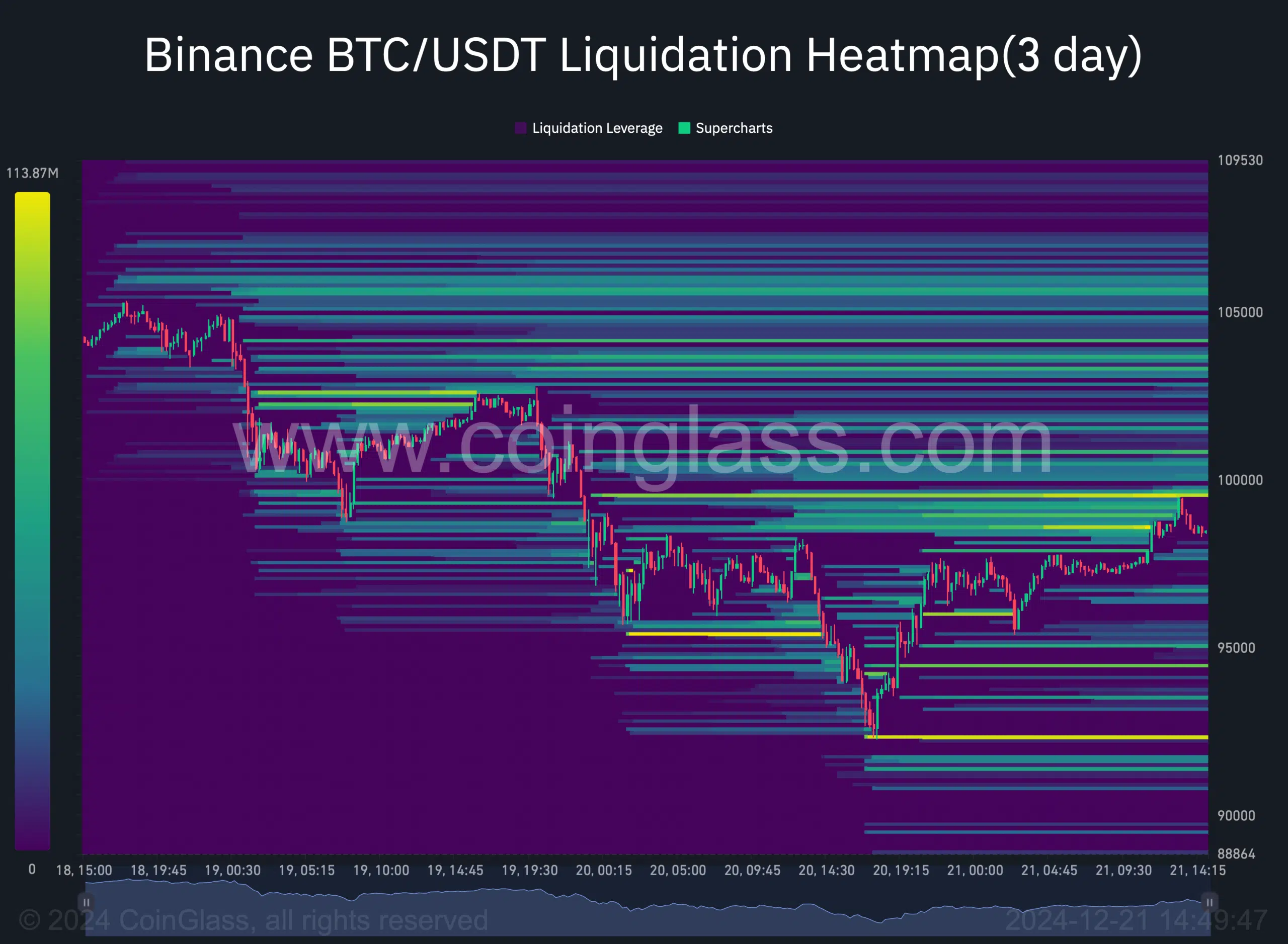

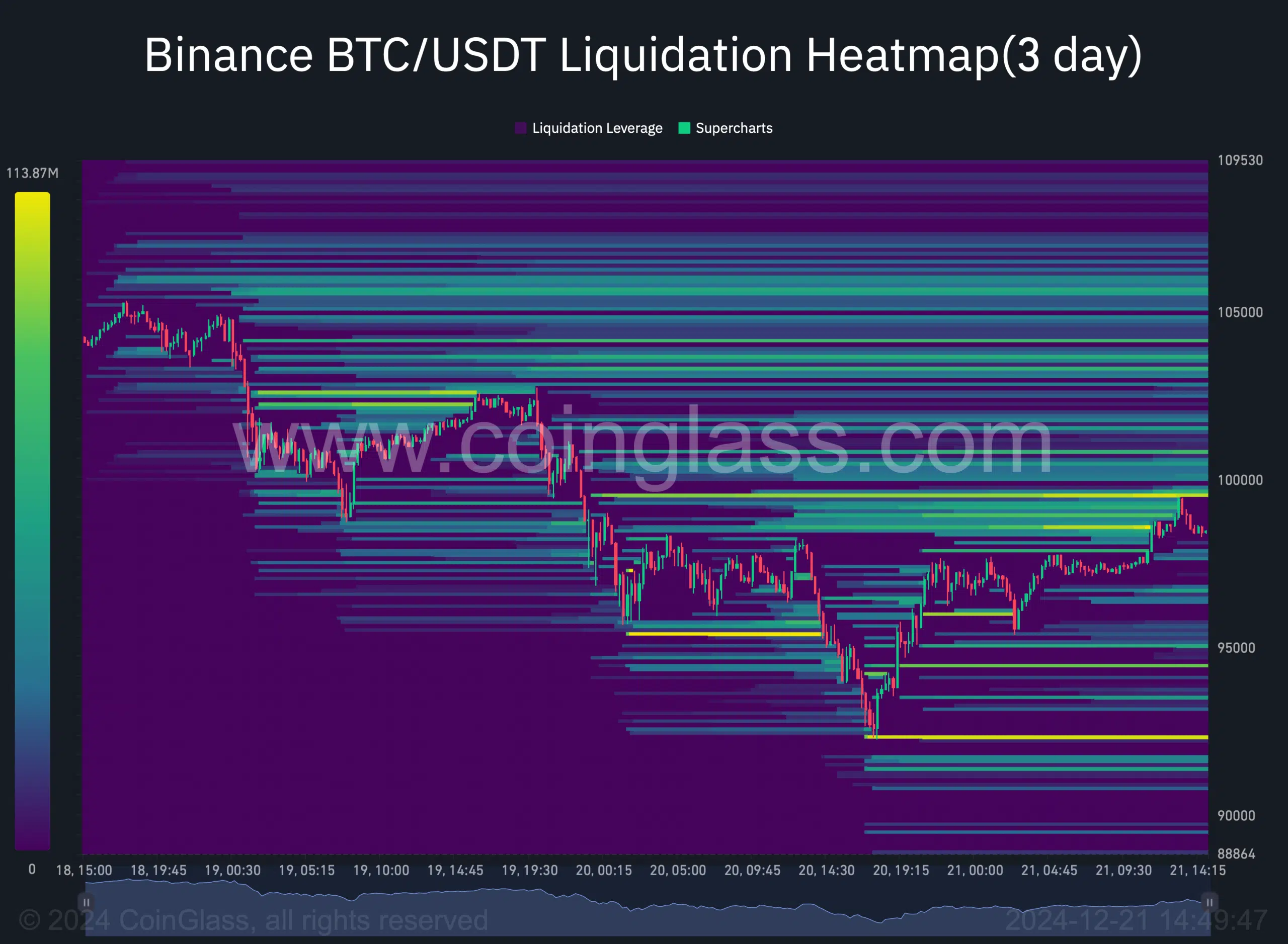

- Bitcoin’s liquidation heatmap highlighted a powerful resistance stage at $99k

- Market indicators and metrics have been ambiguous in regards to the shopping for/promoting strain

Bitcoin [BTC] has been struggling to push its worth past $100k after a pullback from that stage just a few days in the past. Whereas this pullback took many unexpectedly, the newest on-chain information revealed a attainable cause behind it.

So, does this imply buyers have to attend longer to see the king coin cross that stage once more?

What’s occurring with Bitcoin?

After a week-long decline, Bitcoin’s worth managed a 3% worth hike within the final 24 hours. Nonetheless, this wasn’t sufficient to push it previous the $100k-level.

Ali Martinez, a well-liked crypto analyst, shared a tweet stating a attainable cause behind BTC’s restricted motion. In response to the identical, the cryptocurrency is dealing with a brick wall between $97,500 and $99,800, the place 924,000 wallets beforehand bought over 1.19 million BTC.

Martinez talked about that if BTC can break above that stage, then it gained’t be too bold to anticipate the coin to succeed in a brand new all-time excessive. AMBCrypto’s evaluation of Coinglass’ information additionally revealed the same resistance zone close to $99k. This was the case, as a major quantity of BTC will get liquidated at that stage.

Supply: Coinglass

