AAVE worth continues to surge, cementing its place as the largest lending protocol in crypto with a market cap of $5.5 billion—greater than all different high 10 lending protocols mixed.

The token has risen a powerful 220% this yr and 110% in simply the final 30 days, pushed by sturdy bullish momentum and growing market curiosity. Technical indicators such because the RSI and CMF spotlight ongoing constructive tendencies, although some indicators of cooling momentum counsel potential consolidation forward.

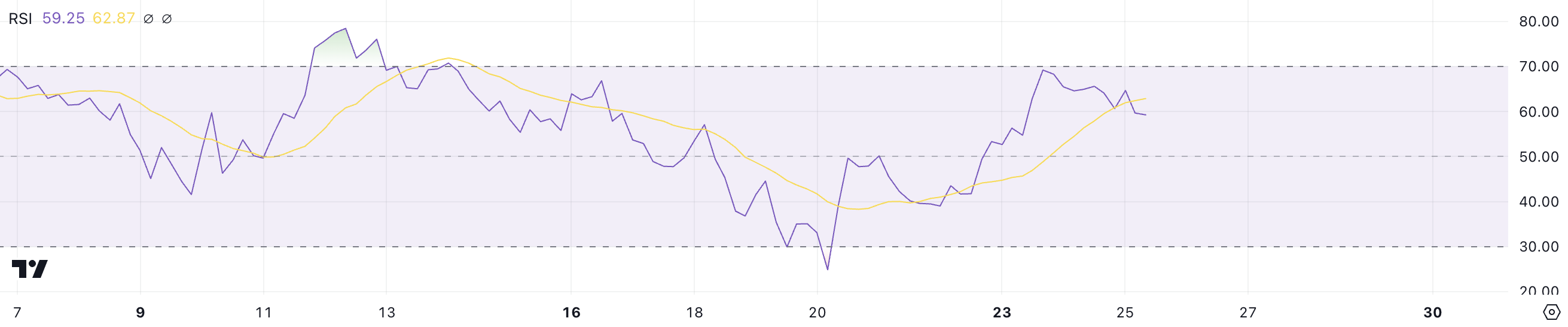

AAVE RSI Is Impartial After Virtually Reaching the Overbought Zone

AAVE Relative Power Index (RSI) is presently at 59.2, down from 69.19 on December 23, when its worth peaked at $382. This decline in RSI means that AAVE worth has moved away from overbought territory, the place heightened shopping for strain sometimes precedes a worth correction.

Whereas the present RSI nonetheless displays comparatively sturdy momentum, the pullback signifies that the market could also be stabilizing after a interval of intense shopping for exercise.

RSI is a momentum indicator that measures the velocity and magnitude of worth actions on a scale from 0 to 100. Values above 70 point out overbought circumstances, signaling the potential for a correction, whereas values beneath 30 counsel oversold circumstances, usually previous a rebound.

With AAVE RSI at 59.2, the coin stays in a neutral-to-bullish vary, signaling that the uptrend might proceed within the quick time period if shopping for momentum rebuilds. Nonetheless, the decline from overbought ranges additionally means that AAVE worth might consolidate, permitting the market to soak up current positive aspects earlier than deciding its subsequent path.

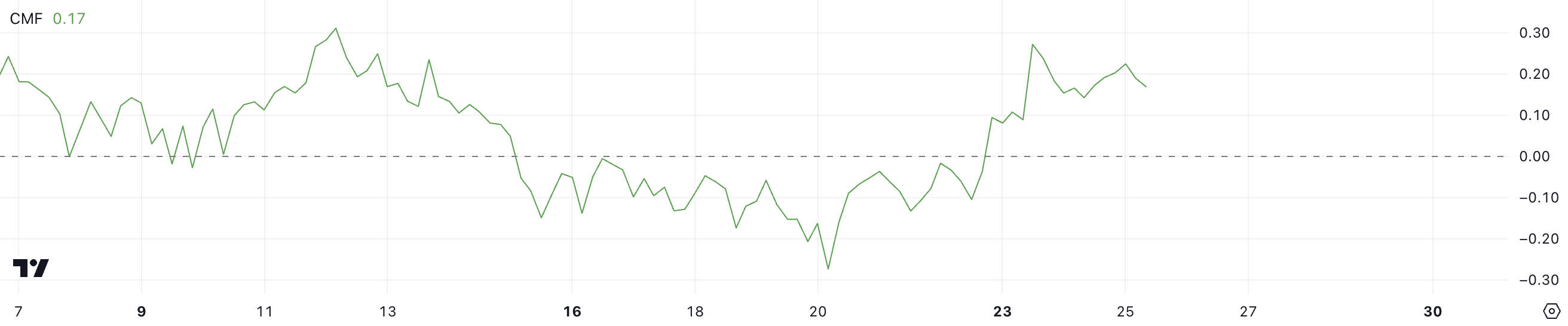

AAVE CMF Is Nonetheless Very Optimistic, However Down From The Current Peak

AAVE’s Chaikin Cash Movement (CMF) is presently at 0.17, sustaining a constructive development since December 23, when it reached a peak of 0.27. This means that AAVE has been experiencing constant capital inflows, reflecting sturdy shopping for strain out there.

Whereas the CMF has declined from its current peak, the constructive worth means that consumers are nonetheless in management, albeit with barely diminished depth.

CMF is a volume-weighted indicator that measures the buildup or distribution of an asset over a particular interval, starting from -1 to +1. Optimistic CMF values point out accumulation and shopping for strain, whereas destructive values signify distribution and promoting strain.

With AAVE CMF at 0.17, the continuing constructive influx means that the token might maintain its present worth ranges and even see additional positive aspects within the quick time period if shopping for exercise persists. Nonetheless, the decline from the December 23 peak signifies that momentum could also be cooling, probably resulting in a interval of consolidation earlier than any decisive transfer.

AAVE Worth Prediction: Can AAVE Rise to 3-Yr Highs?

If the present constructive momentum continues, AAVE worth might take a look at $400, a major degree that may mark its highest worth since 2021. The token must rise simply 7.5% to achieve this milestone, supported by the golden cross formation on December 23 and EMA traces that point out the uptrend might persist.

This alignment of technical indicators means that bullish sentiment stays sturdy, with consumers prone to push costs larger if the development holds regular.

Nonetheless, as highlighted by the CMF, the power of the uptrend has waned in contrast to a couple days in the past, signaling the potential for a development reversal. If AAVE worth uptrend loses steam, the worth might drop to check the $355 assist degree.

Ought to this assist fail, AAVE would possibly see additional declines, with potential targets at $297 and even $271, reflecting a major correction.

Disclaimer

According to the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.