- Bitcoin’s pullback over the previous month has reset speculative exercise.

- The sentiment was barely grasping and the market was seemingly prepared for one more sustained interval of uptrend.

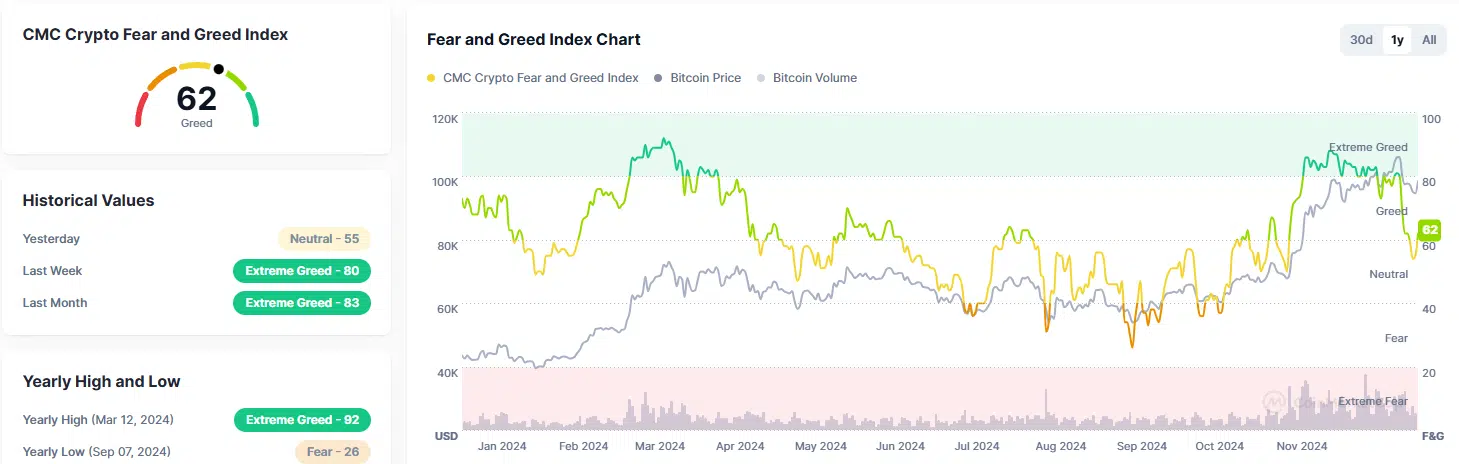

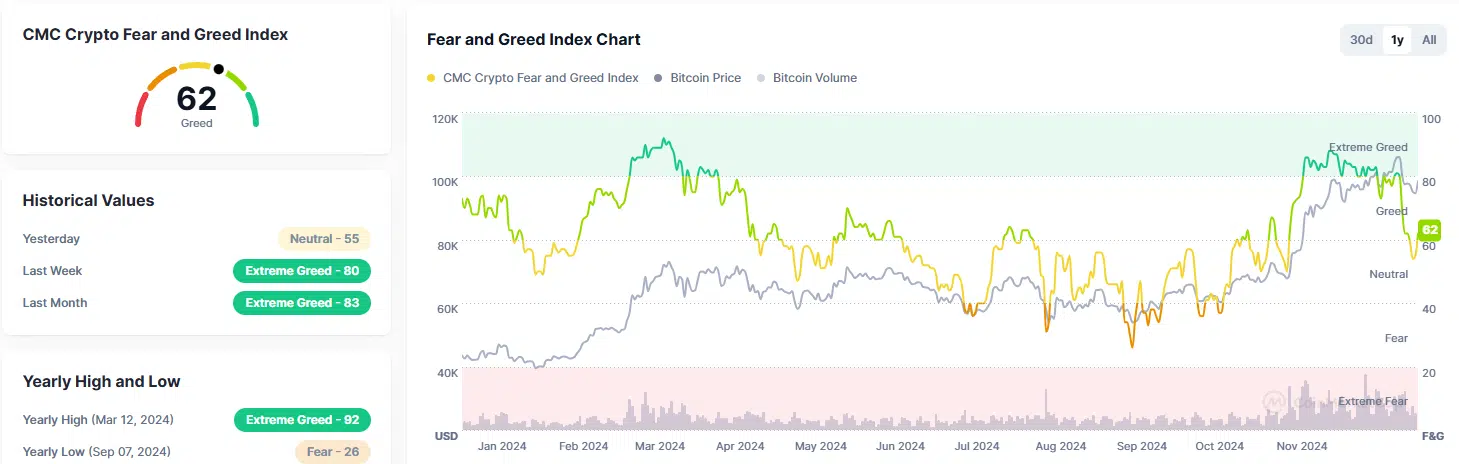

Bitcoin [BTC] was buying and selling at $98k after the current correction from $108k to $92.5k. This noticed the Bitcoin Worry and Greed worth drop to impartial, from the place they’re climbing larger now.

The sentiment throughout the crypto market is especially dictated by Bitcoin’s traits. There will be dozens of outliers that pattern towards BTC or massively outperform the main crypto. But, these are often the exceptions and never the norm, particularly amongst large-cap cash.

Overheated signals- have they receded?

Supply: CoinMarketCap

The CoinMarketCap Crypto Worry and Greed Index had hovered above 80 from the eleventh of November to the twelfth of December. This month-long bullish sentiment noticed BTC achieve 24.6%. Since then, the grasping sentiment has fallen and reached 54 on the twenty third of December.

As a rule of thumb, it’s a good suggestion to purchase when the sentiment is fearful and promote when grasping. Nonetheless, throughout sturdy traits, as we noticed over the previous month, grasping readings will be accompanied by sturdy market-wide good points.

