The rise of digital identification administration has reworked how we work together on-line, however it additionally brings challenges of safety, privateness, and belief. Blockchain expertise is rising as a cornerstone of those options, providing decentralized, clear, and safe frameworks for managing identities.

We sit down with Sebastian Rodriguez, Chief Product Officer at Privado ID, who outlines blockchain’s position in digital identification options.

Self-Sovereign Identification: A Person-Centric Mannequin

Self-sovereign identities (SSI) empower customers to regulate their knowledge and guarantee privateness. By decentralizing knowledge administration, blockchain eliminates reliance on centralized establishments, creating techniques the place belief is embedded within the expertise itself.

The self-sovereign identification mannequin is on the coronary heart of blockchain-based digital identification techniques. In contrast to conventional techniques, the place organizations retailer and management consumer knowledge, SSI locations customers on the middle.

Blockchain acts as a verifiable repository for credentials, permitting customers to handle their identities securely. Rodriguez explains that this method affords important advantages like credential revocations, key rotations, and belief registries.

“Blockchain is without doubt one of the many elements at play in self-sovereign identification options. A lot of these options place the consumer on the middle of their knowledge change and are consent-driven. That is what actually helps to enhance the safety and privateness of the consumer—being the actual proprietor of their knowledge,” Rodriguez mentioned in an interview with BeInCrypto.

Privado ID leverages superior cryptographic methods, together with Zero-Data Proofs, to make sure knowledge privateness.

This ensures customers can confirm their credentials with out exposing delicate data. Mixed with good contracts, this methodology allows trustless identification verification processes, eradicating reliance on central authorities.

Blockchain’s main perform in identification techniques is to anchor belief. It offers a public, immutable registry for credentials issued by trusted organizations, reminiscent of governments or monetary establishments.

This enables customers to confirm the authenticity of credentials whereas enabling issuers to revoke them if needed. In keeping with Juniper Analysis, automation of identification and money-laundering checks, allied to the blockchain to confirm digital identification, can allow financial savings of as much as 50% of banks’ present prices inside just a few years.

By separating knowledge storage from verification processes, blockchain ensures safety whereas sustaining flexibility for cross-platform use. This mannequin is especially efficient in industries like finance, healthcare, and governance, the place belief and compliance are paramount.

Challenges in Blockchain-Based mostly Identification Techniques

Regardless of its promise, blockchain-based digital identification techniques face important adoption limitations. One problem is guaranteeing accessibility for non-crypto-native customers. Rodriguez emphasizes the significance of hiding advanced blockchain processes from customers.

“Typically, it’s higher to cover the blockchain from the top customers if we’re concentrating on mass adoption past the crypto neighborhood – we’re competing with the easiness of Google and Apple. Comfort has gained the battle in opposition to privateness over and over – to win this battle we must always settle for that the consumer expertise is essential,” Rodriguez mentioned.

To handle these boundaries, Privado ID makes use of a “blockchain mild” method. This methodology minimizes consumer interactions with blockchain, specializing in seamless integration throughout networks. Cross-chain interoperability is one other important function.

“Our system verifies credentials with out requiring blockchain transactions, making it chain-agnostic,” Rodriguez mentioned.

Reusable Know Your Buyer (KYC) credentials are altering monetary companies. Customers full KYC verification as soon as, storing credentials in decentralized tokens to be used throughout a number of platforms.

This reduces prices for establishments whereas enhancing consumer privateness. Moreover, blockchain-based age verification techniques are being adopted in on-line companies and gaming, guaranteeing compliance with out revealing delicate consumer knowledge.

Blockchain’s Future in Digital Identification

The evolution of digital identities is poised to redefine on-line belief and safety. Rodriguez believes blockchain will play a central position on this transformation.

“Identification is greater and wider than blockchain – and its evolution within the coming years will influence each facet of our digital lives. Now we have lived with out robust, trusted identities for years, utilizing our social accounts as proxies of our identities – however there’s a motive why you’ll be able to’t use an electronic mail deal with to vote or to purchase a home. AI will push the boundaries of our belief and our sense of possession to the purpose the place trusted identities can be a should. In 10 years we’ll bear in mind the present state of the Web because the “wild” days, in the identical approach we bear in mind the 90’s because the “naive” years,” Rodriguez mentioned.

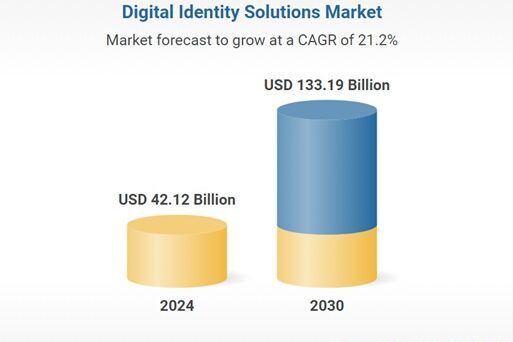

The worldwide digital identification resolution market measurement is projected to develop from $42 billion in 2024 to $133 billion by 2030.

As digital identification techniques mature, they have to stability privateness, safety, and ease of use. Rodriguez stresses that consumer expertise can be important to widespread adoption.

Blockchain’s potential to supply transparency and safety whereas respecting consumer privateness positions it as a game-changer in digital identification. With extra improvements en route, blockchain-based identification techniques are poised to remodel how we work together and transact on-line.

Disclaimer

Following the Belief Venture pointers, this function article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its workers. Readers ought to confirm data independently and seek the advice of with knowledgeable earlier than making selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.