Bitcoin’s stint at its new all-time excessive of $108,200 was short-lived. In lower than every week, its value dropped by over 12%, reaching $95,000 on Dec. 23.

Whereas pullbacks starting from 20% to as excessive as 30% are commonplace dulling bull rallies, this value reversal was accompanied by a cascade of lengthy liquidations, which additional amplified the downward value stress over the weekend.

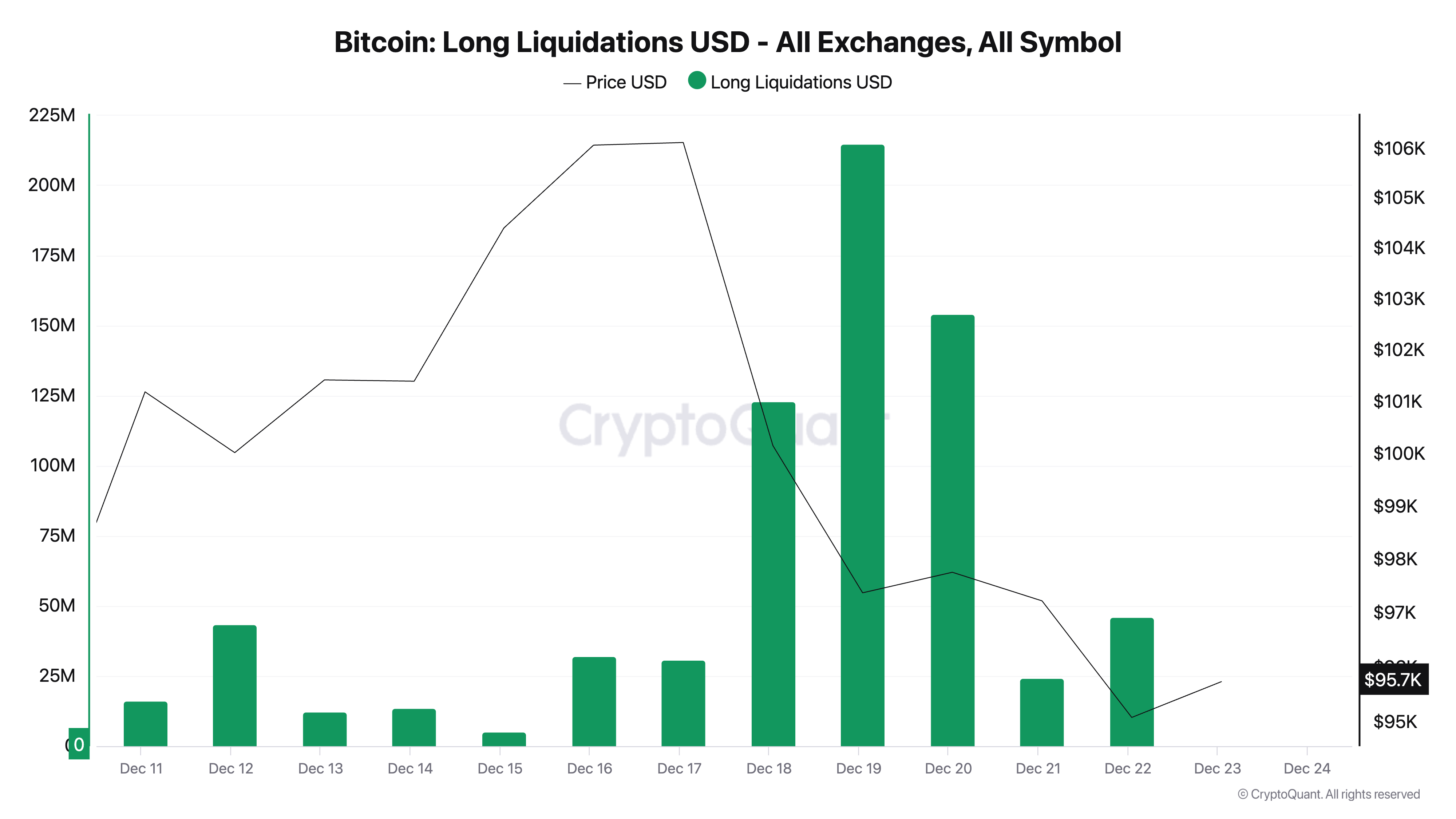

Between Dec. 17 and Dec. 22, over $540 million in lengthy positions have been liquidated throughout exchanges. The most important single day for liquidations was Dec. 19, when roughly $214 million in longs have been worn out.

The variety of liquidations we’ve seen up to now week reveals the dangers of overleveraged buying and selling. As quickly as BTC started to retrace from its ATH, merchants with high-leverage lengthy positions have been pressured to shut their positions as their margin ranges have been shortly breached. These pressured liquidations added to the promoting stress, accelerating Bitcoin’s decline beneath the important thing psychological help of $100,000.

Lengthy liquidations happen when the worth of an asset drops beneath a dealer’s liquidation threshold, usually set by the extent of leverage they use. The extra leverage, the smaller the worth motion wanted to set off a liquidation.

On this case, Bitcoin’s steep drop triggered a wave of liquidations because the market deleveraged. The Federal Reserve’s tighter financial coverage probably contributed to the sell-off by dampening investor sentiment and rising market volatility. As soon as Bitcoin failed to keep up its value above $100,000, the next liquidation cascade turned what may need been a managed pullback right into a sharper decline.