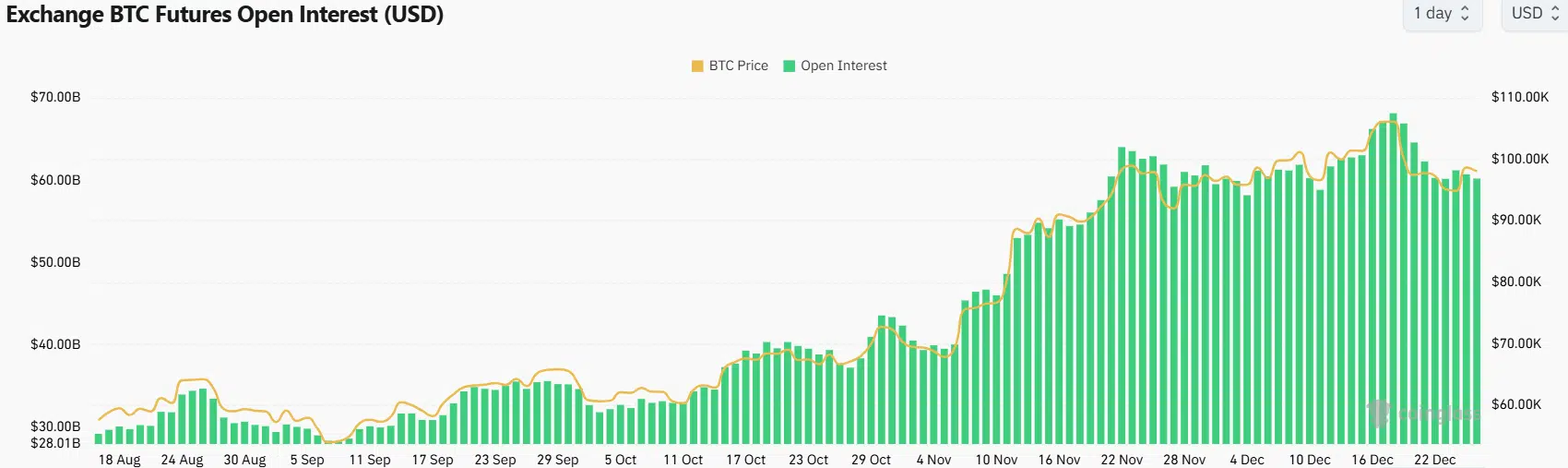

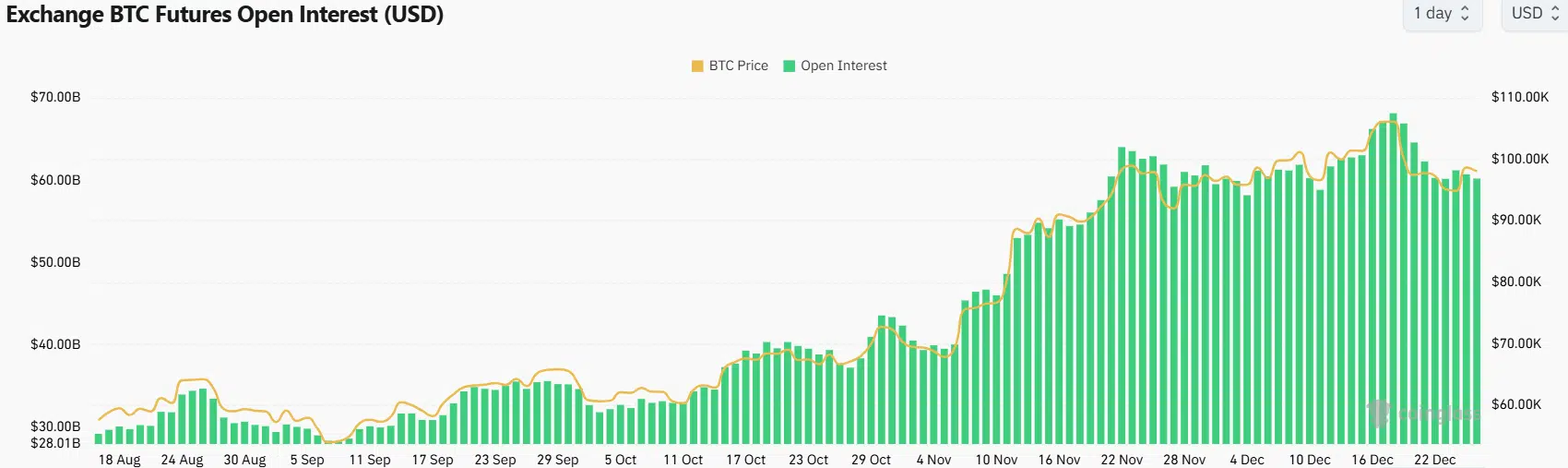

Supply: Coinglass

One other gauge of the Bitcoin Worry and Greed sentiment was via the Open Curiosity knowledge. The chart above exhibits that BTC OI has dropped from $68.13 billion to $60.21 billion prior to now 9 days.

It was an indication that speculators had been cautious of going lengthy, and mirrored hesitancy from bullish futures market contributors.

