VanEck, a number one asset administration agency, has lately projected that america might considerably minimize its nationwide debt by as a lot as 36% by 2050 via adopting a Strategic Bitcoin Reserve.

This initiative aligns with Senator Cynthia Lummis’s Bitcoin Act, which advocates for the US to amass 1 million bitcoins throughout the subsequent 5 years. The lawmaker argues that such a reserve might place future generations on a extra steady monetary footing, free from money owed they didn’t accrue or profit from.

How a Bitcoin Reserve Might Rework US Debt Administration by 2050

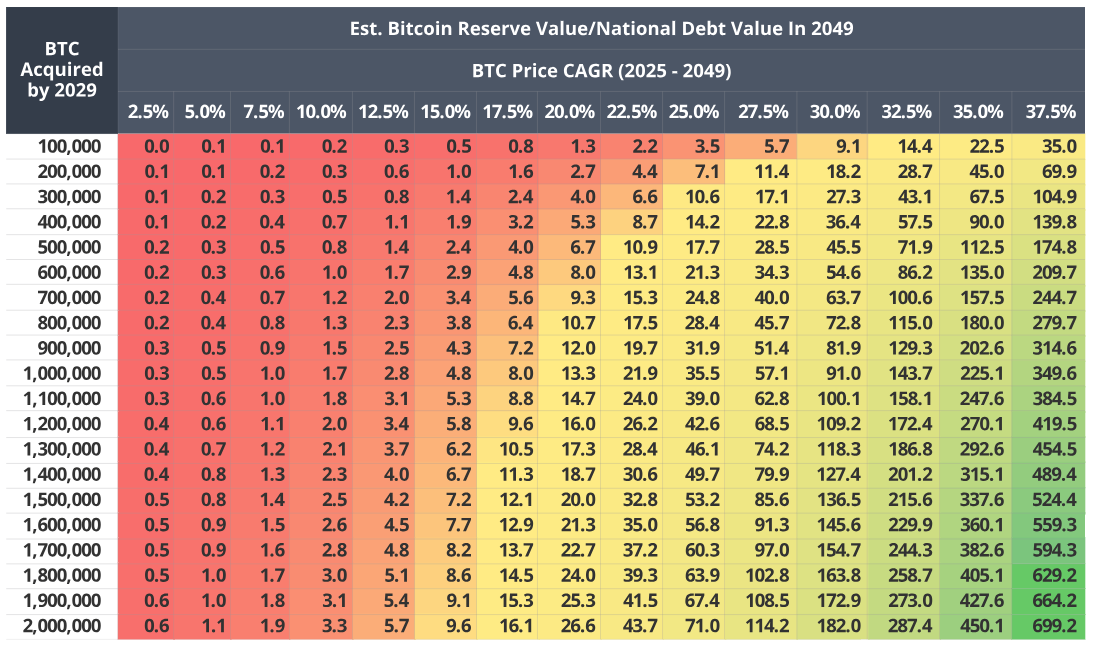

VanEck’s evaluation helps this technique, predicting that such an funding might minimize nationwide liabilities by an estimated $42 trillion by 2049. This projection assumes a constant debt development charge of 5% and an annual bitcoin appreciation charge of 25%.

On this situation, Bitcoin’s worth would skyrocket to over $42 million, making it a considerable participant within the world monetary enviornment by 2049.

“Assuming at the moment’s $900 trillion of whole world monetary property compound at 7.0% from 2025 – 2049, Bitcoin would symbolize 18% of world monetary property on this situation,” the agency added.

Mathew Sigel, VanEck’s head of analysis, emphasised Bitcoin’s potential position in reshaping the worldwide monetary panorama. He instructed that Bitcoin would possibly turn into the main settlement forex in world commerce – presenting an alternative choice to the US greenback – particularly for nations in search of to sidestep US sanctions.

“It’s very attainable bitcoin shall be broadly used as a settlement forex for world commerce by nations who wished to keep away from the parabolic enhance in USD sanctions which have been imposed,” Sigel wrote.

To kickstart this formidable challenge, VanEck recommends a number of preliminary measures, together with stopping the sale of Bitcoin from US asset forfeiture reserves.

Moreover, they counsel that changes could possibly be made beneath President Donald Trump’s incoming administration, akin to revaluing gold certificates to their present market costs and utilizing the Trade Stabilization Fund to make preliminary Bitcoin purchases.

Certainly, these steps might assist set up the reserve shortly with out ready for intensive legislative approval.

Nevertheless, the proposal has met with some skepticism. Enterprise Capitalist Nic Carter has questioned whether or not a Bitcoin reserve would genuinely bolster the US greenback. In the meantime, Peter Schiff proposes another of the creation of a brand new digital forex known as the USAcoin.

“The US might save some huge cash by creating USAcoin. Identical to Bitcoin, the provision will be capped at 21 million, however with an upgraded blockchain to make USAcoin truly viable to be used in funds,” Schiff instructed.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.