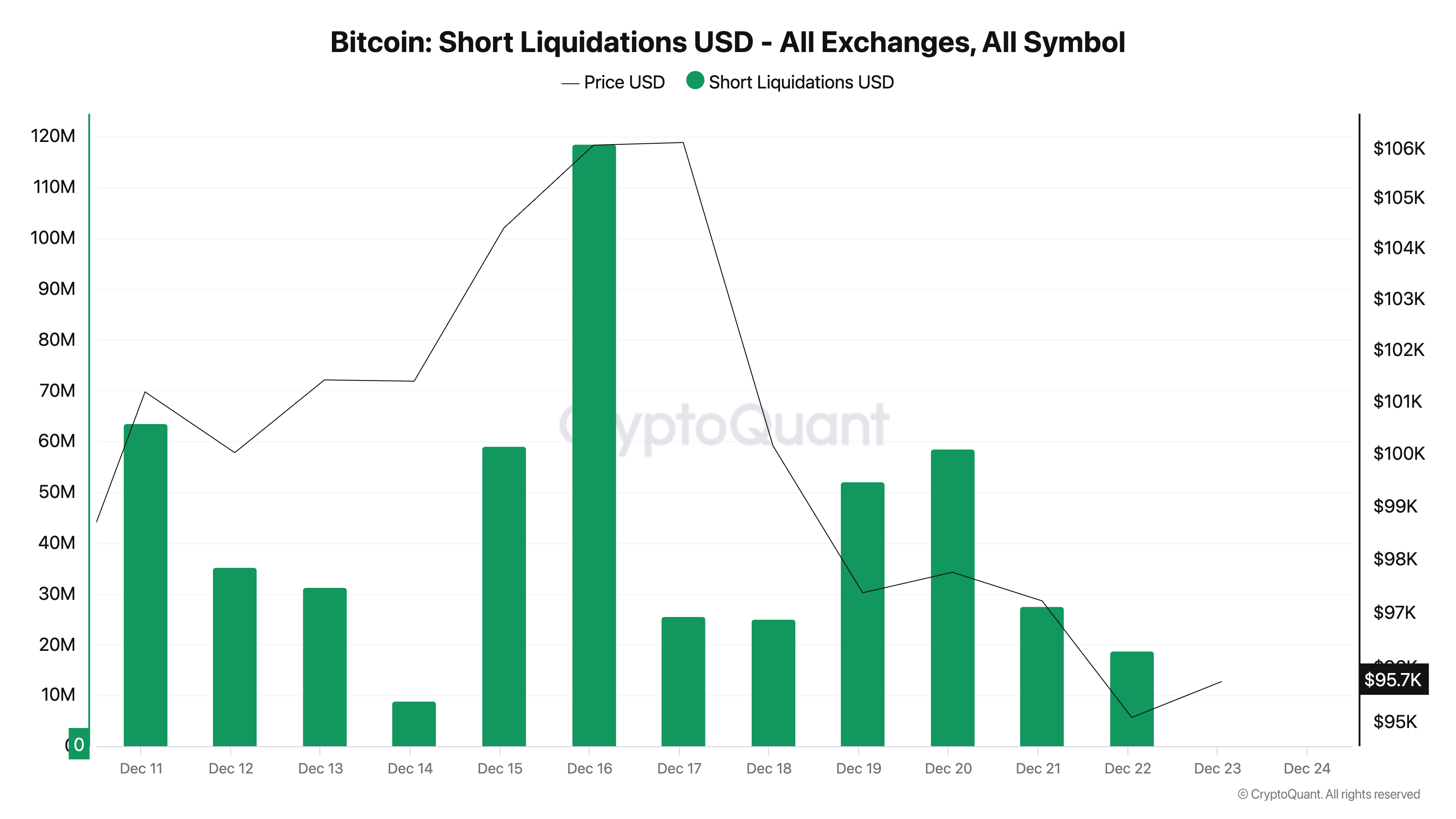

Whereas lengthy liquidations dominated throughout the value drop, it’s additionally essential to research the sooner spike briefly liquidations that occurred on Dec. 16, simply as Bitcoin was approaching its all-time excessive. That day, roughly $120 million briefly positions have been liquidated as Bitcoin surged towards $108,200.

This transfer invalidated bearish bets made by merchants who anticipated the rally to falter. The fast value enhance triggered a brief squeeze, forcing merchants to shut their positions by shopping for Bitcoin, which in flip added upward stress on the worth.

The distinction between longs and shorts reveals the function leverage performs in shaping value actions in periods of volatility. Longs, which totaled $540 million, far exceeded the $120 million briefly liquidations, reflecting how market sentiment had shifted from over-optimism to a pointy correction.

Brief liquidations peaked throughout the rally as bearish merchants misjudged the power of the bullish momentum. In distinction, lengthy liquidations intensified throughout the sell-off, as bullish merchants discovered themselves overextended when the worth reversed.

The timing and magnitude of those liquidations additionally supply insights into dealer conduct. Brief liquidations occurred as Bitcoin reached new highs, indicating that some market members underestimated the rally’s power. However, the lengthy liquidations throughout the value drop present {that a} considerably larger variety of merchants have been caught off guard by the velocity and depth of the correction, notably as Bitcoin broke beneath $100,000.

Evaluating the 2 tendencies, it’s evident that Bitcoin’s rally and subsequent drop have been closely influenced by leveraged positions. The quick liquidation spike on Dec. 16 contributed to the rally’s momentum, pushing Bitcoin to its all-time excessive. Nonetheless, the lengthy liquidations that adopted have been way more vital by way of market influence, driving Bitcoin’s value down by over 12% inside a number of days.

The publish Bitcoin tumbled to $95k after $540 million in lengthy liquidations appeared first on CryptoSlate.