- On the time of writing, BTC was slumping for the fourth day.

- Bitcoin’s SOPR, nonetheless, reveals optimistic tendencies from LTH.

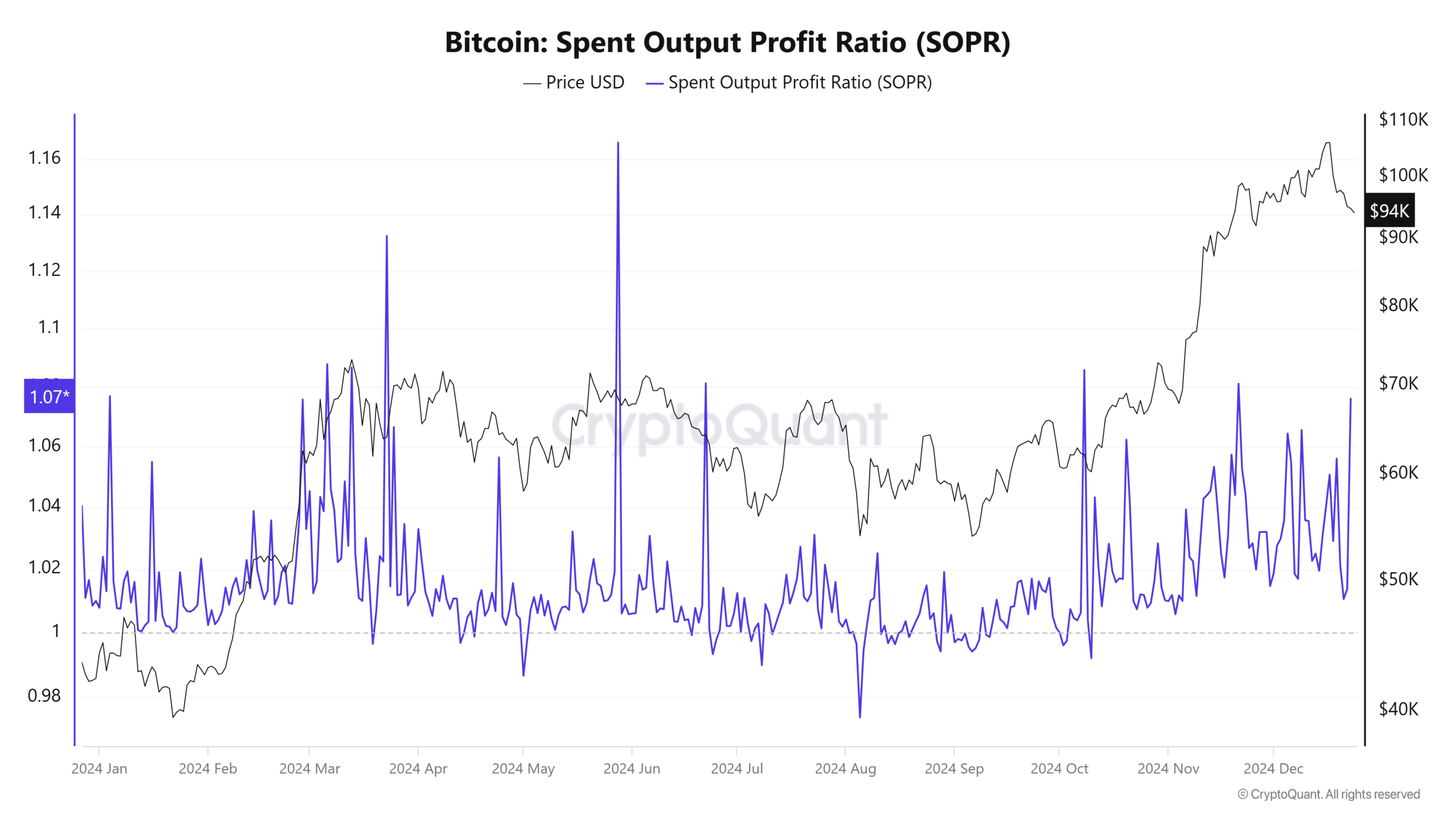

As Bitcoin[BTC] hovered close to $94,000, the Spent Output Revenue Ratio (SOPR) and the Lengthy-Time period Holder (LTH) and Quick-Time period Holder (STH) SOPR ratio charts provide worthwhile insights into the market’s dynamics.

Whereas these metrics mirror profitability and sentiment amongst totally different investor courses, the value chart means that Bitcoin is getting into a essential part. Are long-term holders holding agency for a possible rally, or might additional consolidation be on the horizon?

Bitcoin SOPR metrics spotlight investor conviction

Evaluation of the SOPR metric reveals Bitcoin stays above the impartial threshold of 1.0, signaling that almost all Bitcoin transactions happen at a revenue. This can be a optimistic indicator reflecting confidence amongst market individuals, significantly during times of worth volatility.

Traditionally, a secure or rising SOPR throughout corrections typically precedes a restoration, suggesting sellers are taking income moderately than exiting positions in panic.

Supply: CryptoQuant

The LTH SOPR/STH SOPR ratio highlights the divergence in sentiment between long-term and short-term holders. Lengthy-term holders are steadfast, with minimal promoting exercise at present worth ranges. Conversely, short-term holders present lowered exercise, indicating profit-taking or cautious positioning.

