Shiba Inu (SHIB) worth has declined 10% over the previous seven days, following its December 7 peak when it reached its highest ranges since January 2024. The current pullback highlights weakening momentum, with key indicators resembling RSI and DMI reflecting a bearish shift in market sentiment.

Whereas SHIB’s downtrend at the moment lacks important power, continued promoting stress might push the worth towards key help ranges. Nevertheless, a restoration above important resistance might sign a possible reversal and renewed bullish momentum within the quick time period.

SHIB RSI Has Been Impartial Since December 20

Shiba Inu Relative Energy Index (RSI) is at the moment at 40.4, down from roughly 57 simply two days in the past. This important drop signifies a lack of shopping for momentum, with the market leaning towards a bearish sentiment.

The transfer towards decrease RSI ranges means that sellers have gained management, pushing the worth nearer to oversold territory, although not but totally in that zone.

RSI is a momentum indicator that measures the velocity and magnitude of worth actions on a scale from 0 to 100. Values above 70 point out overbought situations, which regularly precede a correction, whereas values beneath 30 counsel oversold situations, doubtlessly resulting in a rebound.

With SHIB RSI at 40.4, it stays in a bearish-neutral vary, indicating some promoting stress with out but reaching oversold ranges. Within the quick time period, this might imply that SHIB’s worth could proceed to say no or stabilize close to present ranges until sturdy shopping for curiosity re-emerges to shift the momentum.

Shiba Inu Present Downtrend Is Not That Sturdy

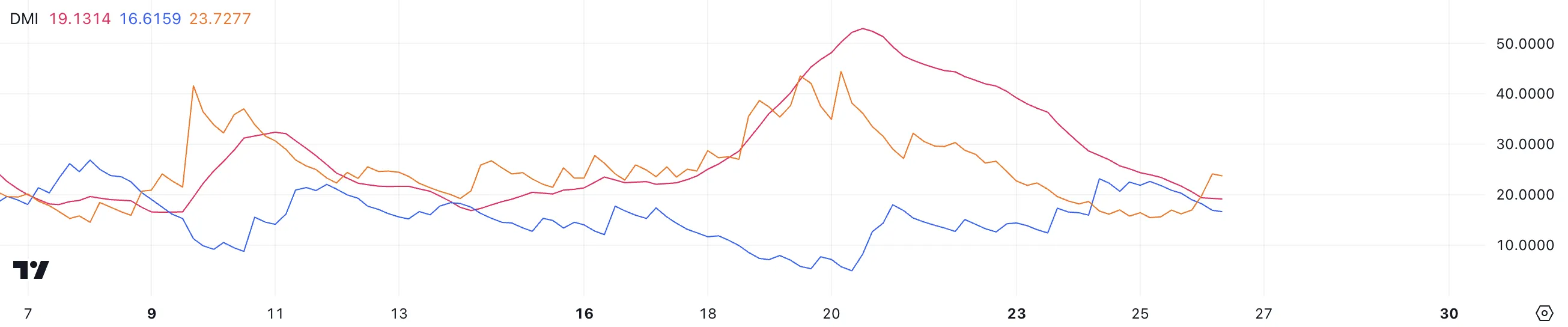

SHIB’s Directional Motion Index (DMI) chart reveals its Common Directional Index (ADX) at 19.13, down from increased ranges simply three days in the past. This decline in ADX signifies that the power of Shiba Inu present downtrend is weakening, although the development stays intact.

The D+ (optimistic directional indicator) has dropped to 16.6 from 23 two days in the past, signaling decreased shopping for momentum, whereas the D- (unfavourable directional indicator) has risen to 23.7 from 18.6, reflecting a rise in promoting stress. This mix means that sellers at the moment dominate the market, with shopping for curiosity persevering with to fade.

ADX is a development power indicator that measures the depth of a development on a scale from 0 to 100, with out indicating its route. Values beneath 20 sign weak traits, whereas values above 25 signify sturdy traits. With SHIB ADX at 19.13, the downtrend lacks important power, regardless of sellers sustaining management as indicated by the upper D-.

Within the quick time period, this might imply SHIB’s worth might even see continued bearish stress, although the weakening development suggests the potential for stabilization or consolidation if shopping for momentum begins to get well.

