Earlier right now, in a publish on X (previously Twitter), Ki Younger Ju, the CEO of CryptoQuant, shared his insights in regards to the present state of Bitcoin’s market. His commentary revolves round whale accumulation—a time period used to explain large-scale purchases of Bitcoin by large traders. Ki Younger Ju identified that information of whale accumulation, which used to shake the market simply two or three years in the past, has now grow to be so routine that it now not surprises anybody. This shift, he defined, is indicative of a deeper development: retail traders are withdrawing from Bitcoin, leaving whales because the dominant gamers out there.

Ju steered that the market’s dynamics are actually largely dictated by these large gamers. This actuality, he stated, is widely known however not typically mentioned in-depth. Importantly, Ju clarified that whereas we’re in a bull market, this isn’t but a bubble. To elucidate, he outlined a bubble as a interval when the market value considerably exceeds the capital flowing in, as measured by blockchain knowledge. For the time being, on-chain knowledge signifies that $7 billion in weekly capital is getting into the Bitcoin market—a determine that helps the present value ranges.

Regardless of this, Ju acknowledged the potential for corrections. He predicted that if such a drop happens, it’s unlikely to exceed 30%, and any such dip would possible be short-lived. The truth is, he anticipates a robust rebound afterward, doubtlessly with costs climbing greater than 30% following the correction. He additionally expressed confidence that the height of this Bitcoin cycle remains to be far off and challenged predictions of an imminent bear market, questioning the reasoning of those that ignore on-chain knowledge.

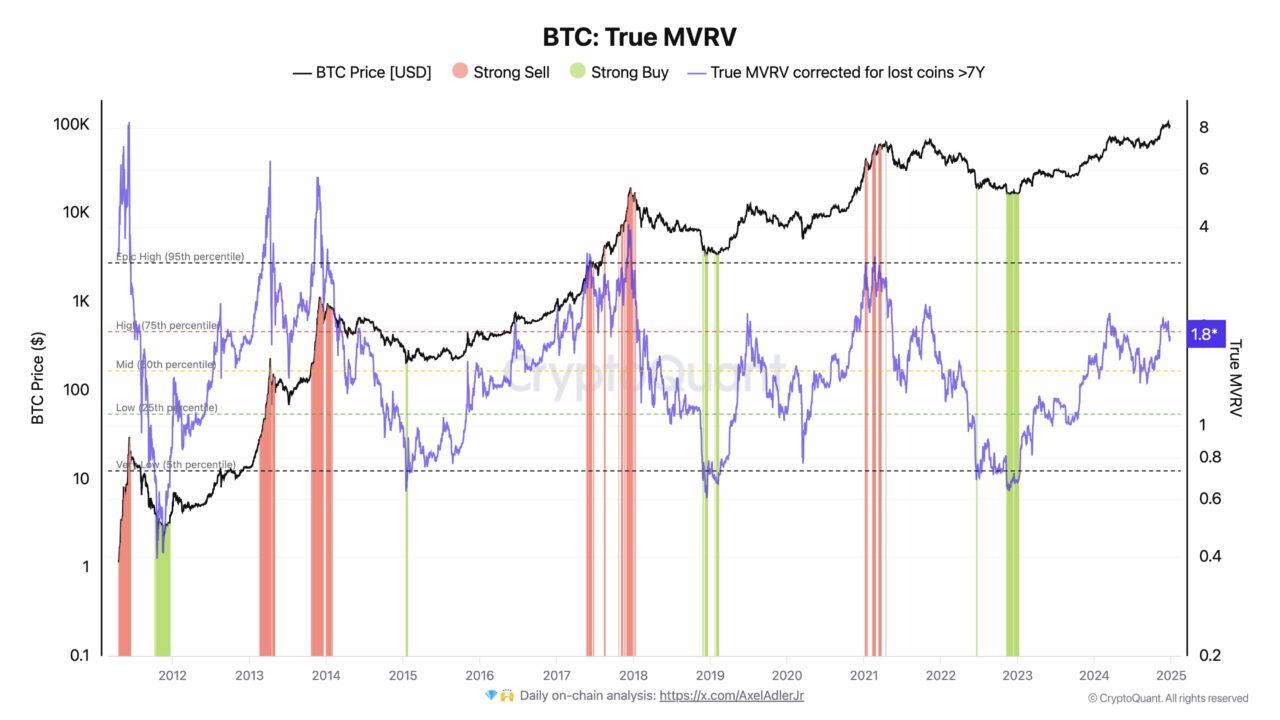

Ju’s publish was accompanied by a chart titled “BTC: True MVRV,” which may seem advanced at first look.

Let’s break it down in easy phrases. MVRV stands for Market Worth to Realized Worth, a metric used to gauge whether or not Bitcoin is overvalued or undervalued at its present value. The “Market Worth” refers to Bitcoin’s complete market capitalization (present value multiplied by circulating provide), whereas “Realized Worth” calculates the worth of Bitcoin primarily based on the worth at which every coin final moved on-chain. By evaluating these two values, MVRV presents perception into market sentiment and potential value actions.

The chart plots Bitcoin’s value alongside the MVRV ratio, adjusted for cash which were misplaced or untouched for over seven years (to make sure accuracy by excluding inactive cash). Listed below are the important thing zones and what they imply:

- Sturdy Promote Zones (Crimson): These are durations when the MVRV ratio may be very excessive, typically above 4. This means that Bitcoin’s market value is much greater than its realized worth, suggesting the market is overheated. Traditionally, these zones have aligned with market tops, the place vital value drops typically comply with.

- Sturdy Purchase Zones (Inexperienced): These are durations when the MVRV ratio may be very low, typically under 1. These zones point out that Bitcoin’s market value is undervalued relative to its realized worth. Traditionally, these have been the perfect instances to purchase Bitcoin, aligning with market bottoms.

- Mid-Vary Zones (Yellow): These are impartial areas the place the market value aligns extra carefully with realized worth. In these durations, the market is neither overvalued nor undervalued, reflecting balanced situations.

Presently, the chart reveals the MVRV ratio at roughly 1.8, which is above the mid-range however not but within the “Sturdy Promote” territory. This implies that whereas Bitcoin’s value is climbing, it’s not dangerously overvalued. Historic knowledge signifies that the market has room to develop earlier than reaching a possible peak.

By juxtaposing this knowledge with historic traits, Ju’s argument turns into clearer: Bitcoin’s present value actions are in line with a wholesome bull market quite than a speculative bubble.