The variety of digital asset buyers in South Korea has surged considerably towards the tip of 2024. For the primary time, South Korea compiled detailed statistics from its 5 main cryptocurrency exchanges (Upbit, Bithumb, Coinone, Korbit, and Gopax).

This improvement would possibly push the federal government to create a safe buying and selling setting, shield buyers’ rights, and guarantee market stability.

Report-Breaking 15.59 Million Crypto Buyers in South Korea

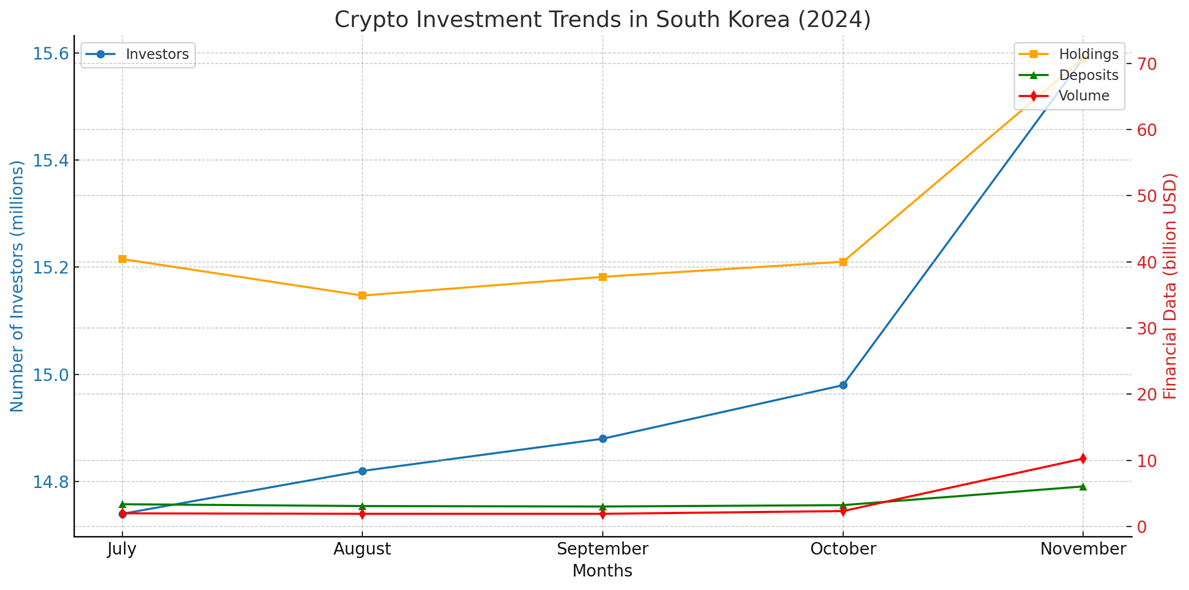

Based on Yonhap Information Company, Consultant Lim Gwang-hyun of South Korea’s Democratic Social gathering (a member of the Nationwide Meeting’s Finance and Planning Committee) disclosed knowledge from the Financial institution of Korea. The information reveals that as of late November, the variety of home digital asset buyers reached 15.59 million, a rise of 610,000 in comparison with late October. This determine accounts for 30% of South Korea’s whole inhabitants (roughly 51.23 million).

In November, the common every day buying and selling quantity on South Korea’s digital asset exchanges reached 14.9 trillion KRW (roughly $10.5 billion), practically matching the mixed buying and selling worth of the KOSPI inventory market (9.92 trillion KRW) and KOSDAQ (6.97 trillion KRW).

By the tip of November, the overall worth of digital property held by South Korean buyers reached 102.6 trillion KRW (roughly $70.3 billion), a big improve from 58 trillion KRW ($39.7 billion) in October.

Deposits—funds not but invested and held on exchanges—reached 8.8 trillion KRW ($6.03 billion) by the tip of November, up sharply from 4.7 trillion KRW ($3.2 billion) in late October.

