Attempt, an asset administration agency began by Vivek Ramaswamy, needs to launch an ETF that invests in convertible bonds issued by MicroStrategy and different firms that purchase Bitcoin.

The agency has filed an utility with the SEC on December 26.

Bitcoin’s Demand Continues to Develop Amongst Retail Buyers

Based on the submitting, the ETF goals to present traders publicity to “Bitcoin Bonds,” that are convertible securities issued by firms like MicroStrategy that use the cash to purchase Bitcoin.

Attempt will actively handle the ETF, investing straight in these bonds or utilizing monetary merchandise like swaps and choices. The asset administration agency was based by republican politician Vivek Ramaswamy again in 2022.

In November, he joined Tesla founder Elon Musk in main the Division of Authorities Effectivity (DOGE), a non-public initiative to cut back wasteful authorities spending. Nevertheless, its similarity with the biggest meme coin DOGE, has repeatedly triggered market volatility.

“Vivek’s ETF firm has filed for a Bitcoin Bond ETF that can observe (utilizing swaps) convertible bonds issued for the aim of shopping for Bitcoin- so basically it’s a Microstrategy convertible bond ETF till different companies do the identical,” ETF analyst Eric Balchunas wrote on X (previously Twitter).

In the meantime, trade analysts count on extra crypto ETFs to be authorized below Trump’s administration. Earlier this month, the SEC authorized the first-ever duel Bitcoin and Ethereum ETFs from Hashdex and Franklin Templeton.

Attempt’s proposed Bitcoin Bonds ETF might provide one other distinctive monetary product for retail traders eager for Bitcoin’s publicity.

“Elon’s silence about Bitcoin because the election, mixed with current information about Vivek’s Bitcoin Bond ETF applicatio,n has introduced my confidence in a strategic US Bitcoin reserve to a close to assure. Day one is just not off the desk. Issues are in movement that can not be undone,” wrote well-liked influencer The Bitcoin Therapist.

MicroStrategy’s Inventory Exhibits Pararrell Demand to Bitcoin

The idea of a Bitcoin Bond ETF is profitable as a result of it supplies oblique publicity to MicroStrategy’s Bitcoin acquisition advantages.

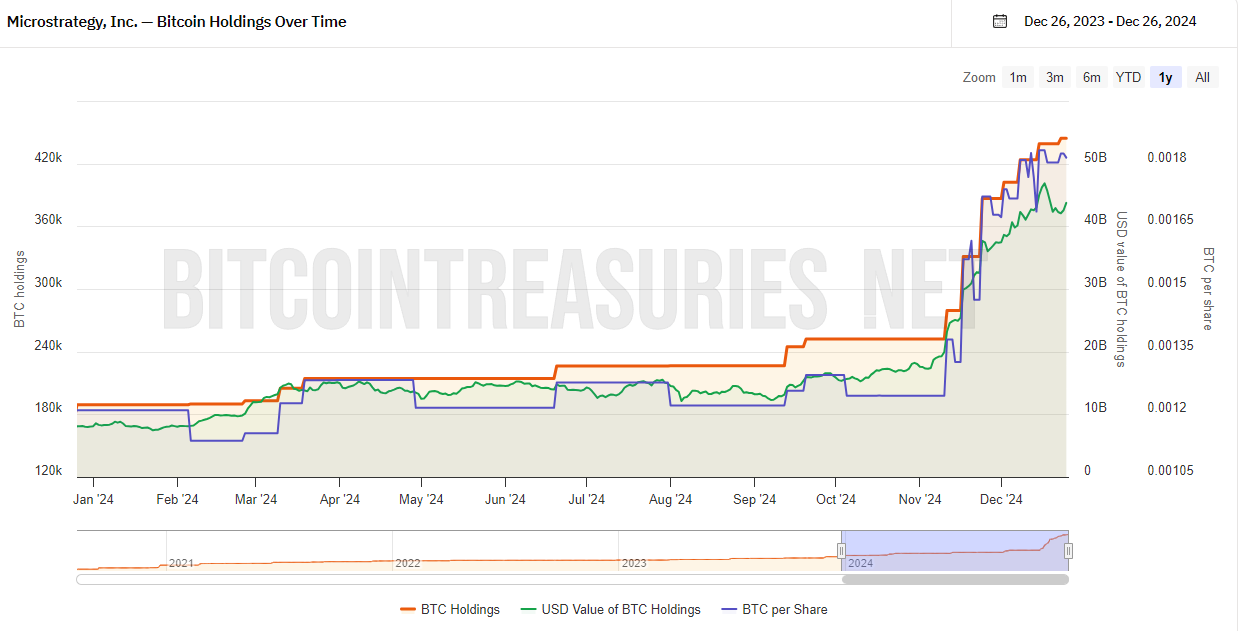

Since 2020, MicroStrategy, led by Michael Saylor, has spent over $27 billion shopping for Bitcoin. This has boosted its inventory value by over 2,200%.

Nevertheless, the agency has aggressively ramped up its Bitcoin purchases all through 2024. In December alone, MicroStrategy purchased over $4 billion value of BTC. All of those purchases befell when the token was hovering above $95,000.

Additionally, Bitcoin’s bullish efficiency in 2024 has been mirrored in MSTR’s inventory efficiency. The inventory gained practically 400% year-to-date, driving MicroStrategy among the many prime 100 public firms.

On the similar time, this success led to the inventory’s inclusion within the Nasdaq-100 index. There’s additionally important potential for inclusion within the S&P 500 subsequent 12 months.

MicroStrategy has funded these Bitcoin purchases by issuing new shares and convertible bonds. These bonds have low or no curiosity however might be transformed into MSTR shares.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.