A crypto strategist who nailed the pre-halving Bitcoin correction earlier this yr is warning that BTC could head decrease as resistance continues to strengthen.

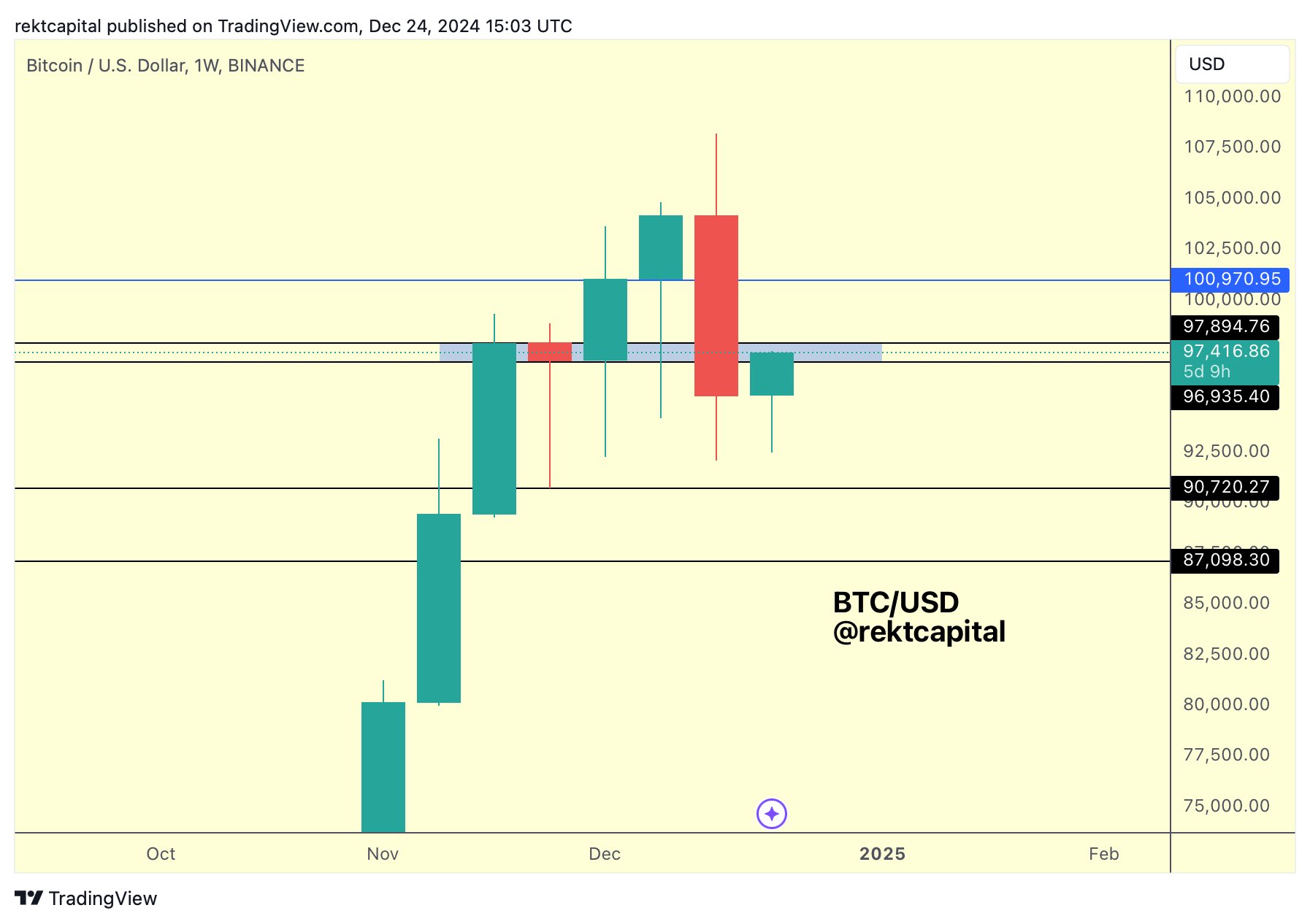

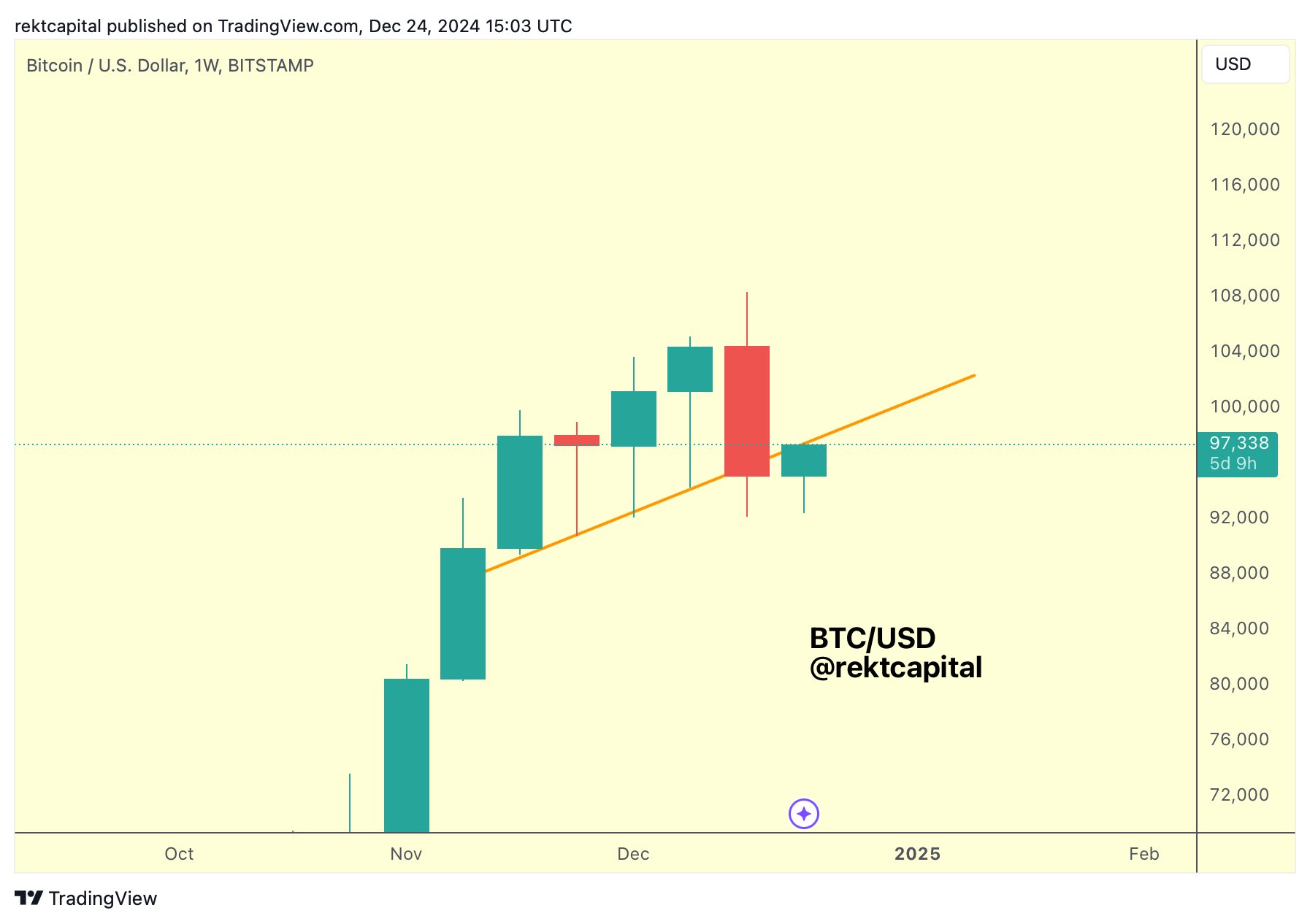

Pseudonymous analyst Rekt Capital tells his 523,400 followers on the social media platform X that Bitcoin is trying near-term bearish because it struggles to reclaim key assist ranges on the weekly chart whereas it chops across the $90,000 vary.

“[Monday], Bitcoin confirmed some indicators of a reduction rally after which value was rejected to nearly new lows. [Tuesday], Bitcoin [was] rebounding but once more and as soon as once more into the outdated assist. Total, so long as the beforehand misplaced helps flip into new resistance extra draw back needs to be anticipated. Conversely, a reclaim of those beforehand misplaced helps would clearly be bullish.”