“The dimensions of digital asset buying and selling is rising quickly and is now corresponding to the inventory market. The federal government should totally put together to ascertain a secure buying and selling setting, shield customers’ rights, and guarantee market stability,” Consultant Lim Gwang-hyun emphasised.

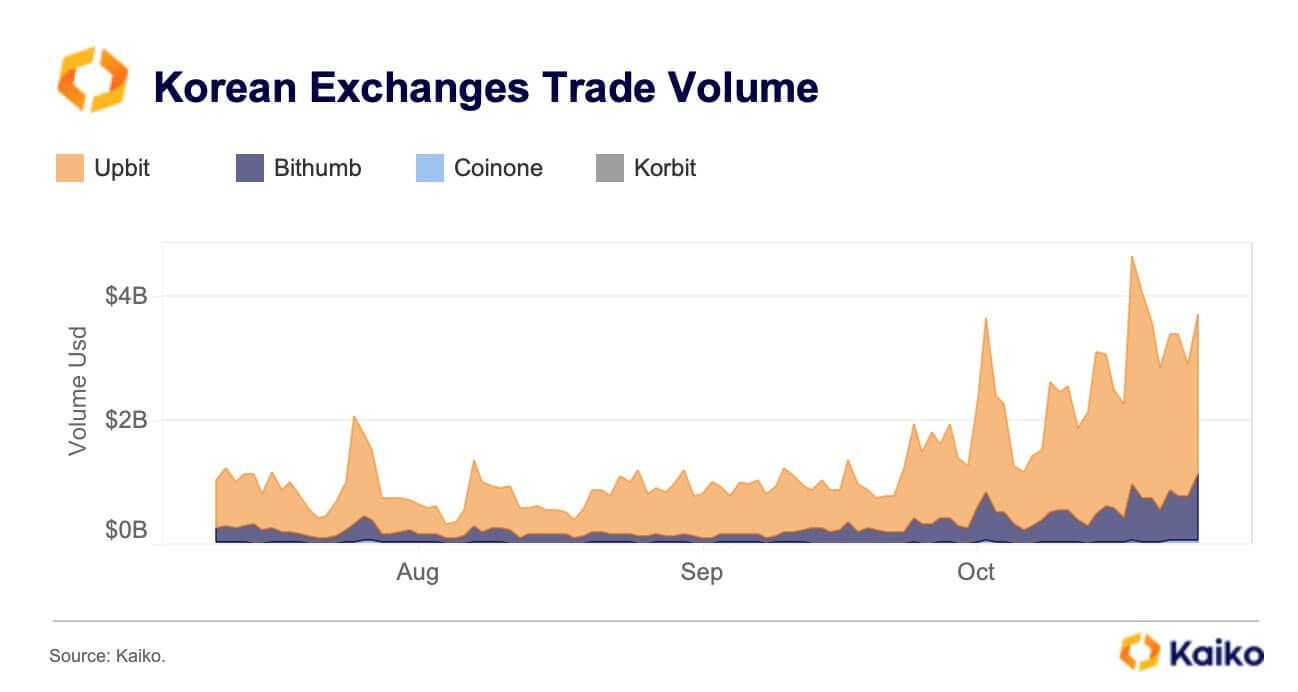

Moreover, knowledge from Kaiko signifies that cryptocurrency buying and selling volumes on South Korean exchanges soared in November, with the vast majority of exercise focused on Upbit. Upbit’s market share skyrocketed from 43% to just about 90% between September 2020 and Could 2021, and it has maintained excessive ranges since then. Altcoins account for 88% of buying and selling exercise on Upbit.

Nonetheless, South Korea’s crypto market nonetheless experiences some turbulence, particularly after President Yoon Suk Yeol’s surprising declaration of martial legislation. Though martial legislation was revoked afterward, crypto buying and selling continues to face quite a few regulatory hurdles.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.