Accumulation traits have restarted after the battle below $100k

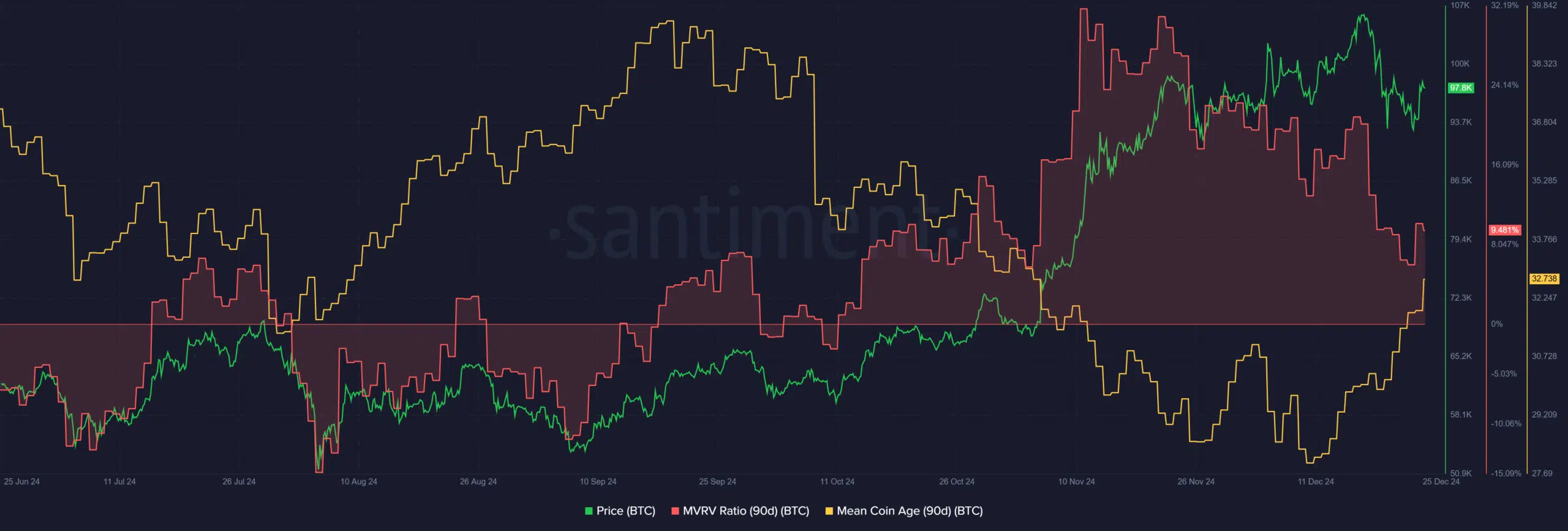

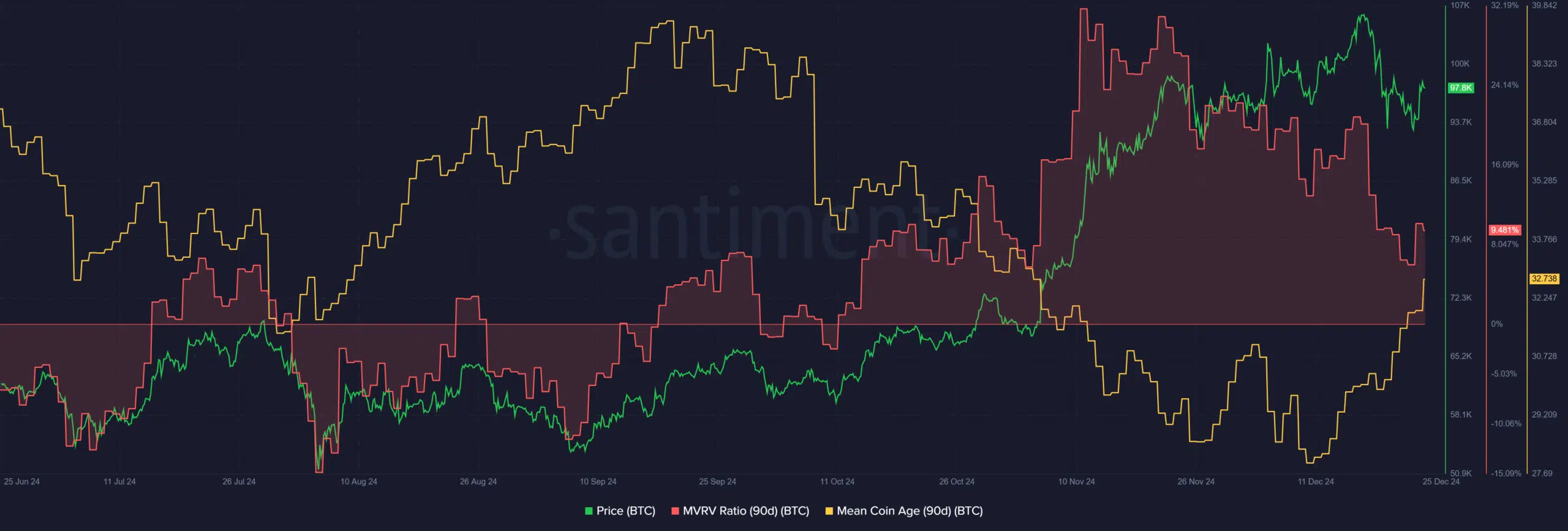

Supply: Santiment

Whereas the sentiment throughout the market cooled down because of the current sell-off, there have been some positives for BTC. The imply coin age had been in a downtrend from late September to mid-December.

This pattern has begun to reverse over the previous ten days, exhibiting accumulation and was a powerful bullish signal.

The 90-day MVRV ratio was at 9.46%, exhibiting that on common, holders inside this time window had been at a good revenue. But, it too has been trending downward for almost six weeks.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This was an indication that promoting strain from brief to medium-term holders’ profit-taking would seemingly have a minimal affect within the coming days.

Placing the clues collectively, the renewed accumulation and the sentiment reset had been agency indicators that Bitcoin is prepared for its subsequent sustained push past $100k.