These metrics collectively recommend sturdy help from skilled holders who stay assured regardless of Bitcoin’s latest pullback.

Bitcoin key ranges below menace

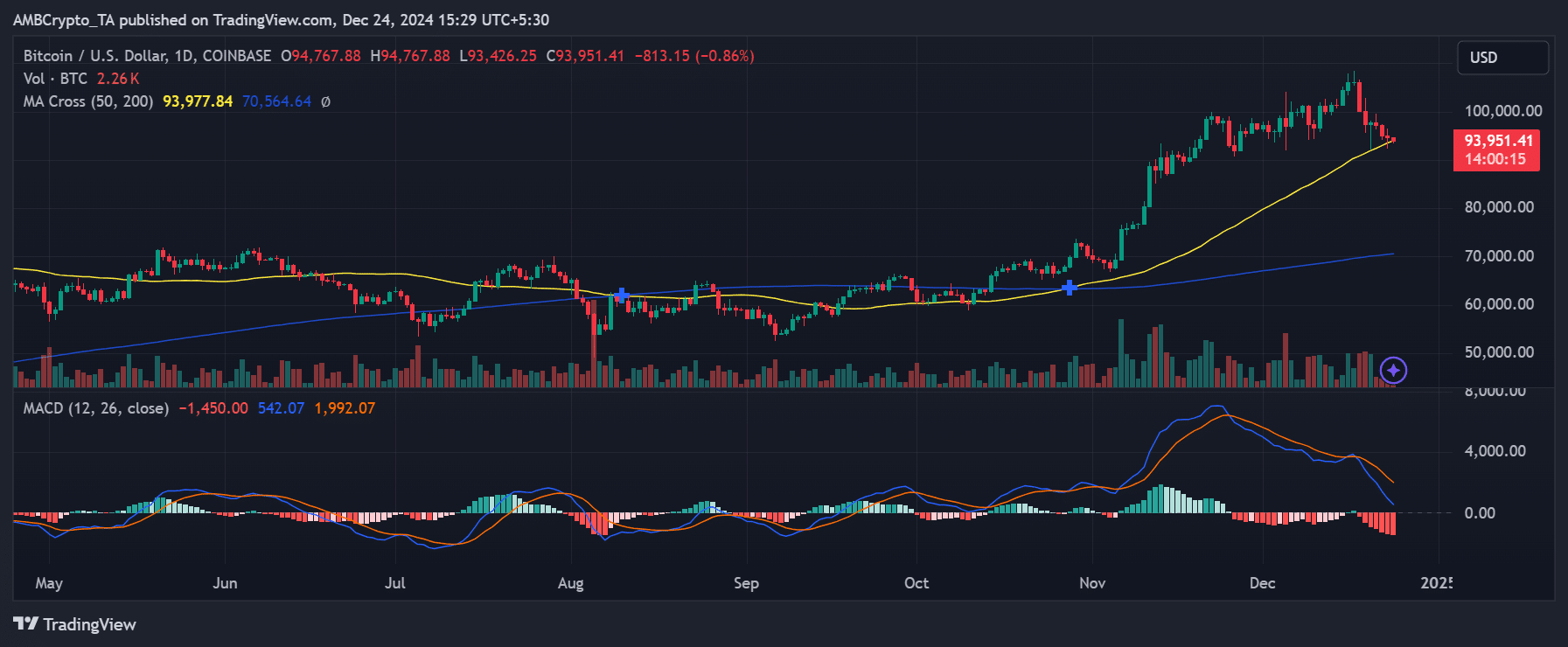

The value chart evaluation displays Bitcoin’s battle to keep up its bullish momentum after peaking close to $99,000. It’s buying and selling simply above its 50-day Shifting Common (MA) at $93,977, which acts as a essential help degree.

A sustained breach beneath this degree might set off a deeper correction, probably testing decrease help zones round $92,000.

Supply: TradingView

The MACD indicator on the chart displays bearish momentum, because the MACD line has crossed beneath the sign line. The declining histogram bars additional point out rising promoting stress, which aligns with the slight pullback noticed in latest periods.

Moreover, buying and selling volumes are diminishing, suggesting that the present part is marked by lowered market participation.

LTH and STH habits: A basis for restoration?

The SOPR metrics, coupled with worth chart tendencies, underscore the resilience of long-term holders.

The regular accumulation by these individuals signifies confidence in Bitcoin’s long-term worth. On the identical time, short-term holders’ lowered exercise displays warning however doesn’t sign panic promoting.

If Bitcoin manages to defend its key help ranges and SOPR metrics stay above 1.0, this might pave the best way for a resumption of the broader uptrend.

Nevertheless, any failure to keep up these ranges might result in prolonged consolidation as bearish momentum continues to problem the market’s upward trajectory.

– Learn Bitcoin ( BTC) Value Prediction 2024-25

Bitcoin’s SOPR metrics and worth chart provide a combined however insightful image of the market. Whereas long-term holders’ confidence and regular profitability present a powerful basis, short-term bearish alerts can’t be ignored.

Buyers ought to carefully monitor the $93,977 help zone and SOPR tendencies for clues concerning the subsequent main worth motion.