Within the meantime, Alphractal, a knowledge analytics platform, highlighted an anomaly between BTC’s worth and its funding charge. The tweet talked about that the aggregated funding charge displays the steadiness between consumers and sellers in perpetual futures contracts.

When the funding charge rises considerably, it often signifies a predominance of lengthy positions – An indication of market optimism. Nonetheless, latest developments indicated that Bitcoin started to fall, despite the fact that the funding charge remained constructive.

“The worth drop, regardless of the constructive Funding Price, suggests warning. A persistently excessive Funding Price might expose the market to liquidations, whereas stabilization or reversal of the Funding Price ought to be monitored to anticipate future strikes.”

Will BTC consolidate extra?

Now, to see whether or not the king coin could also be heading, AMBCrypto checked its crucial metrics. The coin’s trade reserves continued to drop—An indication of rising shopping for strain. This discovering was additional supported by Bitcoin’s purchase quantity.

The metric touched 100 on 19 December. For starters, a price nearer to 100 signifies that purchasing exercise is dominant available in the market for a specific asset. On this explicit case – BTC.

Supply: Hyblock Capital

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Quite the opposite, the Chaikin Cash Circulation (CMF) had a unique studying. The technical indicator registered a decline, which frequently means a drop in shopping for strain.

If that’s true, then buyers must wait longer to see BTC break the $99k resistance and climb above $100k once more.