Bitcoin has endured days of underwhelming worth motion, retreating from its all-time excessive of $108,364 to a neighborhood low of $92,100. Regardless of this sharp pullback, the value construction stays bullish, fueling optimism amongst analysts and merchants who consider Bitcoin’s rally might resume at any second. Market sentiment seems cautious however hopeful, with many eyeing key help and resistance ranges for affirmation of the subsequent main transfer.

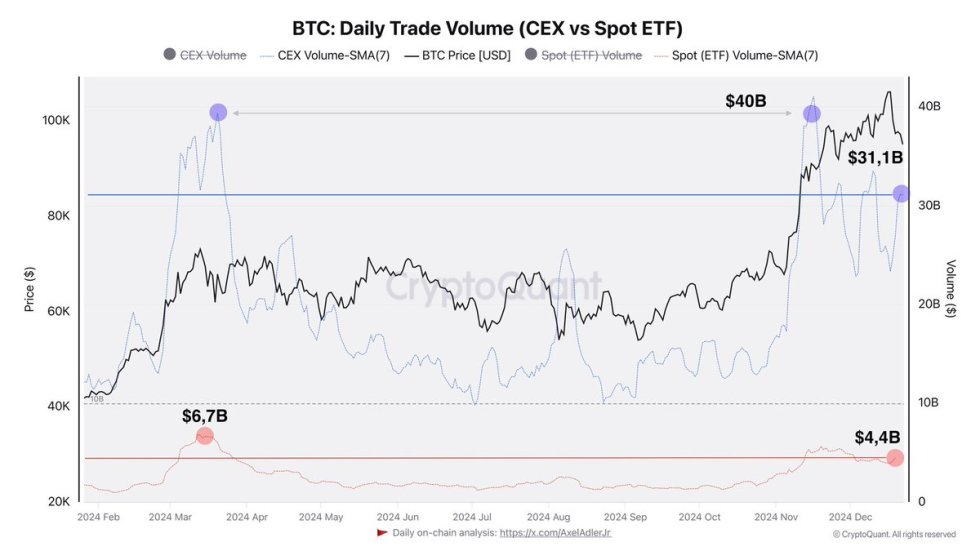

CryptoQuant analyst Axel Adler just lately shared intriguing knowledge on X, shedding gentle on Bitcoin’s present buying and selling dynamics. In keeping with Adler, the typical day by day buying and selling quantity on centralized exchanges (CEX) is presently at $31 billion—considerably decrease than the $40 billion file highs noticed in March and December of this 12 months. This decline in buying and selling exercise means that market individuals are ready for clearer alerts earlier than committing to massive positions.

The decreased buying and selling quantity highlights an atmosphere of consolidation and potential accumulation as BTC continues to carry above important help ranges. With bullish sentiment nonetheless intact and on-chain metrics pointing to sturdy fundamentals, the approaching days might present pivotal insights into Bitcoin’s trajectory. Traders are actually intently monitoring the value motion for indicators of renewed momentum because the market braces for what could possibly be the subsequent section of Bitcoin’s bull run.

Metrics Counsel An Ongoing Rally

Bitcoin has been present process a interval of consolidation under its all-time excessive, and plenty of buyers have felt a way of uncertainty, questioning if the cycle’s prime has already arrived. This worry has been amplified by the latest worth pullback, however key metrics recommend that there’s nonetheless loads of room for development and demand available in the market. The present worth motion would possibly look bearish to some, however the underlying knowledge factors to a continued bullish outlook within the close to time period.

Prime analyst Axel Adler just lately shared insightful knowledge on X, revealing that the typical day by day buying and selling quantity on centralized exchanges (CEX) presently stands at $31 billion, which is $9 billion decrease than the file highs noticed in March and December of this 12 months.

Regardless of this decline in quantity, it means that the market is in a consolidation section slightly than a full-blown downturn. Moreover, ETF buying and selling volumes stay sturdy, averaging $4.4 billion per day, with a peak of $6.7 billion reached in March. Mixed, these metrics whole a median of $35.5 billion in day by day buying and selling quantity, reflecting substantial exercise available in the market.

Now, take into account the situation the place conventional finance (TradFi) by no means entered the house. In such a situation, the market would have seemingly continued because it has up to now—pushed by futures and spot market exercise throughout cycle peaks.

The involvement of TradFi has undoubtedly added liquidity, nevertheless it hasn’t basically altered the market’s pure dynamics. The truth that Bitcoin continues to expertise wholesome buying and selling quantity means that the bull market is probably not over simply but.

Bitcoin Holding Robust Above $95K

Bitcoin is presently holding above the essential $95,000 stage, which is a key worth level for figuring out the short-term course. This stage has acted as a major help zone, and if BTC can keep its place above $95K within the coming days, a push in the direction of the $100K mark can be anticipated. This potential upward transfer would sign that the bulls are regaining management and are getting ready to problem earlier all-time highs.

Nevertheless, if BTC fails to carry above $95K and loses this stage of help, it could seemingly ship the value to check decrease demand zones. On this situation, the subsequent important help stage lies round $92,000, which might act as a important check for the market’s energy. A breach under this mark would improve the probability of a deeper correction, with BTC probably shifting towards even decrease ranges.

The approaching days will likely be essential for BTC, as sustaining help above $95K is important for sustaining the bullish momentum and avoiding additional draw back stress. The market stays in a fragile steadiness, and the subsequent transfer might decide whether or not Bitcoin continues its ascent or faces a extra important pullback.

Featured picture from Dall-E, chart from TradingView