Bitcoin (BTC) has skilled a 5% dip over the previous week. As of this writing, the main coin trades at $96,905, beneath the important thing $100,000 value degree.

Apparently, the current decline has not sparked a wave of sell-offs. This implies that the bullish sentiment stays sturdy, and market contributors count on the coin’s value to rise again above $100,000 within the close to time period.

Bitcoin Sees Decline in Selloffs

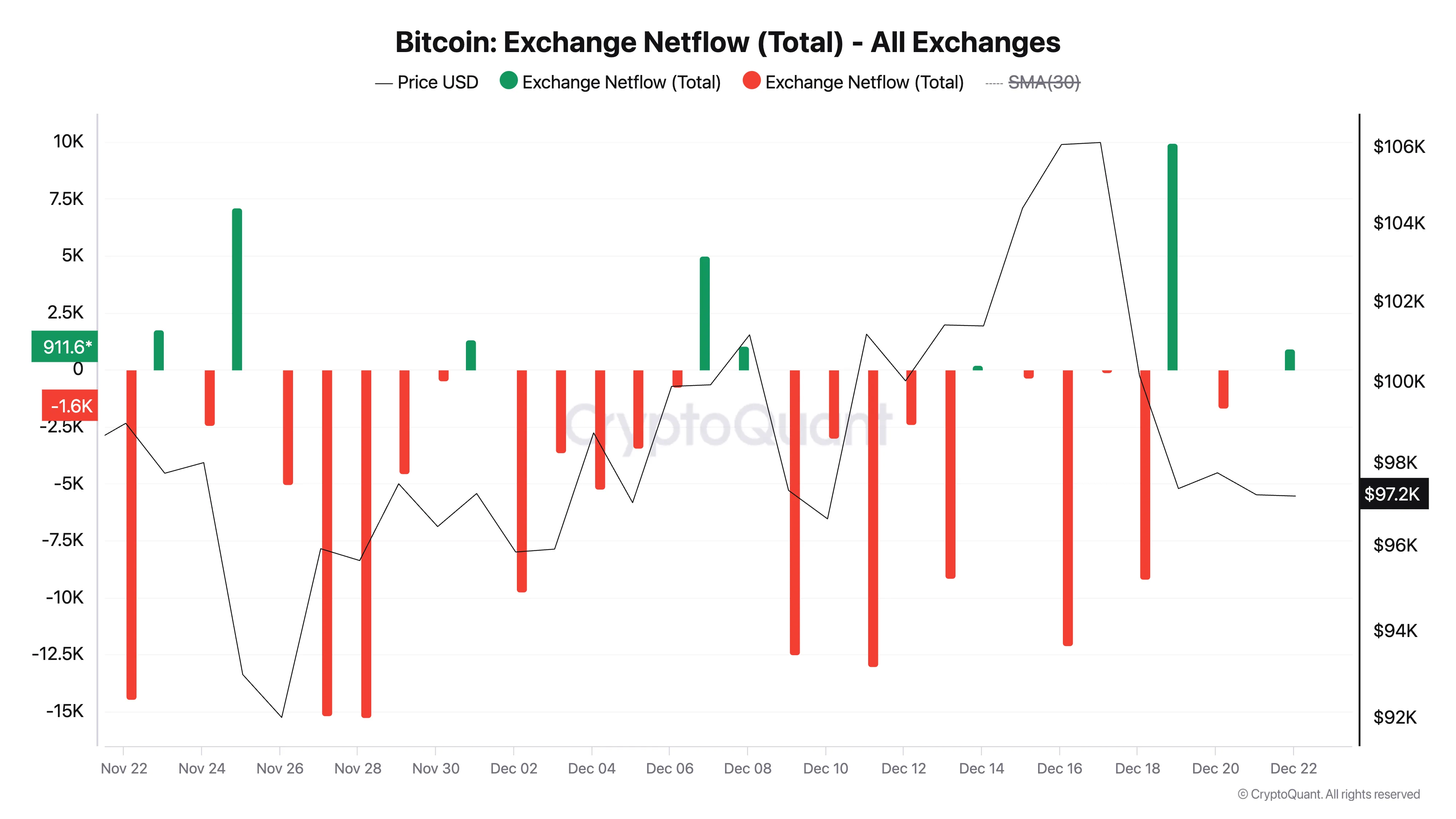

Based on CryptoQuant’s information, BTC internet outflows from cryptocurrency exchanges over the previous week have exceeded $2.5 billion. Internet outflows from exchanges monitor the quantity of cash or tokens withdrawn from change wallets.

When an asset’s change outflow spikes, it signifies a shift in the direction of holding belongings in non-public wallets quite than buying and selling or promoting. This typically indicators a bullish sentiment, as traders might count on costs to rise.

Commenting on its implications for Bitcoin, pseudonymous CryptoQuant analyst KriptoBaykusV2 famous in a current report:

“If the pattern of Bitcoin outflows continues, this might cut back promoting stress available in the market. With fewer Bitcoin out there on exchanges and demand staying the identical or growing, costs might see upward momentum.”

