On December 23, pseudonymous analyst Marty Marty shared an evaluation of the U.S. Greenback Index (DXY), highlighting its potential impression on monetary markets, together with cryptocurrencies.

The DXY, which measures the power of the U.S. greenback in opposition to a basket of main currencies, presently stands at 107.84. This marks a major restoration from its year-to-date low of round 100 in July and displays a pattern of greenback strengthening.

The greenback’s strengthening aligns intently with main occasions, together with Donald Trump’s victory within the November 2024 U.S. presidential election. His America-first agenda, which prioritizes home progress via insurance policies reminiscent of extending tax cuts, potential commerce tariffs, and infrastructure spending, has heightened market anticipation of expansive fiscal measures. These proposals may enhance authorities borrowing and inflationary pressures, resulting in increased rates of interest and additional strengthening the greenback. This outlook has boosted the DXY as buyers search the relative security and stability of the world’s reserve forex.

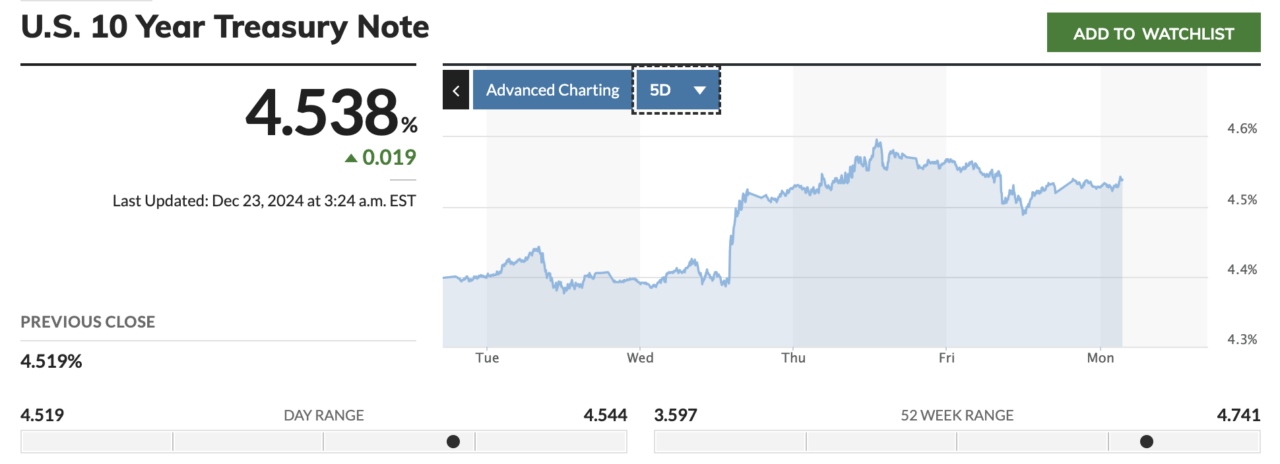

Including to the complicated dynamics, the Federal Reserve introduced a 0.25 share level charge lower on December 18, lowering its goal vary to 4.25%–4.50%. Usually, charge cuts result in decrease bond yields, as borrowing prices fall and markets worth in simpler financial situations. Nonetheless, on this case, the yield on the 10-year Treasury Observe has risen to 4.54% for the reason that Fed’s choice.

This seemingly counterintuitive transfer could be defined by the hawkish tone of the Federal Open Market Committee (FOMC) press convention.

Fed officers signaled that the tempo of charge cuts would sluggish in 2025 resulting from persistent inflation issues, suggesting a chronic interval of tighter financial situations than markets had initially anticipated. This stance has pushed yields increased as bond buyers demand extra compensation for holding longer-term debt in an inflationary atmosphere.

The interaction between these components—fiscal coverage, financial alerts, and inflation expectations—has important implications for asset costs. A rising DXY usually exerts downward strain on danger property, together with cryptocurrencies. This occurs as a result of a stronger greenback reduces world liquidity, growing the chance price of holding speculative investments like Bitcoin and Ethereum. Commodities, reminiscent of gold and oil, additionally are likely to face downward strain when the greenback strengthens, as they turn into dearer for patrons utilizing different currencies, typically resulting in diminished demand.

Nonetheless, this relationship is just not absolute. Sure property can carry out nicely during times of greenback power. For example, U.S. Treasury bonds, whereas initially affected by rising yields, typically appeal to world buyers in search of safe-haven property. Defensive sectors within the inventory market, reminiscent of healthcare and utilities, may present resilience. Even gold, which normally strikes inversely to the greenback, can rise during times of utmost uncertainty, as each gold and the greenback are thought-about secure havens.

The broader macroeconomic atmosphere underscores the interconnectedness of world markets. Cryptocurrencies, typically considered as impartial from conventional monetary programs, are deeply influenced by modifications in liquidity, rates of interest, and danger sentiment. If the DXY continues to strengthen, cryptocurrencies might face headwinds as buyers cut back publicity to higher-risk property. Conversely, a weakening greenback may create a extra favorable atmosphere for Bitcoin, Ethereum, and different digital property by bettering world liquidity and reigniting investor danger urge for food.

Featured Picture by way of Pixabay