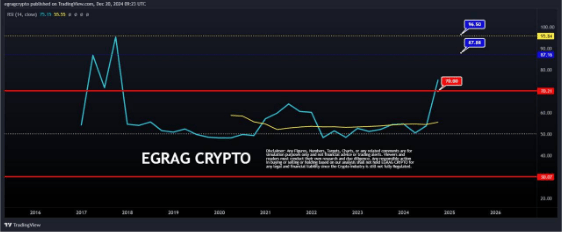

For his 3-month chart evaluation, Egrag Crypto acknowledged that the Relative Energy Index (RSI) on this timeframe nonetheless has loads of room to broaden. He added that the XRP worth has already crossed the 70 mark, which is “extraordinarily bullish,” and that the crypto nonetheless has two extra bullish targets at 87 and 96.

On the time of writing, the XRP worth is buying and selling at round $2.36, up over 4% within the final 24 hours, based on information from CoinMarketCap.

Featured picture from The Giving Block, chart from TradingView