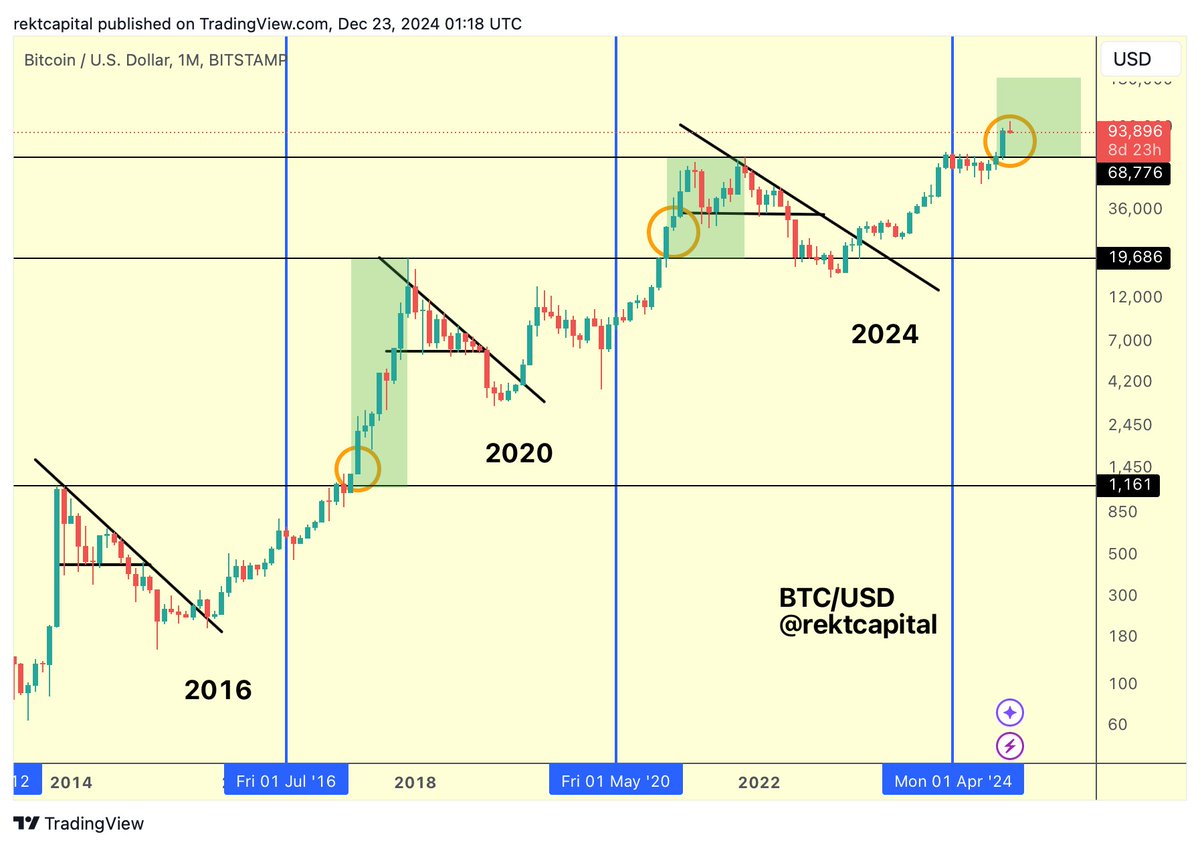

The analyst additionally says {that a} Bitcoin correction throughout these weeks of the present bull market cycle shouldn’t be uncommon primarily based on historic priority, and it may set the flagship crypto asset up for rallies.

“BTC is providing extra affirmation for extra draw back than causes to be bullish for the second. As soon as Bitcoin clears its traditionally corrective weeks seven, eight and 9 in value discovery the alternative will likely be true. It’s Christmas and this retrace is a present.”

Lastly, the analyst means that Bitcoin has about 38% left to finish within the bull market cycle primarily based on earlier cycles and that the ultimate stage is historically essentially the most explosive section.

“Bitcoin bull market progress: 62%. (Progress will pace up within the parabolic section).”

Bitcoin is buying and selling for $98,151 at time of writing, up greater than 125% within the final yr.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses chances are you’ll incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/80’s Youngster