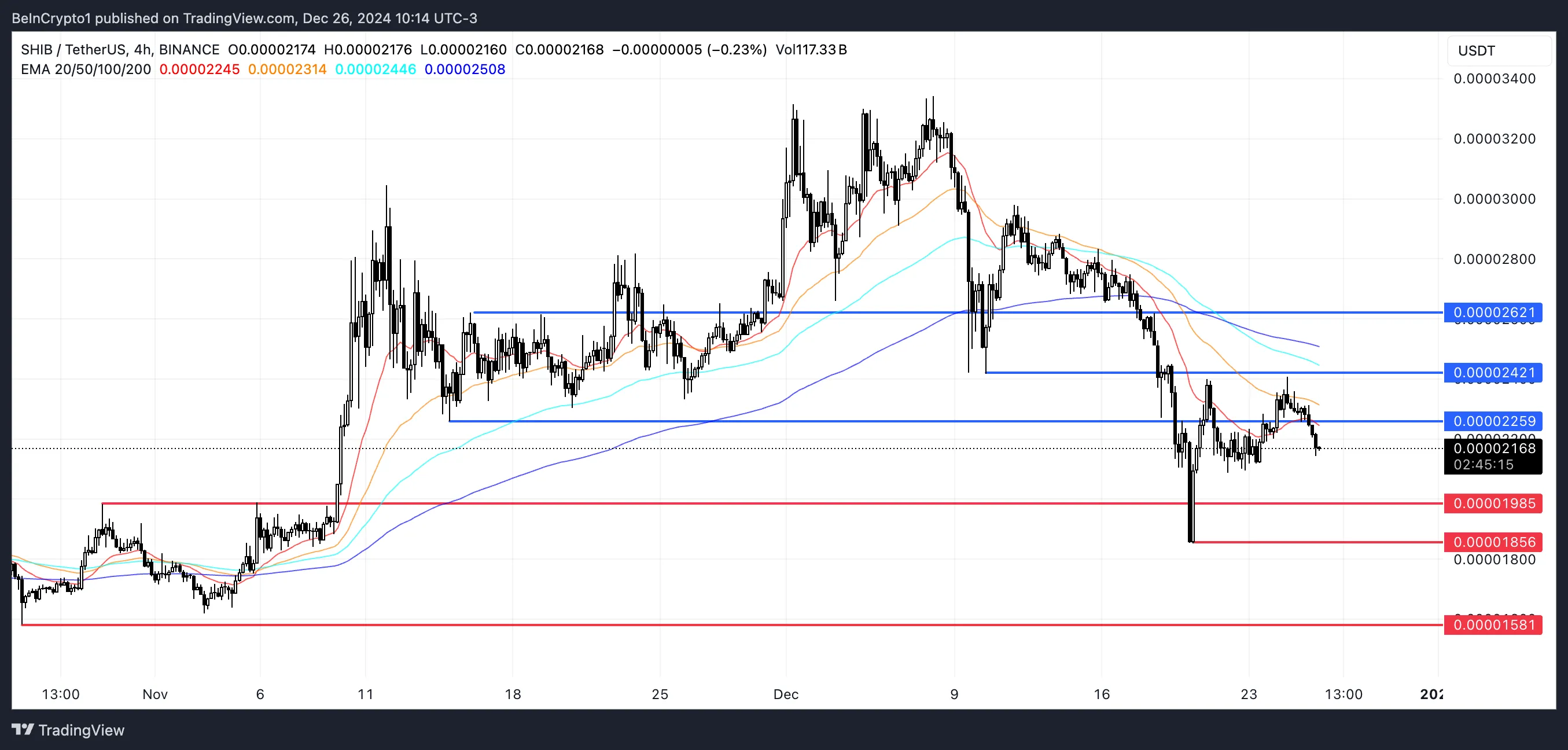

SHIB Worth Prediction: Again to $0.000015 Quickly?

If SHIB present downtrend persists, the worth might quickly take a look at the help stage at $0.0000198.

Ought to the downtrend regain power, SHIB worth could proceed to say no, with potential resistance ranges round $0.000018 and $0.0000158 being examined subsequent.

Conversely, if SHIB worth manages to get well its uptrend and break above the resistance at $0.000022, the token might goal increased ranges at $0.000024 and even $0.000026.

These ranges spotlight the significance of the $0.000022 resistance and the $0.0000198 help as key thresholds for figuring out whether or not SHIB can reverse its bearish trajectory and regain a extra optimistic outlook within the quick time period.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.