Este artículo también está disponible en español.

Japan-based early-stage funding agency Metaplanet continues its Bitcoin (BTC) shopping for spree. The corporate introduced at this time that it has bought 619.7 BTC for $61 million – together with charges and different bills – making it the agency’s largest Bitcoin acquisition so far.

Metaplanet Will increase BTC Holdings To 1,762

The current crypto market downturn from its all-time highs (ATH) doesn’t seem to hassle Metaplanet, because the Tokyo-listed agency made its largest BTC buy so far, shopping for 619.7 BTC price $ 61 million at a mean value of round $96,000.

Associated Studying

To recall, Metaplanet began shopping for BTC earlier this yr in Might with a purchase order of 97.9 BTC. Since then, the corporate has bought BTC each month, barring September, and crossed the 1,000 BTC milestone in November. The newest acquisition has pushed Metaplanet’s complete Bitcoin holdings to 1,762, purchased at a mean value of $75,600 per BTC.

Notably, this $61 million buy is sort of double the worth of Metaplanet’s earlier largest acquisition, which occurred in November and was price near $30 million. The corporate’s constant BTC accumulation has earned it the nickname “Asia’s MicroStrategy,” in reference to the US-based enterprise intelligence agency identified for its aggressive Bitcoin shopping for technique.

It’s price highlighting that at this time’s BTC buy comes per week after Metaplanet raised $60.6 million via two tranches of bond issuance for the aim of “accelerating BTC purchases.” Metaplanet’s newest buy additionally makes its BTC reserves the Twelfth-largest amongst publicly listed companies globally.

In accordance with Metaplanet’s official announcement, its BTC Yield – a proprietary metric used to measure the efficiency of its Bitcoin acquisition technique – stood at 310% from October 1 to December 23. The agency emphasised that this technique is designed to be “accretive to shareholders.”

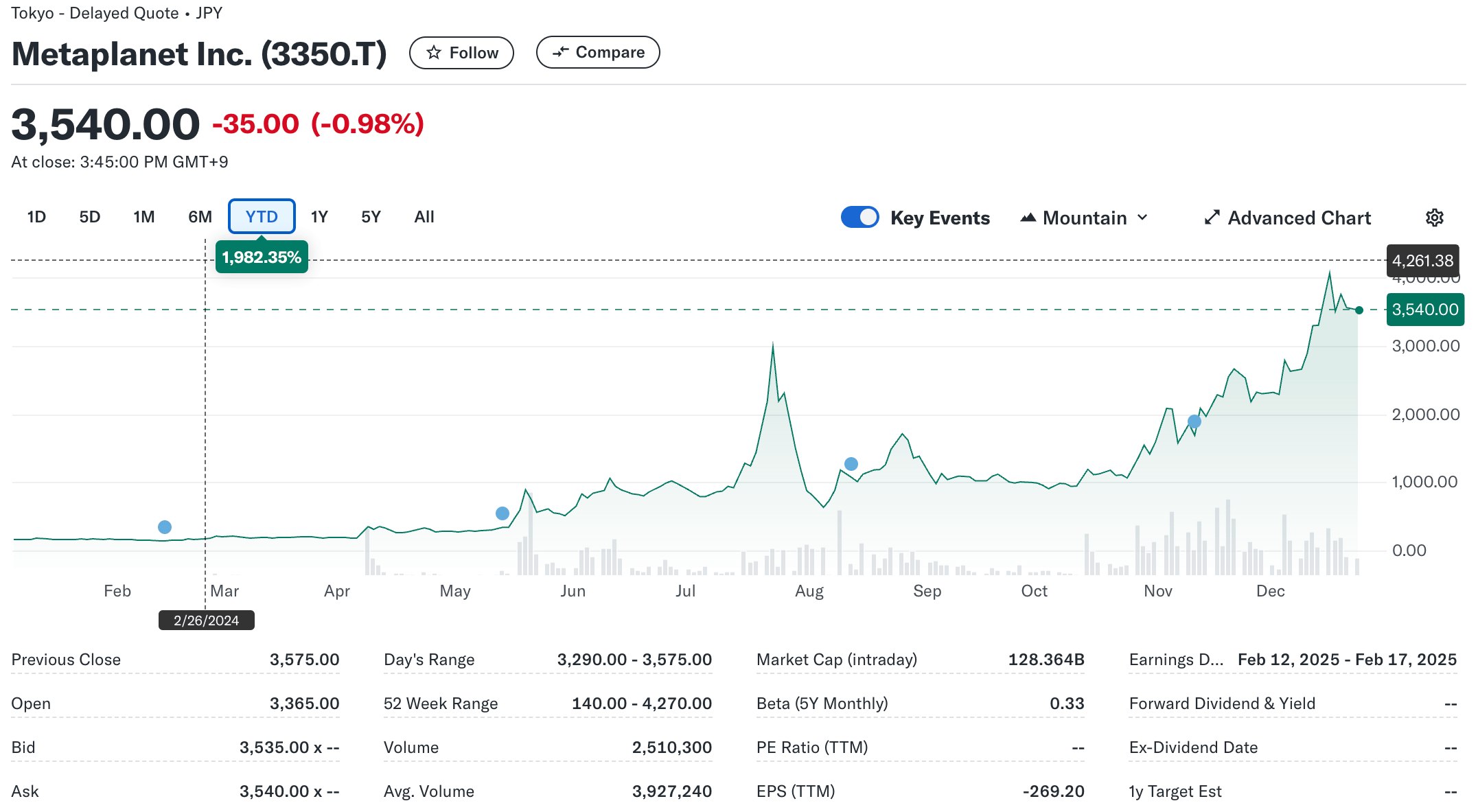

Regardless of at this time’s vital BTC buy, Metaplanet’s inventory value noticed little motion, closing at $22.5, down 0.98% for the day. Nevertheless, on a year-to-date foundation, the corporate’s inventory has surged by an astounding 1,982%, reflecting the long-term advantages of its Bitcoin-centric technique.

Bitcoin Provide Crunch To Hasten Adoption?

With Bitcoin’s complete most provide capped at 21 million, the digital asset has solidified its status as an inflation-resistant retailer of worth. A current report highlights that BTC provide on crypto exchanges has hit multi-year lows, indicating that holders are more and more withdrawing BTC from exchanges, lowering circulating provide and probably driving costs increased.

Associated Studying

Bitcoin’s shortage has triggered an unofficial race amongst companies – and presumably even governments. As an illustration, Bitcoin mining agency Hut 8 just lately bought 990 BTC for $100 million, rising its complete holdings to over 10,000 BTC. Equally, MARA, one other Bitcoin mining firm, acquired 703 BTC earlier this month, bringing its complete holdings to 34,794 BTC.

Speculations surrounding a possible US strategic Bitcoin reserve are additional strengthening BTC’s provide crunch narrative, which can fast-track its adoption. At press time, BTC trades at $94,003, down 1.5% previously 24 hours.

Featured picture from Unsplash, charts from Yahoo! Finance and Tradingview.com