Mantra (OM) value faces a vital technical part as a number of indicators level to potential bearish strain forward. The DeFi token has declined 13% over the previous seven days, persevering with its correction from the all-time excessive reached on November 18, with present costs down 21% from that peak.

Technical indicators paint a combined image, with RSI holding impartial territory whereas the Ichimoku Cloud suggests growing bearish momentum. Including to the uncertainty, a possible dying cross formation looms on the horizon, which might speed up the downward motion if confirmed.

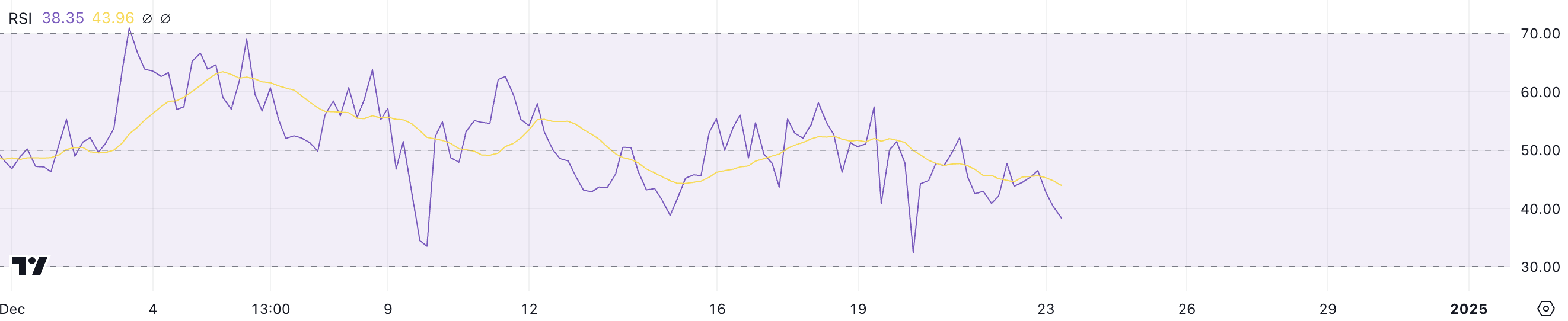

OM RSI Has Been Impartial Since December 3

The Relative Power Index (RSI) for OM has maintained a comparatively impartial place at 38.3, displaying minimal volatility since December 3. RSI is a momentum oscillator that ranges from 0 to 100, with readings beneath 30 indicating oversold circumstances and above 70 suggesting overbought ranges.

The center vary between these thresholds, notably round 40-60, sometimes signifies a impartial market state the place neither consumers nor sellers have decisive management.

With Mantra RSI presently at 38.3, the asset sits barely beneath the impartial midpoint of fifty, suggesting delicate bearish strain however not sufficient to point oversold circumstances. This prolonged interval of impartial RSI readings might point out a consolidation part, with the potential for a directional transfer as soon as the indicator breaks decisively above 50 (bullish) or beneath 30 (bearish).

The present studying suggests merchants is perhaps ready for stronger alerts earlier than making important strikes, although the slight bearish lean at 38.3 warrants consideration to potential draw back dangers.

Ichimoku Cloud Reveals a Bearish Setting For OM

The Ichimoku Cloud chart for OM exhibits a bearish pattern creating over the previous week.

The inexperienced line (Chikou Span) has crossed beneath the value motion, whereas the blue line (Conversion Line) has dropped beneath the crimson line (Base Line), forming a bearish cross round December 19.

The cloud formation itself has transitioned from inexperienced to crimson, indicating a shift from bullish to bearish sentiment. The value is presently buying and selling beneath each the cloud and all main Ichimoku strains, suggesting robust downward momentum.

Nevertheless, as all strains are starting to converge close to the present value stage, this might sign a possible consolidation part or pattern change forward.

OM Worth Prediction: The $3.31 Assist Is Elementary

The short-term transferring common for OM presently maintains its place above the long-term one, although with lowering momentum that hints at a possible dying cross formation.

If this bearish sign materializes with the shorter MA crossing beneath the longer one, Mantra value might face elevated promoting strain pushing it towards the $3.31 help stage, with additional draw back to $3.03 if the primary help fails.

Alternatively, if OM value manages to regain bullish momentum earlier than the dying cross kinds, the value might goal the instant resistance at $3.76.

A profitable breach of this stage may pave the best way for prolonged features towards the $4.25 mark, although this state of affairs requires a transparent shift in present market sentiment and perhaps a brand new surge on the Actual-World Belongings (RWA) narrative.

Disclaimer

In step with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.