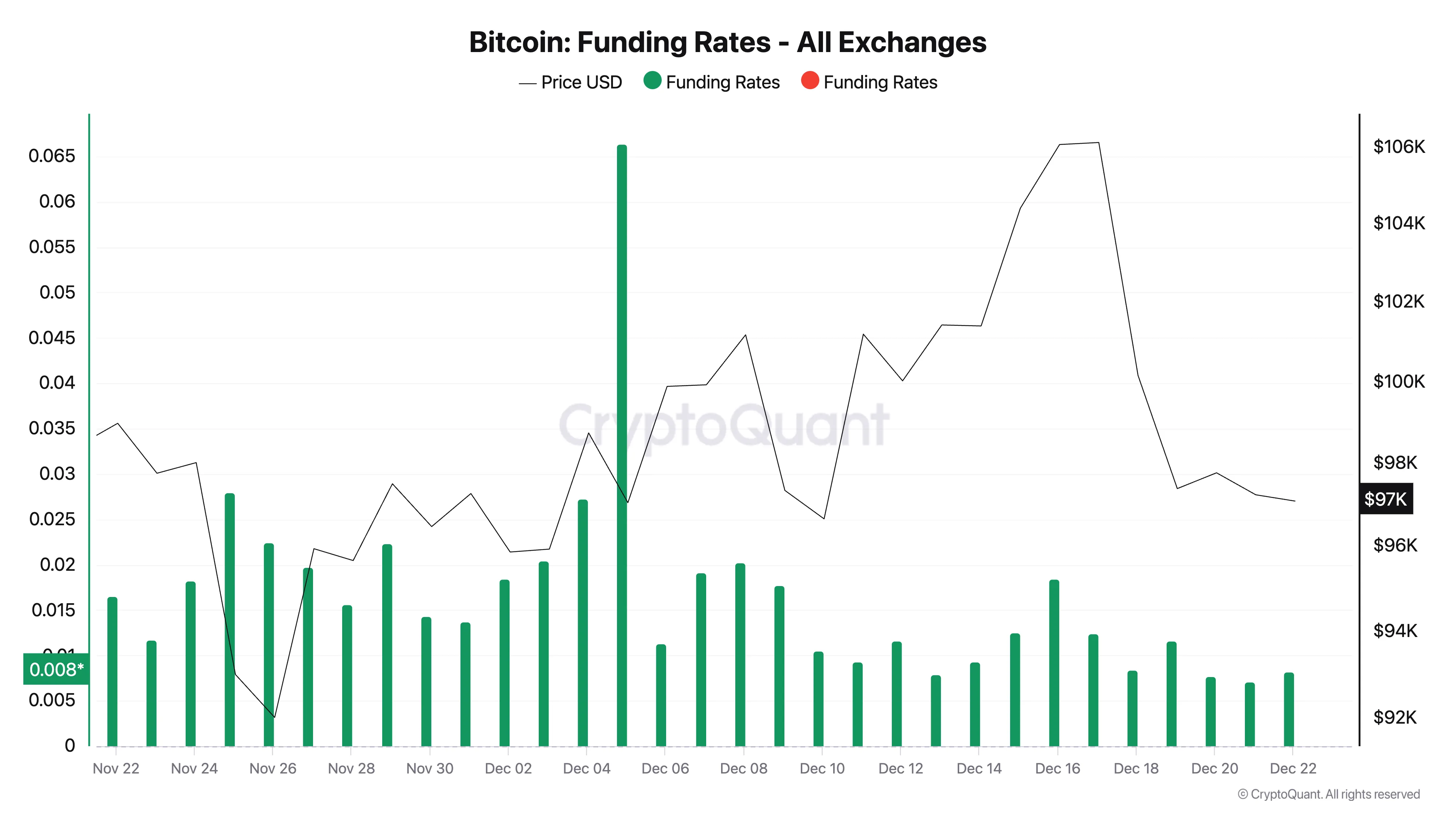

Moreover, the coin’s optimistic funding charge helps the chance of this upward projection within the close to time period. Presently, the funding charge in perpetual futures markets stands at 0.0081.

When an asset’s funding charge is optimistic, it means lengthy positions are paying quick positions. This means that the market sentiment is bullish, with merchants anticipating costs to rise.

Bitcoin Worth Prediction: Coin Battles Dynamic Resistance at $100,000

The broader market drawdown has precipitated BTC’s value to fall beneath the Main Span A of its Ichimoku Cloud, which kinds a dynamic resistance at $100,160. This indicator tracks the momentum of an asset’s market developments and identifies potential assist/resistance ranges.

When an asset’s value trades beneath the Main Span A of the Ichimoku Cloud, it signifies a bearish pattern as promoting stress is robust and patrons are struggling to push the value increased. This situation typically indicators additional draw back potential until the value breaks again above the cloud.

Bitcoin’s value profitable break above this degree will propel it towards its all-time excessive of $108,388. However, a failed try to interrupt above this resistance might trigger Bitcoin’s value to say no to $95,690.

Disclaimer

According to the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.