Solana (SOL) value continues to draw vital person exercise and transaction quantity on purposes like Raydium, Pumpfun, and Jito. Regardless of this, SOL has fallen 17% over the previous 30 days, shedding its $100 billion market cap and presently sitting at $90.6 billion.

Indicators akin to BBTrend and ADX counsel a weakening downtrend, with indicators of a possible restoration in momentum. Key ranges at $183 help and $194.99 resistance will decide whether or not SOL stabilizes and climbs again towards $200 or faces additional draw back.

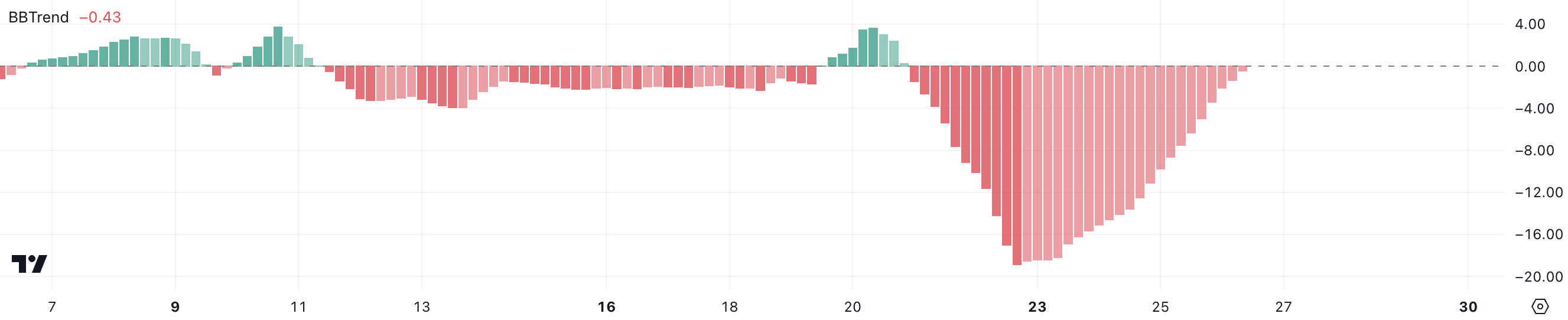

Solana BBTrend Is Nearly Optimistic After 5 Days

Solana BBTrend is presently at -0.43, its highest degree since December 21. This marks a big restoration after hitting a low of -18.89 on December 22. This regular upward motion means that bearish momentum is weakening, and shopping for strain has been regularly growing over the previous few days.

Though SOL BBTrend remains to be destructive, the method towards impartial and probably optimistic territory signifies a shift in market sentiment that would pave the best way for value stabilization or an uptrend within the brief time period.

BBTrend, or Bollinger Band Pattern, is a momentum indicator derived from Bollinger Bands that measures the worth’s relationship to the band midpoint. Optimistic BBTrend values replicate bullish momentum, whereas destructive values sign bearish circumstances.

If SOL’s BBTrend turns optimistic once more, because it final did on December 20, it could verify a full reversal of bearish sentiment and probably help a renewed upward value pattern. Within the brief time period, this ongoing restoration in BBTrend is a optimistic sign, suggesting that SOL value might see additional positive aspects if shopping for momentum continues to construct.

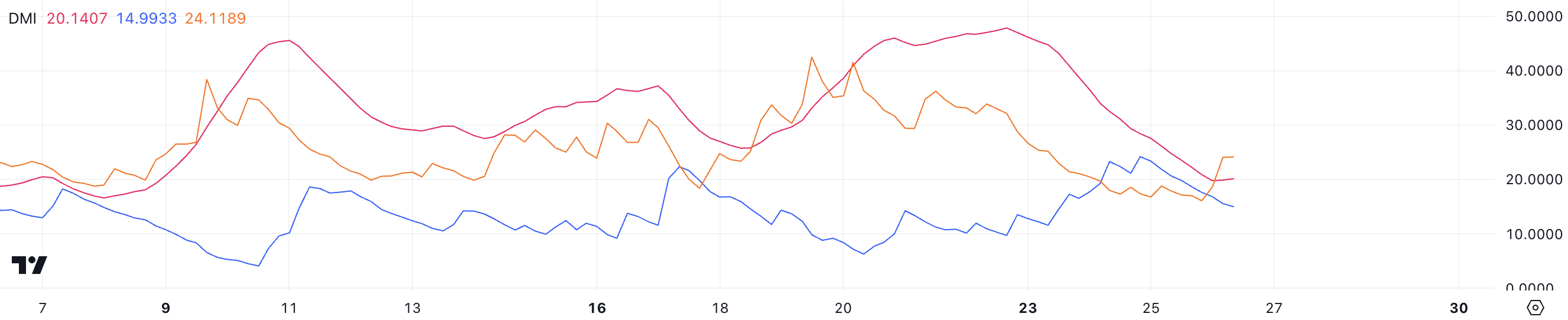

SOL Present Downtrend Isn’t that Sturdy, However It Might Recuperate

SOL’s Directional Motion Index (DMI) chart reveals that its Common Directional Index (ADX) is presently at 20.14, a pointy decline from practically 50 simply three days in the past. This drop signifies a big weakening in pattern energy, at the same time as SOL stays in a downtrend.

The D+ (optimistic directional indicator) has fallen to 14.99 from 24 two days in the past, signaling a discount in shopping for strain. In distinction, the D- (destructive directional indicator) has risen to 24.11 from 17.3, reflecting elevated promoting exercise. This mix means that sellers presently dominate the market, though the weakening ADX implies that the bearish pattern could also be shedding steam.

ADX measures pattern energy on a scale from 0 to 100, with out specifying course. Values beneath 20 counsel a weak pattern, whereas values above 25 point out a powerful one. With Solana ADX at 20.14, the present downtrend is shedding depth, at the same time as promoting strain stays increased than shopping for exercise.

Within the brief time period, this might imply that SOL value might stabilize or consolidate, as the shortage of a powerful pattern might present patrons with a chance to re-enter the market. Nonetheless, continued dominance by the D- might nonetheless push costs decrease if sellers keep management.

Solana Value Prediction: Can SOL Rise Again to $200 Quickly?

Solana value is presently buying and selling inside a spread outlined by a help degree at $183 and a resistance at $194.99. If the $183 help fails to carry, SOL value might face extra bearish strain, probably dropping to the subsequent key degree at $175.

This state of affairs would point out continued promoting momentum, making the $183 help a vital threshold for sustaining stability within the brief time period.

Then again, if SOL value manages to regain optimistic momentum and break above the $194.99 resistance, it might open the door for additional upward motion.

The subsequent targets could be $204 and $215, marking a possible 14% upside from present ranges.

Disclaimer

In keeping with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.