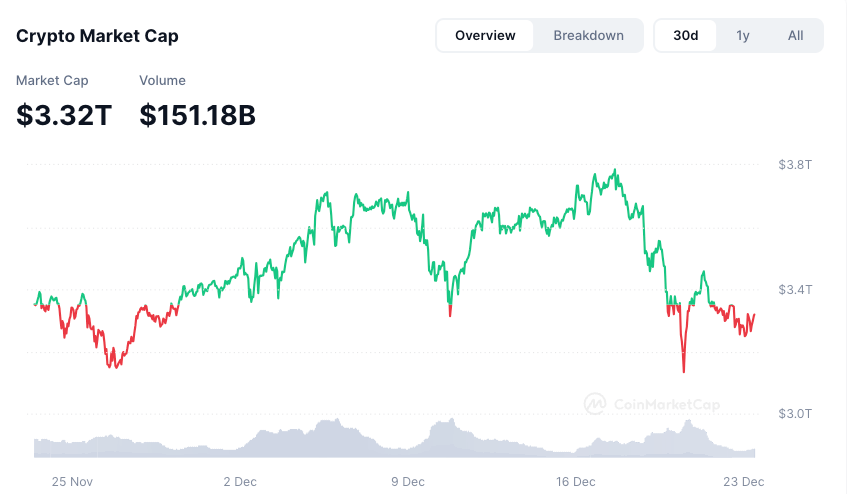

The entire market capitalization of the cryptocurrency market has dropped by round $42 billion during the last 24-hour interval as the costs of main cryptocurrencies, together with bitcoin, Ethereum’s ether, and XRP, see drops between 1% and a couple of.7%.

Regardless of the drop, BTC is now buying and selling at $96,000 after rising greater than 2.6% from the December low round $92,500 seen after the Federal Reserve minimize rates of interest by 25 foundation factors, however feedback from Chair Jerome Powell urged a extra hawkish stance, suggesting fewer price cuts can be made subsequent 12 months.

Powell’s feedback dampened investor sentiment and affected threat belongings throughout markets, with the inventory market’s benchmark index, the S&P 500, plunging by greater than 3.5% earlier than recovering, whereas nonetheless being down 2.2% for the week.

Regardless of the cryptocurrency area’s restoration over the previous few days, for the week BTC continues to be down greater than 8%, whereas ether misplaced 15% of its worth in the identical interval. Different main altcoins, together with DOGE, SOL, XRP, and ADA, misplaced between 21% and 10% of their worth over the previous week.

The drawdown noticed the cryptocurrency area erase its positive aspects over the previous month, which dampened investor sentiment and sure elevated profit-taking from buyers who benefited from the market’s rally after the U.S. elections.

Furthermore, in accordance with information from CoinGlass, over 14 billion price of bitcoin choices are set to run out on Deribit alone, whereas $1.7 billion price of choices will expire on Binance on the identical day. Equally, round $3.8 billion price of ETH choices are set to run out on Deribit, together with $400,000 on Binance, on December 27.

The utmost ache level for bitcoin choices — the worth at which most choices contracts would expire nugatory — is at present at $84,000. Ether choices’ most ache level is at $3,400.

These choices’ expiry may usher in important volatility, with merchants doubtlessly transferring to regulate their positions forward of the expiry.

The cryptocurrency area may be seeing a slight downward motion. Over the weekend, the founding father of Hex and PulseChain, Richard Coronary heart, was added to Interpol’s Purple Discover listing over fraud and violent assault costs.

It’s additionally price noting that U.S. President-elect Donald Trump has appointed Bo Hines, a former school soccer participant, because the Govt Director of the Presidential Council of Advisers for Digital Property, which is also referred to as the “Crypto Council.”

Earlier this month, Trump appointed David Sacks, a former chief working officer of PayPal, because the White Home’s new AI and Cryptocurrency Czar. In a put up on the social media platform TruthSocial, Trump stated that Sacks would “information coverage for the Administration in Synthetic Intelligence and Cryptocurrency, two areas vital to the way forward for American competitiveness.”

Regardless of the drop, latest headlines have revealed Japanese funding agency Metaplanet has made its largest-ever bitcoin buy, shopping for a further 619.7 BTC in a single transaction after the worth of the cryptocurrency dropped under the $100,000 stage. The acquisition was valued at almost $60 million, when BTC was buying and selling at $96,000.

Featured picture through Pexels.