An analyst who continues to construct a following with macro crypto calls believes Bitcoin (BTC) is sort of able to enter the parabolic stage of its market cycle.

Pseudonymous analyst TechDev tells his 490,300 followers on the social media platform X that Bitcoin is flashing technical indicators that preceded steep rallies prior to now.

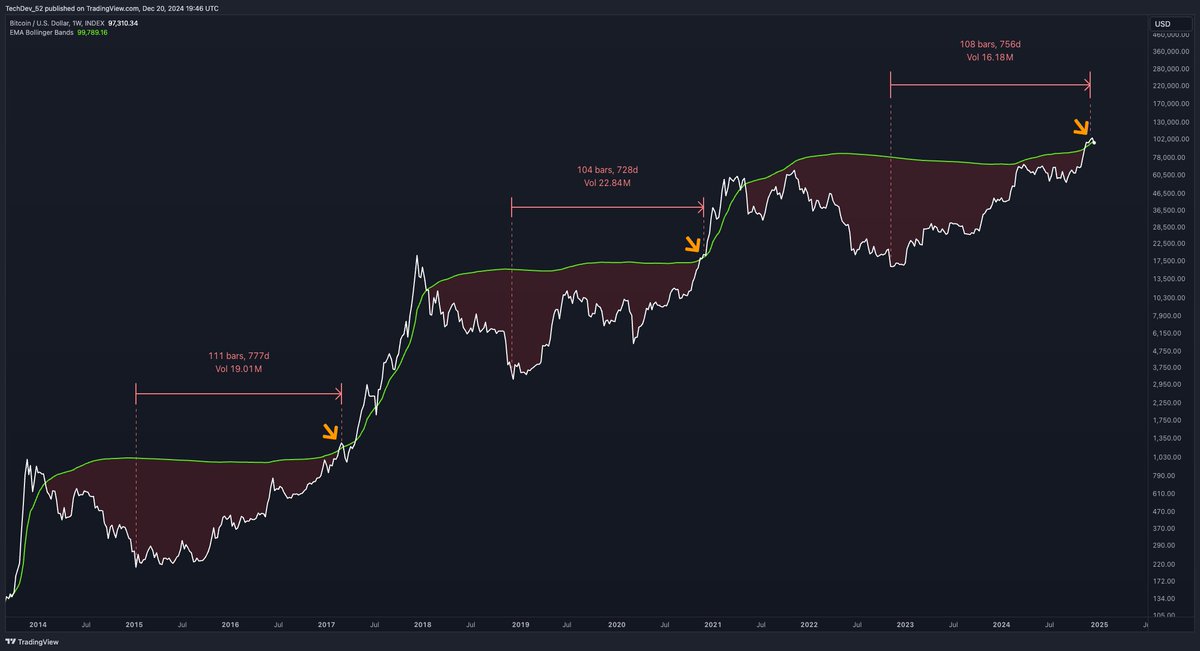

The dealer shares a chart suggesting that Bitcoin has breached the higher vary of its Bollinger Bands within the two-month time-frame after spending about two years recovering from a bear market backside.

Merchants use Bollinger Bands to determine potential intervals of volatility growth and decide whether or not an asset is overbought or oversold.

TechDev’s chart additionally means that the 2 indicators have been current in the course of the 2016 and 2020 market cycles – simply earlier than BTC ignited parabolic surges.

“That is the place issues have gotten thrilling.”

Taking a look at BTC from a special perspective, TechDev says Bitcoin is within the early phases of a parabolic ascent based mostly on the crypto king’s logarithmic transferring common convergence divergence (LMACD) indicator. The LMACD indicator is designed to disclose adjustments in an asset’s pattern, energy and momentum.

“Being attentive to the excessive time frames (HTFs) affords one of the best likelihood to commerce the cycles.

$30,000 was not the highest, as a result of HTF growth had not ended.

$50,000 was not the highest, as a result of HTF growth had not ended.

$70,000 was not the highest, as a result of HTF growth had not ended.

$90,000 was not the highest, as a result of HTF growth had not ended.

And HTF growth nonetheless has not ended.”

Based mostly on the dealer’s chart, he appears to counsel that Bitcoin won’t witness a cycle prime till the LMACD on the two-month chart hits its resistance at 0.12. BTC’s LMACD seems to be at present hovering at 0.04.

At time of writing, Bitcoin is buying and selling for $97,274.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you could incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in online marketing.

Generated Picture: Midjourney